Download Pintu App

Bitcoin Hits New All-Time High at $118K – What’s Powering This Explosive Rally?

Jakarta, Pintu News – Bitcoin (BTC) price has broken its previous record high, soaring to $118,667 amid a wave of inflows from institutions and rising investor confidence.

This surge came after sustained accumulation, declining supply on the exchanges, as well as bullish momentum forming above key resistance levels.

Favorable United States policies, including the move towards a national reserve of Bitcoin, helped fuel this rally.

Meanwhile, macroeconomic changes such as a weakening dollar and expectations of lower interest rates further strengthen Bitcoin’s appeal as a hedge, opening up opportunities for further gains.

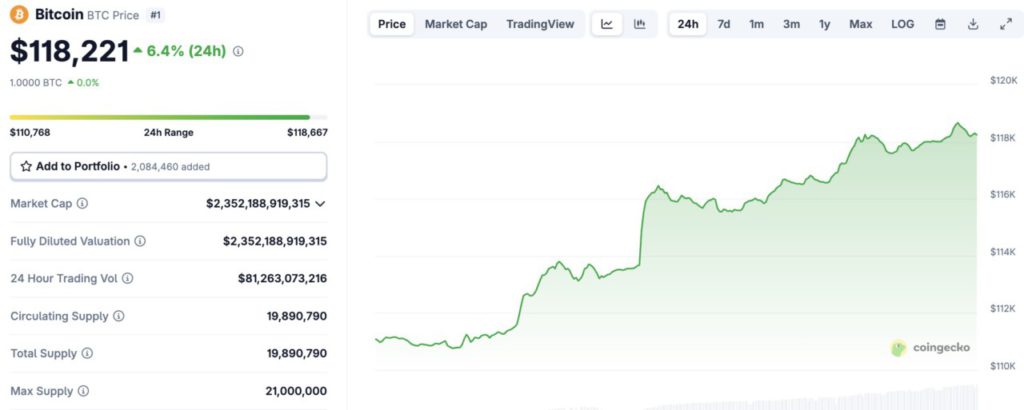

Bitcoin price hits $118,000 on July 11, 2025

The price of Bitcoin set another new record by breaking through $118,667 or the equivalent of IDR 1,913,506,472, and is now hovering around $118,221, recording a daily increase of 6.4% in the last 24 hours.

Read also: Why Did Crypto Go Up Today – July 11, 2025

Over the past 24 hours, the price of BTC moved between $110,768 and $118,667, showing high volatility synonymous with strong bullish momentum. Bitcoin’s market capitalization has now reached $2.35 trillion, with a fully diluted valuation at the same figure.

The trading volume in the last 24 hours was also unusually high at around $81.2 billion, reflecting very active market activity – most likely triggered by both heavy buying and liquidation of short positions.

Institutional Demand Drives Price Spikes

One of the key drivers behind Bitcoin’s price boom has been the surge in interest from institutions. In recent weeks, spot Bitcoin ETFs recorded net inflows worth billions of dollars, reflecting strong demand from both retail and professional investors.

Asset managers such as BlackRock, Fidelity, and VanEck have become dominant players in the market, adding legitimacy and encouraging capital flows into BTC. This not only absorbs existing supply, but also reduces the amount of Bitcoin in circulation, creating a bullish supply-demand imbalance.

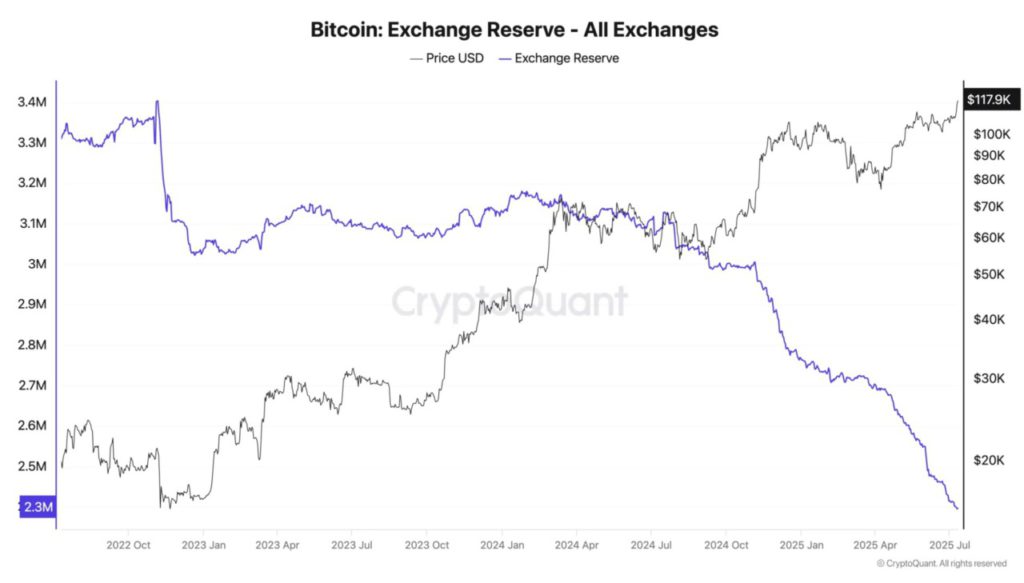

On-chain data shows a consistent outflow of Bitcoin from exchanges, signaling that more and more asset holders are moving their Bitcoin to cold storage instead of keeping it available for trading.

This pattern is in line with the long-term accumulation phase seen in previous bull runs. As the ETF narrative develops and institutional FOMO(fear of missing out) emerges, Bitcoin’s role as a digital store of value is strengthening, contributing to the sustained price rise.

Read also: Altseason Index: 98% of Altcoins Beat Bitcoin in Last 2 Days – Altseason Has Started?

Macro Support & Mutually Reinforcing Technical Triggers

Global macroeconomic conditions also play an important role in Bitcoin‘s surge. When central banks-particularly the Federal Reserve-signala possible interest rate cut, investor interest in alternative assets like Bitcoin increases sharply.

The weakening US dollar and growing concerns over long-term inflation make BTC an attractive hedge.

At the same time, technical price movements confirmed a strong and bullish market structure, with Bitcoin consistently breaking key resistance levels, triggering the liquidation of leveraged short positions.

BTC price has now reached the last barrier before entering a strongprice discovery phase. Currently, the price is moving within this phase but a short-term correction is still possible. However, if the price manages to break the upper limit of this range, it is possible that the bearish scenario could be temporarily delayed.

The RSI indicator has yet to enter the overbought zone, which suggests that the token still has bullish potential. Therefore, a rise above the current range could potentially push the price to around $130,000, which could be a new record high in this bull run.

Overall, the latest data shows that over $300 million of short positions have been liquidated in just one day, strengthening the pace of the rally. In addition, the psychological impact of the price’s return to previous highs has reawakened the enthusiasm of retail investors, attracting new participants to the market.

The combination of favorable macro conditions and internal market dynamics suggests that this move is not merely speculative, but could be the foundation of a broader, sustainable bull cycle.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinpedia. Bitcoin Reaches $118K Milestone- Here’s What Could Drive Prices Even Higher. Accessed on July 11, 2025

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.