Download Pintu App

Will Bitcoin Price Plummet to IDR 1.85 Billion?

Jakarta, Pintu News – The price of the world’s most popular cryptocurrency, Bitcoin (BTC), is under pressure again after setting an all-time record high. After touching the fantastic price of $122,000 or around IDR 1.98 billion, BTC must now be willing to correct to the range of $116,850 (IDR 1.89 billion), down about 5%.

This decline was triggered byprofit-taking by large investors or so-called whales. This increased selling pressure triggered market fears of a potential deeper price correction.

Check out the full analysis in this article!

Crypto whale activity triggers selling pressure

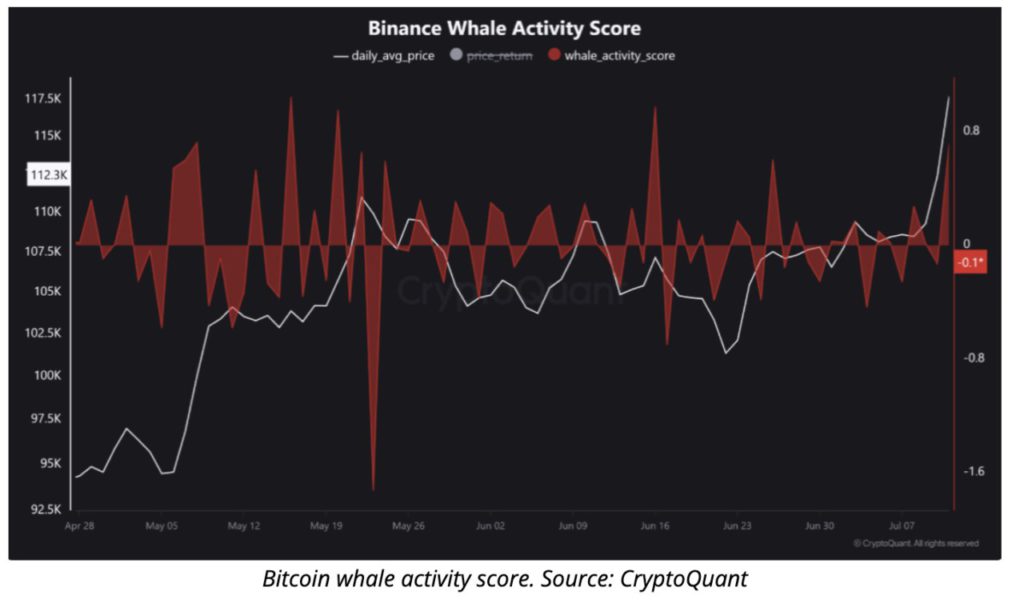

Whale activity on Binance crypto exchange has recently shown a significant spike after Bitcoin hit a record high. CryptoQuant reported that whale activity scores on Binance spiked sharply, signaling that large holders began moving large amounts of BTC to the exchange.

The data noted that around 1,800 BTC had been deposited on Binance in just one day, with more than 35% of the total inflows coming from transactions above $1 million.

This suggests a structured strategy by large players to secure profits or open new positions. This surge in inflows has historically often signaled selling pressure in the market.

Also read: These Top 3 Crypto are Predicted to be Bullish in 2026 According to ChatGPT

Technical Indicators Signal Potential for Further Correction

On the four-hour chart, BTC is seen trading below its 20-period simple moving average (SMA). Closing below this indicator is often a technical signal that the short-term trend is weakening.

If the selling pressure continues, then BTC prices could fall further and test the next support level. Analyst from Bitwise, André Dragosch, also confirmed that there is currently a massive profit realization from long-term holders. He mentioned that the condition when 98% of the supply is in profit is often the trigger for significant corrections.

Read also: Forbes’ Top 5 Crazy Rich of the World – New in 2025

Downside Risk to IDR 1.85 Billion due to Gap in Futures Market

The recent sharp rise in BTC prices created agap in the Chicago Mercantile Exchange (CME) futures market, between $114,380 and $115,630. In the history of cryptocurrency trading, gaps like this usually tend to be “filled” back by price movements.

Mikybull crypto analysts predict that BTC is likely to drop to that range, especially upon the release of US inflation data (CPI).

Meanwhile, MN Capital founder Michael van de Poppe said that although BTC could correct deeper to around $108,000 (IDR 1.75 billion), the long-term trend remains bullish as long as it does not drop below that level. The market is currently at an important crossroads, between continuing the rally or retesting key support.

Conclusion

Although Bitcoin (BTC) price is still in a positive long-term trend, increased whale activity and potential gap filling in the futures market make the short-term outlook look fragile. For cryptocurrency investors, it is important to follow technical indicators and volume movements to avoid getting caught up in major corrections.

With the price approaching the crucial area, BTC could see a drop to below Rp1.85 billion before resuming its rally. Watch out for volatility and be wise in making investment decisions in this dynamic crypto market.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Cointelegraph. Bitcoin price drop to $114K possible as BTC whales take profits. Accessed July 16, 2025.

- Featured Image: Generated by AI

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.