Download Pintu App

Bitcoin (BTC) Price Drops to $117,000: Is a Price Recovery Imminent?

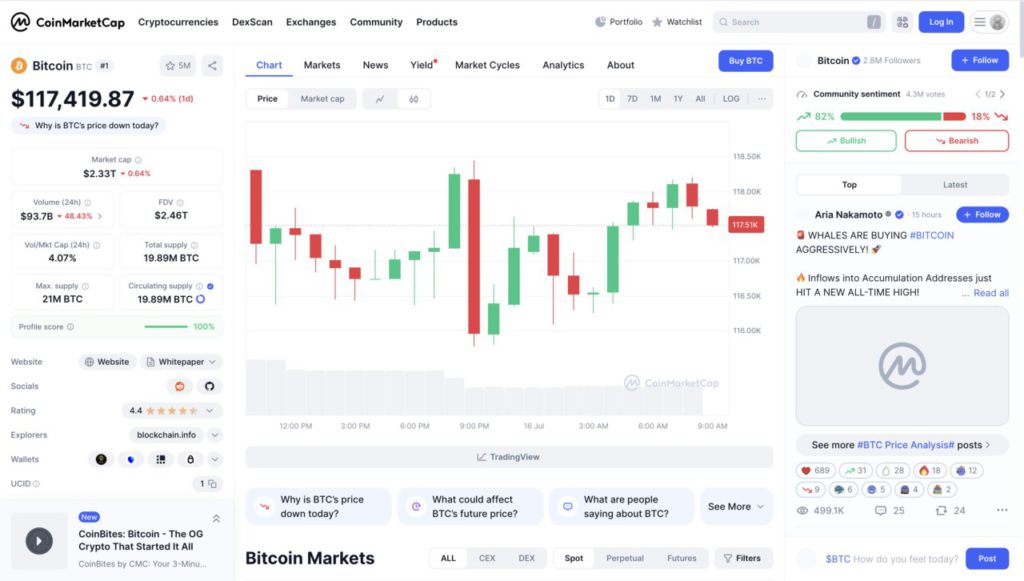

Jakarta, Pintu News – Bitcoin (BTC) experienced a sharp decline on Tuesday after hitting a new record high of $123,091. This decline occurred as some investors chose to take profits and the market started to slow down. Despite this, large investors still continued to buy and data showed strong support for Bitcoin (BTC).

Check out the full analysis below!

The Effect of Profit Taking on Bitcoin (BTC) Price

Bitcoin’s (BTC) price drop of 4.6% to around $117,466 during the day was triggered by a sell-off by some investors taking profits. This phenomenon is not unusual in the crypto market, especially after reaching a new price peak.

Despite the decline, institutional investors continue to show strong interest in Bitcoin (BTC), with ETF fund flows reaching $52.66 billion as of July 14.

In addition, the trading volume in the last 24 hours recorded a significant figure of $5.95 billion. This shows that despite the withdrawal of profits, there is still sufficient liquidity in the market that can support prices.

Also read: Elon Musk Introduces xAI’s Advanced Anime Virtual Friend, Here Are the Details!

Impact on Ethereum (ETH) and Other Altcoins

Not only Bitcoin (BTC), Ethereum (ETH) also saw a decline of 2.8% to around $2,968. Other altcoins such as Solana (SOL), Cardano (ADA), Dogecoin (DOGE), and Stellar (XLM) also followed this downward trend.

Solana (SOL) fell 4.4%, Cardano (ADA) 4.8%, Dogecoin (DOGE) 7.7%, and Stellar (XLM) saw the steepest decline with 10.2%. These declines suggest that the overall market sentiment is cautious, which may be due to profit-taking across the board.

However, it could also be an opportunity for investors to enter the market at a lower price before the next price increase.

Read also: What is Crypto Bubble?

Bitcoin (BTC) Recovery Prospects and Price Patterns

Despite the significant price drop, crypto analysts observed that futures open interest is on the rise, signaling strong demand from big players. The current price pattern may be forming an inverse head and shoulders pattern.

If Bitcoin (BTC) can maintain neckline support at $113,000, there is potential to reach breakout targets of up to $128,000 in the coming months.

Experts believe that the current price drop is only a short pause and not a significant change in direction. With strong support from large investors, prices are expected to continue rising.

Conclusion

Although the crypto market is experiencing some turbulence, the long-term outlook for Bitcoin (BTC) and other cryptos remains positive. Investors who understand market volatility may find opportunities in these price fluctuations.

With continued support from institutional investors and favorable technical indicators, the market may see a price recovery in the near future.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Crypto Times. Bitcoin Pulls Back Below $117k as Profit-Taking Hits, Bounce Back Incoming. Accessed on July 16, 2025

- Featured Image: Generated by Ai

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.