Download Pintu App

Ethereum Hits $3,000 — Is a New All-Time High Just Around the Corner?

Jakarta, Pintu News – Less than two weeks into the third quarter (Q3), Ethereum (ETH) is already outperforming Bitcoin (BTC).

In fact, ETH recorded a return on investment (ROI) of 18.63% from the opening price of $2,468 – more than double BTC’s return in the same period.

According to AMBCrypto’s website, while Bitcoin’s price surge triggered a shift torisk-on assets, Ethereum’s lead reflects something more than just beta rotation – it points to a fundamental structural difference.

Ethereum actively capitalizes on volatility, turning it from a market risk into a strategic tool forprice discovery.

Then, how is Ethereum’s current price movement?

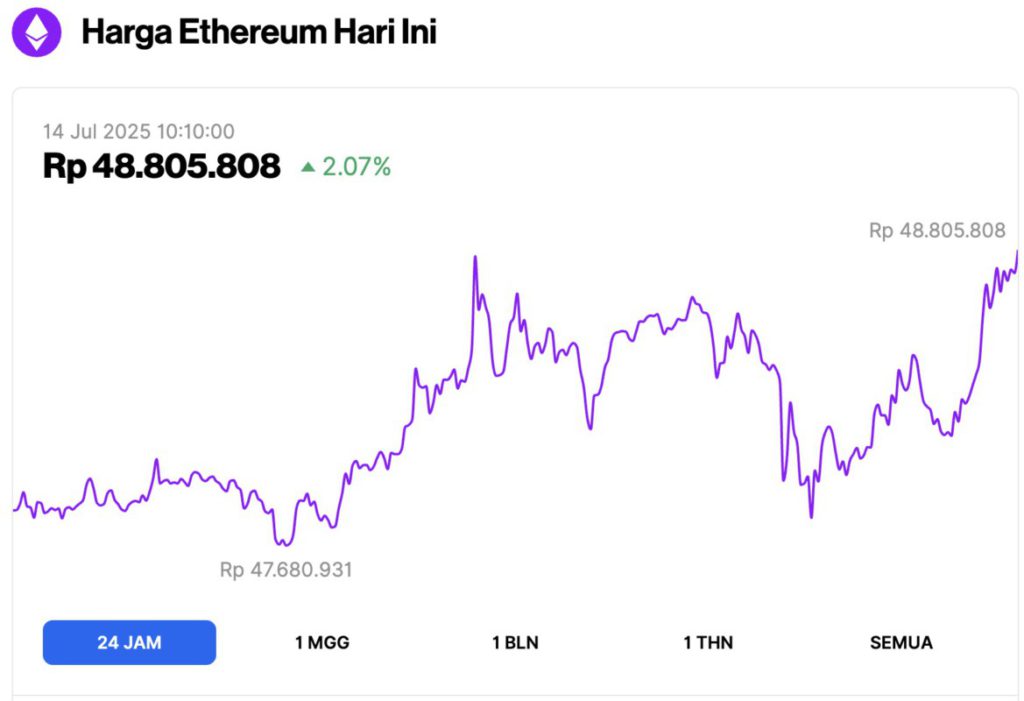

Ethereum Price Up 2.07% in 24 Hours

As of July 14, 2025, Ethereum is trading at approximately $3,005, or around IDR 48,805,808, marking a 2.07% gain over the past 24 hours. Within that time frame, ETH dipped to a low of IDR 47,680,931 and peaked at its current high of IDR 48,805,808.

At the time of writing, data from CoinMarketCap shows that Ethereum’s market capitalization stands at around $363.02 billion, with daily trading volume rising 22% to $19.16 billion within the last 24 hours.

Read also: Bull Run Incoming? 3 Made in USA Cryptos Set to Explode Soon!

Ethereum Turns Volatility into a Competitive Advantage

Bitcoin’s rise to its third all-time high this year reflects structural positioning rather than market momentum.

Currently, about 10.2% of the total supply of 21 million BTC is owned by institutions, governments, and corporations-parties that are generally not easily affected by price fluctuations.

This change is crucial. Each wave of volatility causes more BTC to be “locked up”, which reinforces the potential for price increases.

This was one of the main drivers of Bitcoin’s 60% rally in the last three months, to reach $118,000, despite macro pressures that suppressed fund flows intorisk-on assets.

Meanwhile, Ethereum follows a similar structural strategy to Bitcoin.

In the past 30 days, net new ETH issuance amounted to only 73,202 ETH, while ETH ETFs recorded net inflows of 725,000 ETH. Demand is 10 times higher than supply.

What is most striking is the timing. This surge in ETF inflows occurred when the price of ETH corrected by more than 20%, having previously reached a local peak around $2,800.

So while retail investors were anxious, institutions continued to buy – exactly as they did when ETH bottomed out around $1,385 in the previous cycle.

In other words, smart money sees Ethereum’s volatility as a buying opportunity, accumulating ETH when the general market is still hesitant. Does this mean ETH’s outperformance isn’t just a short-term advantage?

Read also: These 3 Altcoins Are Poised for a Binance Listing — Could They Skyrocket by Over 50% Soon?

A New Phase in Price Discovery

The impact of these structural changes is evident in Ethereum’s price movements. Since June 22, ETH has rallied by 40% – double the 20% gain Bitcoin achieved in the same period.

In the process, Ethereum managed to convincingly break through the $2,800 resistance level, reclaiming prices last seen in early February, although the number of whale addresses in the last 30 days has actually dropped by 15%.

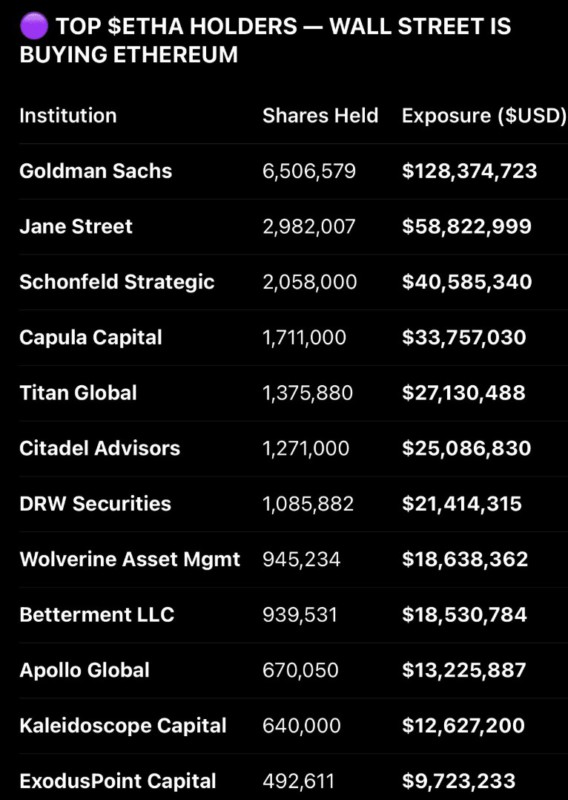

So, who absorbs this volatility? Institutional capital. Exposure to ETHA among Wall Street giants continues to rise, with Goldman Sachs leading the pack with 6.5 million shares, valued at around $128 million.

In fact, the five largest holders now control more than $288 million in exposure to ETH, a clear indication that institutional confidence in ETH is deepening – turning volatility from a threat to asupply-side squeeze.

As a result, this dynamic is pushing Ethereum closer and closer to theprice discovery phase. With this structure, ETH’s 40% gap to its all-time high may close sooner than the market expects.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- AMB Crypto. 3 reasons why Ethereum’s ATH is closer than you think. Accessed on July 14, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.