Download Pintu App

Bitcoin hits a new record of $120,000! Here are the main factors behind the BTC price surge

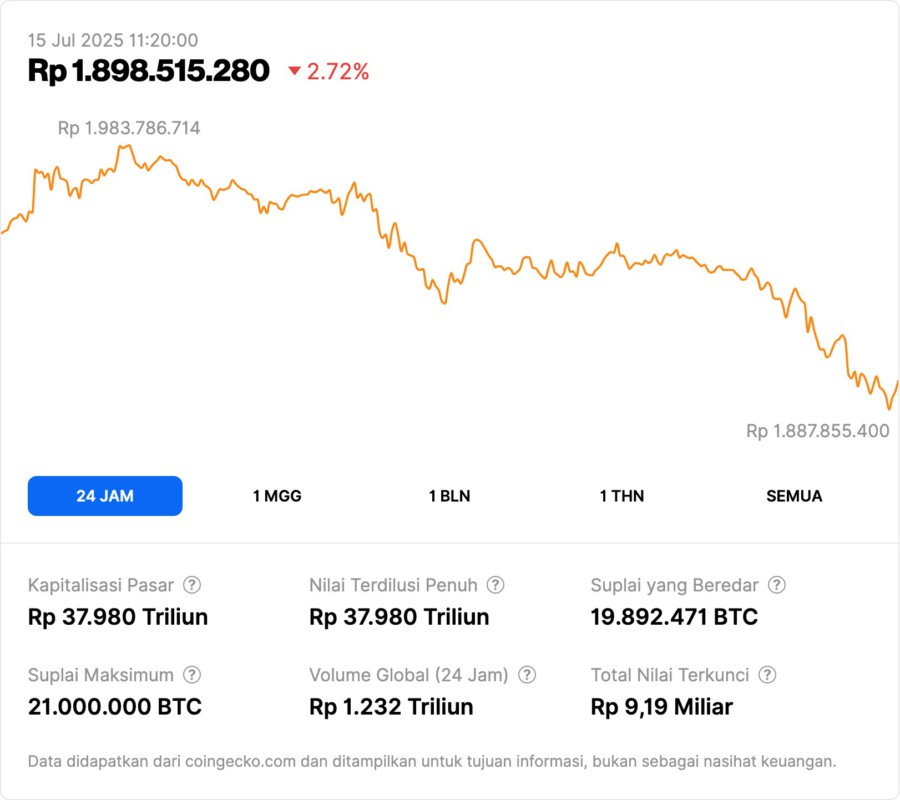

Jakarta, Pintu News – Bitcoin (BTC) made history once again after breaking the all-time high price of $120,000 (equivalent to Rp1.95 billion, exchange rate 1 USD = Rp16,287) on Coinbase on July 14, 2025 at 09:47 WIB. This price surge was driven not only by speculation, but also by a combination of massive institutional accumulation, ETF demand, and bullish long-term investor sentiment.

Institutional Fund Flows and BlackRock’s Bitcoin ETF Record

One of the main drivers of the current rally is the heavy flow of funds from institutions into spot Bitcoin ETFs, especially BlackRock’s IBIT. The ETF now manages more than 700,000 BTC – about $84 billion (Rp1,366 trillion) – surpassing the amount of Bitcoin holdings by the firm MicroStrategy.

BlackRock also set a record as the fastest growing ETF in history, reaching $83 billion in assets under management in just 374 days. The influx of large institutions intensifies the buying pressure on Bitcoin and gives more legitimacy to this major crypto asset as a global investment and hedging tool.

On-chain Activity: Accumulation and Minimal Panic Selling

On-chain data also shows solid bullish signals. The Net Unrealized Profit/Loss (NUPL) indicator for long-term holders of Bitcoin is still at 0.69 – below the market “overheat” threshold (0.75). This means that the majority of long-term holders haven’t profited much so selling pressure is still minimal.

The number of daily transactions also increased steadily, averaging 364,000 transactions per day, but remains below the previous cycle peak. Additionally, “accumulator” addresses – wallets that regularly add BTC without making significant sales – now hold 250,000 BTC, a record high for 2024 and up 71% from the end of last June.

Analysis: Price Could Rise Again, Profit Taking Still Low

Analysts think that the market atmosphere remains conducive and has not yet entered the euphoric phase. Various indicators show that Bitcoin owners are increasingly confident in holding their assets, rather than rushing to profit. Many predict the next price target to be around $130,000-$150,000 (Rp2.11 billion-Rp2.44 billion).

This positive momentum increases the chances of Bitcoin price going higher, especially if institutional flows and long-term accumulation continue.

Conclusion

Bitcoin’s price surge to $120,000 confirms that this major crypto is now an institutional asset. With a combination of ETF fund flows, investor accumulation, and a lack of panic selling, BTC still has the potential to rally in the months ahead. However, investors are reminded to always do their own research and risk management.

Also Read: Big Drama: Coinbase and Binance Deny Each Other Over Media Leaks and Market Grab!

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Cointelegraph. Bitcoin hits new all-time high at $120K. Accessed July 15, 2025.

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.