Download Pintu App

Pi Network Stays Strong at $0.44 Today (07/16/25): Is a Price Surge on the Horizon?

Jakarta, Pintu News – On July 15, the Pi Network price fell by 3.9% in line with the broader crypto market, with Bitcoin (BTC) falling to $117,000.

This latest drop brings PI’s monthly decline to 28%, but there are now signs that a recovery is imminent.

Then, how is Pi Network’s current price movement?

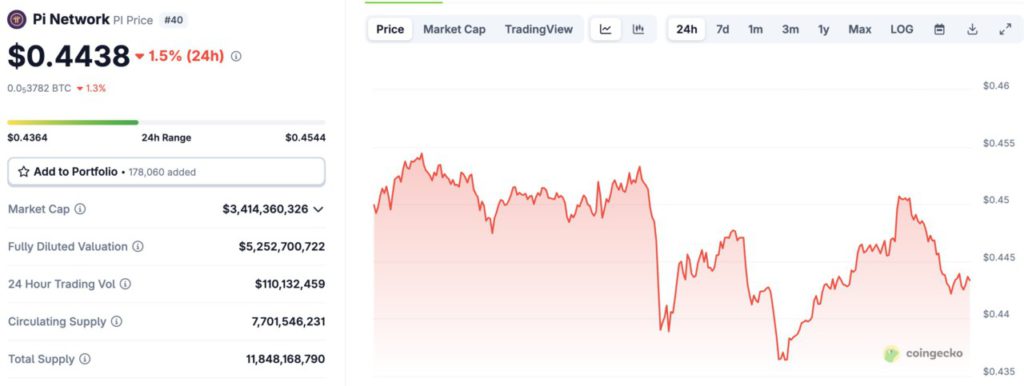

Pi Network Price Drops 1.5% within 24 Hours

On July 16, 2025, the price of Pi Network was recorded at $0.4438, a decrease of 1.5% in the last 24 hours. If converted to the current rupiah ($1 = IDR 16,289), then 1 Pi Network is IDR 7,310.

Read also: Bitcoin Stuck at $117K – Will It Plunge Back Below $110K?

During the last 24-hour period, Pi Network’s price moved in a range of $0.4364 to $0.4544. Furthermore, Pi Network has a market capitalization of $3.41 billion and a fully diluted valuation of $5.25 billion. Trading volume in the last 24 hours was recorded at around $110 million.

Pi Coin Price Falls Alongside Broader Market Decline

Pi Coin’s price continued to come under pressure this month despite a crypto rally that pushed the total market capitalization of all cryptos over $3.68 trillion. This performance is likely due to the ongoing token openings that are increasing supply with each passing day.

The bears have also further tightened their grip as the broader market trend reverses, with Bitcoin prices falling today.

PiScan data shows that the network will open more than 145 million tokens worth $67 million in the rest of the month. Then, there will be an opening of 138.5 million tokens in August, 117 million in September, and 93 million in October.

Investors Continue to Move Pi Tokens Off the Foam

In addition, Pi Coin’s price slumped as investors continued to move their tokens off exchanges. Outflows from exchanges surged by more than 1.4 million tokens in the last 24 hours (07/15).

Investors removed their tokens from exchanges when they sold them. This, in turn, led to greater selling pressure at a time when supply from token openings was on the rise.

There are also concerns about the centralization of the Pi Network, as the Pi Foundation has a lot of power. Its wallet holds over $33 billion worth of tokens without any audits. This centralization partly explains why many major exchanges such as Binance and Upbit have not listed it.

Pi’s trading volume was also low during this rally. The volume in 24 hours (15/7) was recorded at $80 million, lower compared to other popular coins such as Pepe (PEPE), Shiba Inu (SHIB), and Bonk (BONK).

Read also: 3 Crypto that will Rise Today (7/16/25): Check Out the Analysis

Pi Network Price Technicals Point to an Imminent Rise

Pi Coin’s ongoing price drop could be the calm before the storm which could trigger a surge despite the broader market being down.

Its volume and volatility have fallen in recent months. A drop in volume and volatility is often a sign of slow accumulation.

The accumulation phase according to Wyckoff Theory then leads to a strong surge when it enters themarkup phase. The markup phase is characterized by higher demand than supply.

Pi Coin’s price has formed a double-bottom pattern at $0.4056 and a neckline at $1.6664, its highest point in May. Likewise, the token has formed a falling wedge chart pattern, a popular bullish reversal pattern. The two wedge lines are almost converging, which could trigger a breakout.

In addition, the MACD indicator has formed a bullish divergence, a very bullish pattern. Therefore, the token is likely to experience a bullish breakout towards the key resistance point at $1.

A move above the resistance point would signal further upside potential, possibly up to $1,666.

Conversely, a drop below the support level at $0.4056, a double-bottom pattern, would invalidate the long-term bullish projection for Pi Network.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Pi Coin Price Crashes Amid Crypto Rally, Analysis Predicts Recovery. Accessed on July 16, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.