Download Pintu App

Bitcoin (BTC) Hits ATH at $123,000, Are Miners Starting to Take Profits?

Jakarta, Pintu News – This week, the Bitcoin (BTC) miner position index showed a sharp spike, sparking fears of selling pressure from miners. However, analysis of on-chain data provides a more in-depth picture of miner behavior. Does this signal that the Bitcoin (BTC) price has bottomed?

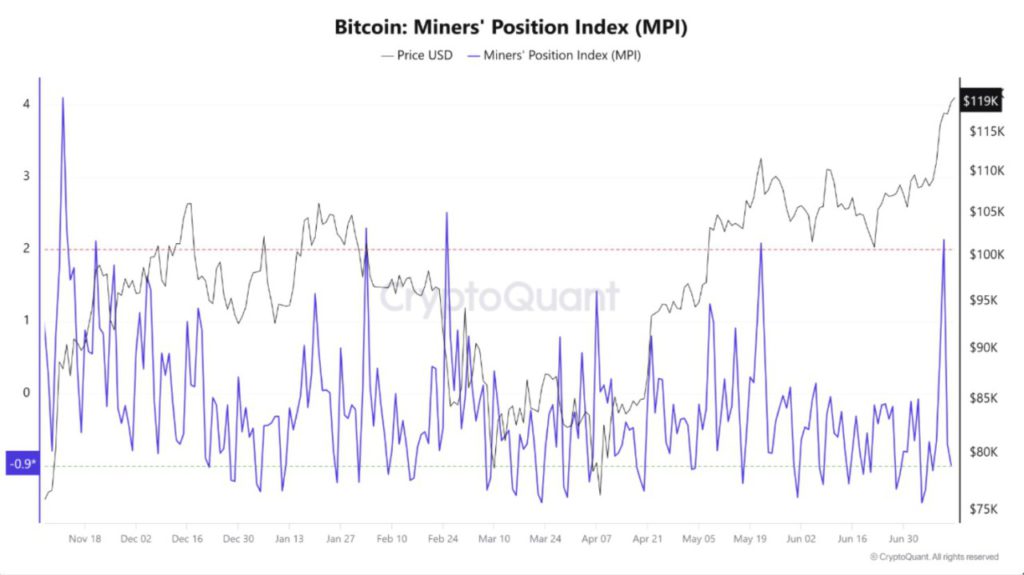

MPI hike triggers profit-taking speculation

The Miners’ Position Index (MPI), which measures the ratio of miners’ outflows to their one-year average, briefly surpassed 2 in mid-July 2025. A reading above 2 indicates that miners are selling their holdings as the price of Bitcoin (BTC) reaches new peaks.

Historically, this has often been followed by a market correction due to massive selling by miners. When miners send more Bitcoin (BTC) to exchanges, especially at levels above their historical averages, they usually prepare to sell to lock in profits when prices are high.

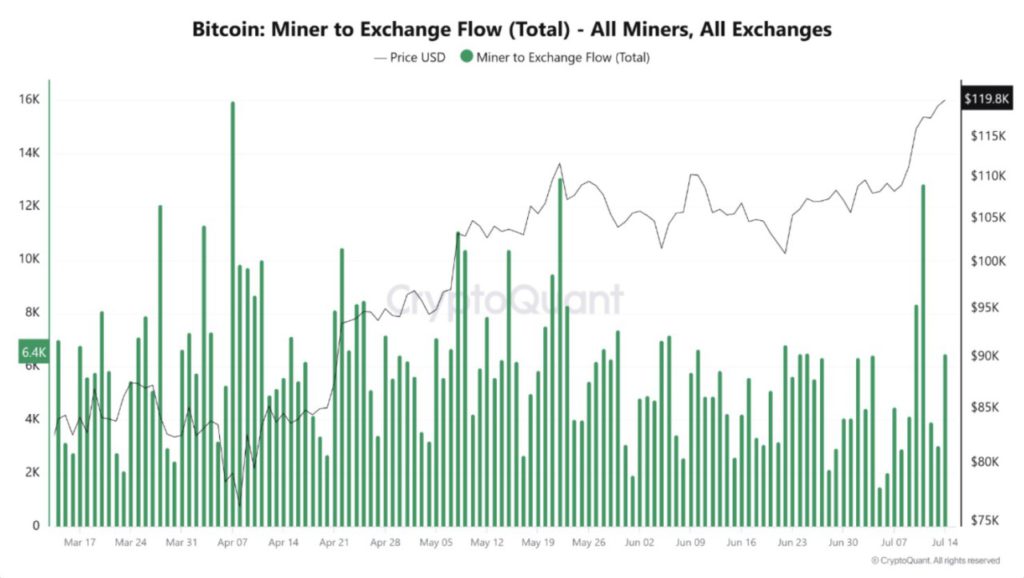

Binance recorded net inflows of nearly 6,000 BTC between July 12 and July 14, coinciding with a surge in Bitcoin (BTC) price to a new record high of $123,091.

These inflows could indicate massive profit-taking, but the move is not necessarily bearish. Some BTC may be allocated for arbitrage, derivative hedging, or over-the-counter transactions, and not necessarily for sale on the market.

Also read: Bitcoin price plummets to $117,000, but these 3 cryptos skyrocket!

Will Miners Take Advantage?

Although the MPI index surged past the key level of 2, it was immediately followed by a sharp decline. This has been a recurring pattern. Previous MPI spikes, including in late 2024, February 2025, March 2025, and June 2025, were usually followed by temporary price declines or stabilization, not sustained selling.

This reversal suggests that while some miners may be taking profits, they are doing so selectively and in smaller batches. It also suggests that the market may be absorbing these sales without serious losses.

In other words, miners may not feel financial pressure. With Bitcoin (BTC) prices still well above average production costs, many may prefer to wait for better margins.

Also read: Bitcoin (BTC) price drops to $117,000, is a price recovery imminent?

Sentiment Increased, but Long-term Trend Still Intact?

Social metrics from Santiment show that when Bitcoin (BTC) hit $123.1K, over 43% of all crypto-related discussions centered on Bitcoin (BTC), a clear sign of euphoric retail interest.

While this signaled strong mainstream momentum, it also signaled a short-term top, especially with the “FOMO” sentiment reaching its peak. Meanwhile, macro developments are shaking up the market.

US President Donald Trump’s announcement of potential 100% tariffs against Russia caused risk outflows across financial markets, dragging Bitcoin (BTC) below $120,000. According to data from CoinMarketCap, Bitcoin (BTC) is currently trading at $117,705, down from its intraday high, although still up 12% in the last month.

Conclusion

By looking at current patterns and data, it seems that Bitcoin (BTC) miners may continue to take profits gradually without triggering massive selling. This shows confidence in the long-term value of Bitcoin (BTC) and the possibility of market stability despite short-term price fluctuations.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Coingape. Are Bitcoin Miners Booking Profits as BTC Price Hits $123k, Is a Sell-Off Ahead? Accessed on July 16, 2025

- Featured Image: Generated by AI

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.