Download Pintu App

Is it Time to Slash ETH? Solana’s Advantages that Might Trigger a ‘Sell ETH’ Moment

Jakarta, Pintu News – Solana (SOL) is now ranked sixth as a cryptocurrency with a market capitalization of approximately $79 billion, at a current price of $148. Solana is only four years younger than Ethereum (ETH), which launched in 2017 and is second only to Bitcoin (BTC) with a market capitalization of $304 billion. Solana is gradually eroding Ethereum’s dominance in three key areas, showing that having more capital does not necessarily guarantee the top spot in the long run.

Ethereum Capital

Ethereum (ETH) has always had the advantage of deep liquidity and a strong developer base. However, Solana (SOL) is fast catching up. The competition is heating up with the tokenization of real-world assets such as bonds, stocks, and real estate, which is projected to be a $16 trillion market by 2030. Ethereum currently hosts around $7.5 billion, which accounts for nearly 60% of all tokenized assets on the chain. In contrast, Solana holds a much smaller share of $361 million, or just 2.8%, but that figure is on the rise.

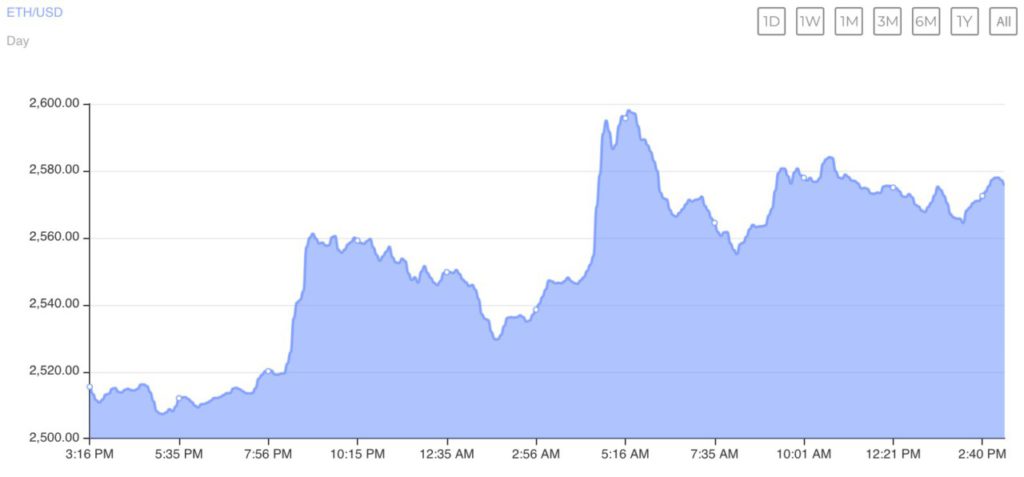

In terms of DeFi, Ethereum has a total value locked (TVL) of $64.2 billion, with more than 418,000 active addresses using the network in the last 24 hours, while trading at $2515. Solana, on the other hand, recorded around 2.95 million active addresses in the past day, a huge spike in user activity, with a TVL of $8.53 billion. Clearly, Solana is attracting attention with how active its users are on a daily basis.

Also Read: Can XRP Soar 35,000%? Check out the Supporting Factors!

DePIN project on Ethereum

DePIN, which stands for Decentralized Physical Infrastructure Networks, is about using blockchain to power real-world systems, such as wireless networks and decentralized storage.

Instead of relying on companies to run this infrastructure, users can donate resources such as bandwidth or storage and get tokens in return. The challenge? These networks require many small and frequent transactions, and Ethereum’s high gas fees make it difficult to scale.

DePIN projects often rely on Layer 2 or sidechains like Polygon or Arbitrum, which adds complexity and fragments the experience across multiple platforms. On the other hand, Solana is becoming a hotspot for DePIN. Its fast and low-cost design makes it ideal for handling real-world activity projects like the one already done by Roam.

And because everything runs on a unified chain, devices and smart contracts can interact seamlessly, something the Ethereum base layer still can’t do efficiently.

AI Agent in SOL

AI agents are becoming a big thing in crypto, think bots that can buy assets, process data, pay for services, and make decisions on the chain without human input. AI agents might perform hundreds or thousands of microtransactions every day. On Ethereum, this is becoming unsustainable.

In Solana, the fee is almost free, only about $0.0001. Solana’s Sealevel Engine enables parallel processing of transactions. AI agents can interact with multiple protocols or smart contracts at once, without the need to wait in line. In contrast, Ethereum executes transactions sequentially. So, agents operating on Ethereum face delays if the network is congested.

Conclusion

Solana shows significant potential to replace Ethereum as the leader in several segments of the crypto market. With technological advancements and increasing adoption, Solana may soon become the top choice for developers and users who need a more efficient and economical blockchain solution. Time will tell if this will be a ‘sell ETH’ moment for many investors.

Also Read: Michael Saylor and a New Strategy Towards 600K Bitcoin (BTC), Can It Be Replicated?

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Crypto News Flash. Is It Time to Trim Ethereum? Why Solana’s Edge May Trigger a Sell ETH Moment. Accessed on July 7, 2025

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.