Download Pintu App

US tariff delay could make Bitcoin set a new record this week, what’s really going on?

Jakarta, Pintu News – Bitcoin (BTC) is predicted to have the opportunity to set a new all-time high (ATH) in the near future, as the global market spotlight is on the United States trade tariff deadline that falls on Wednesday this week. According to Markus Thielen, Head of Research at 10x Research, Bitcoin has the potential to hit a new price record this week or next week, driven by a bullish post-July 4 seasonal trend and a relatively calm market reaction to tariff risks.

On July 9, the 90-day pause period for the United States’ reciprocal tariff policy will end. If the US government again delays the implementation of tariffs, the market could interpret this as a signal of reluctance, supporting investors’ risk appetite. UBS Global Wealth Management analysts also agree that a delay in tariffs could provide positive sentiment for the broad market, including crypto.

Impact of Tariff Delay on Bitcoin and Crypto Prices

John Bollinger, creator of the Bollinger Bands technical indicator, thinks Bitcoin is preparing for an upward breakout, and the price is already only 2% below the ATH recorded on May 22, which is $109,500 (around Rp1.77 billion at an exchange rate of 1 USD = Rp16,241) in Monday’s trading.

Henrik Andersson, CIO of Apollo Capital, expects this week to be volatile. He is optimistic that the US and the EU may reach a trade framework agreement this week. In addition, Andersson highlighted the positive sentiment of Elon Musk mentioning Bitcoin again on social media, which could add to the attractiveness of crypto assets in the eyes of investors.

Also Read: Can XRP Soar 35,000%? Check out the Supporting Factors!

Potential Spike in Market Capitalization and Altcoin Season

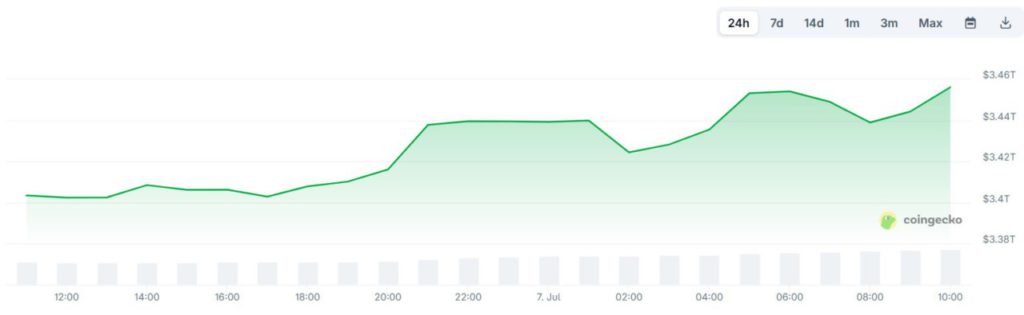

Jeff Mei, COO of the BTSE exchange, said previously the market was worried about volatility ahead of the July 9 tariff deadline, but now appears to be rallying after it was discovered that countries got additional time for negotiations until early August. If economic data on Tuesday improves, the crypto market is likely to continue to rally. In the last 24 hours alone, the total crypto market capitalization grew by more than $50 billion.

On the other hand, Nick Ruck of LVRG Research warned of a potential increase in interest in altcoins in the second half of the year, as expectations of high volatility and a surge in digital asset prices. Eugene Cheung, CCO of OSL, is also optimistic that investors will seek refuge in Bitcoin and Ethereum (ETH) to deal with macroeconomic uncertainty as well as a potential rise in inflation if the Federal Reserve cuts interest rates.

Conclusion

The postponement of US trade tariffs is considered a major catalyst that could push Bitcoin to break a record high price in the near future. This optimism is also supported by seasonal trends, a potential US-EU deal, and positive momentum from crypto personalities. However, market volatility should be kept in mind, especially for investors who are considering getting into digital assets amidst fast-changing global dynamics.

Also Read: Michael Saylor and a New Strategy Towards 600K Bitcoin (BTC), Can It Be Replicated?

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Cointelegraph. Tariff delay could propel Bitcoin to new ATH this week – Analysts. Accessed on 2025-07-08.

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.