Download Pintu App

Ethereum Soars to $3,100 Today: ETH Staking, Stablecoins, and TVL Skyrocket to $63 Billion!

Jakarta, Pintu News – Ethereum (ETH) outperformed Bitcoin by 6% in Q2 2025. Analysis from on-chain research platform, DeFi Report, reveals strong bullish signals for ETH.

The report suggests that Ethereum is on the verge of a breakout, driven by institutional investment, stablecoin growth, and the potential of the GENIUS Act.

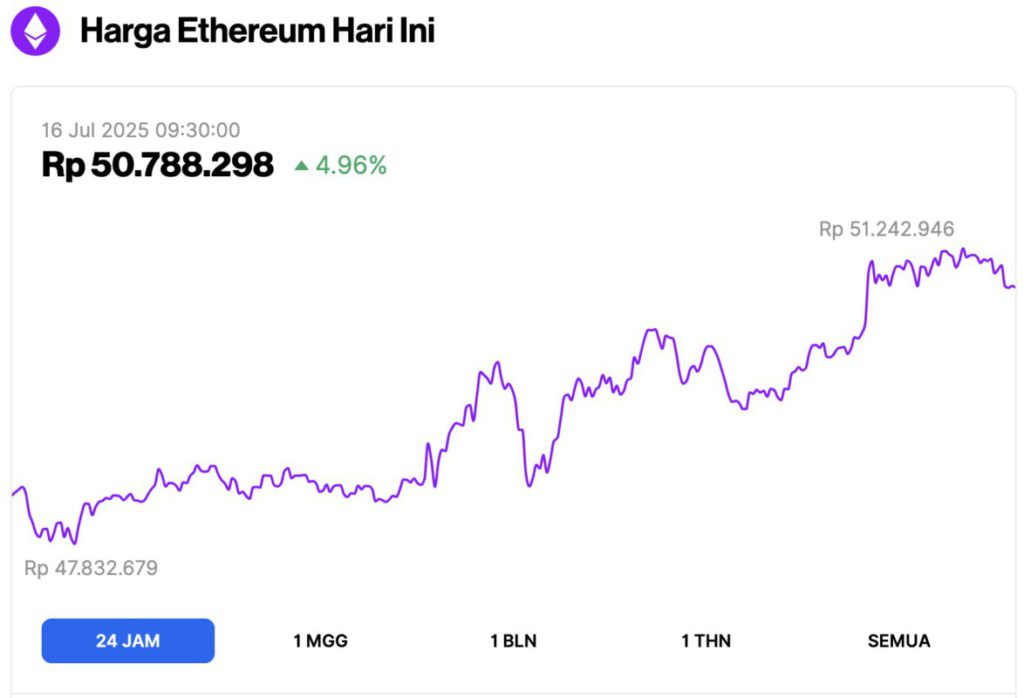

Ethereum Price Up 4.96% in 24 Hours

As of July 16, 2025, Ethereum’s price reached approximately $3,120 (IDR 50,788,298), marking a 4.96% increase in the past 24 hours. During this time, ETH hit a low of IDR 47,832,679 and a high of IDR 51,242,946.

At the time of writing, data from CoinMarketCap shows that Ethereum’s market capitalization stands at around $375.97 billion, with daily trading volume rising 7% to $38.83 billion in the last 24 hours.

Read also: 3 Cryptos You Should Buy Now for Massive Gains as the Bull Run Heats Up!

Ethereum in Q2 2025

The DeFi Report provides a comprehensive overview of the development of the Ethereum network in the last quarter, highlighting its positive factors and growth potential.

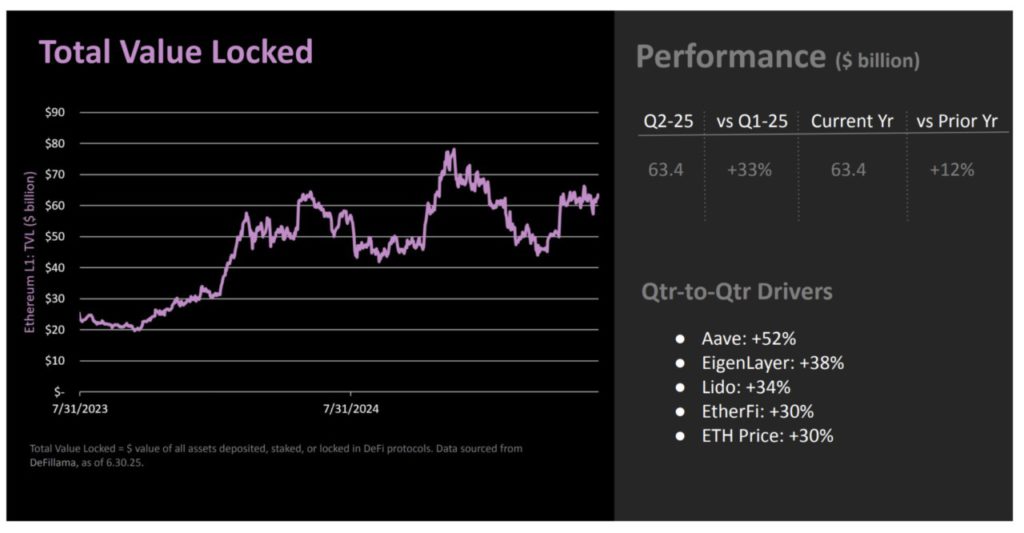

According to the report, Ethereum’s total value locked (TVL) jumped 33% compared to the previous quarter, reaching $63.4 billion. This growth was driven by significant increases in stablecoins and real-world assets (RWAs).

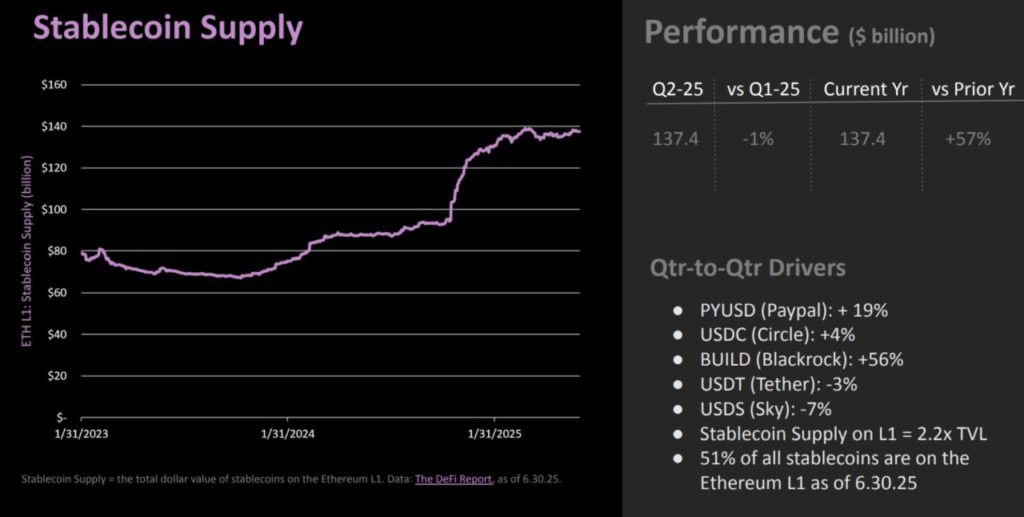

The supply of stablecoins reached $137.4 billion, with large institutional players such as BlackRock and PayPal accounting for the majority of Layer-1 TVL.

DeFi activity exploded, with active lending on Ethereum and L2s increasing 43% to $23.9 billion, led by Maple Finance (up 291%) and Euler Finance (up 174%).

ETH Staking Demand Reaches New Highs

In addition, ETH staking demand reached a new high of 35.6 million ETH in Q2, up 4% compared to the previous quarter.

Read also: Top 4 Altcoins that Crypto Whales Are Buying Ahead of the US CPI Announcement!

The ratio of staked ETH to total circulating supply reached 29.5% (an all-time high), creating deflationary pressure.

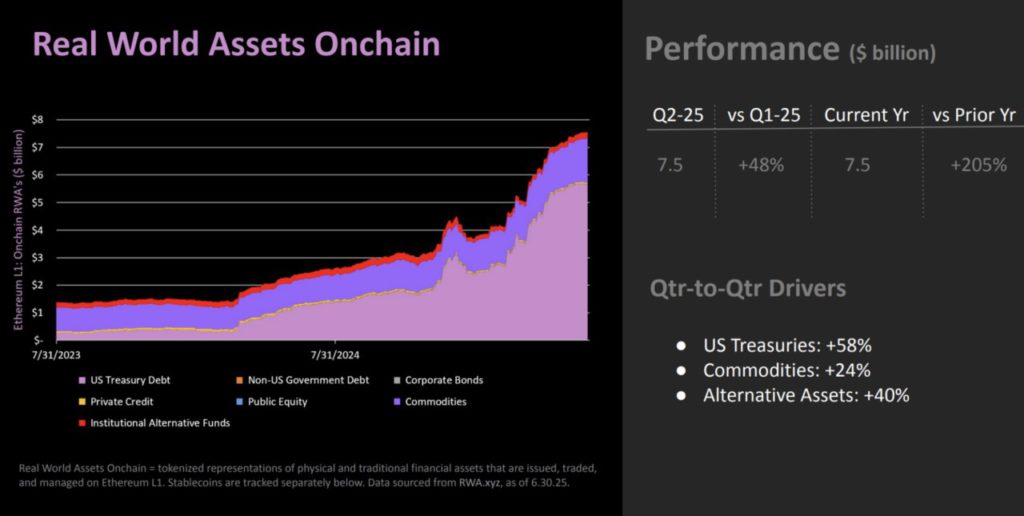

Real-world assets (RWA) in Ethereum grew 48% to $7.5 billion, driven by US Treasury bonds (up 58%) and commodities (up 24%).

The report also noted institutional accumulation, with a 5,829% increase in the amount of ETH held in public treasuries during Q2.

This increase brings the total to 216,000 ETH from SharpLink Gaming and 100,000 ETH from BitDigital.

In terms of valuation, ETH’s Market Cap/TVL ratio recovered to 1.2 (up 19%), indicating promising price appreciation potential.

Impact of the GENIUS Act

The passing of the GENIUS Act, which is expected to happen this week, could trigger a significant spike in ETH prices.

If successful, this legislation will legalize stablecoins in the US, increasing liquidity and trust in the Ethereum ecosystem.

“TheGENIUS Act will bring trillions of stablecoins to Ethereum – all the biggest banks in the world will use Ethereum. If the GENIUS Act is passed, ETH will go up,” commented crypto investor, Ryan.

However, the report warns of risks from global regulations, particularly the EU’s MiCA framework, which will come into effect in Q3 2025.

This could affect non-compliant stablecoins, as seen with Sky’s 7% drop in USDS this quarter. This poses a challenge to the growth of stablecoins, but also opens up opportunities for Ethereum to strengthen its position if it remains compliant.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Ethereum Surges in Q2: Record Staking, Stablecoin Boom, and $63 Billion TVL. Accessed on July 16, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.