Download Pintu App

Ethereum Skyrockets to $3.350 Today — Is This the Start of ETH’s Next Massive Bull Run?

Jakarta, Pintu News – Ethereum (ETH) has officially broken its long-term resistance at $2,900, signaling a significant bullish breakout.

This move ended a months-long accumulation phase between $2,200 and $2,900. ETH jumped more than 15% this week, beating Bitcoin’s (BTC) 9% gain in the same time.

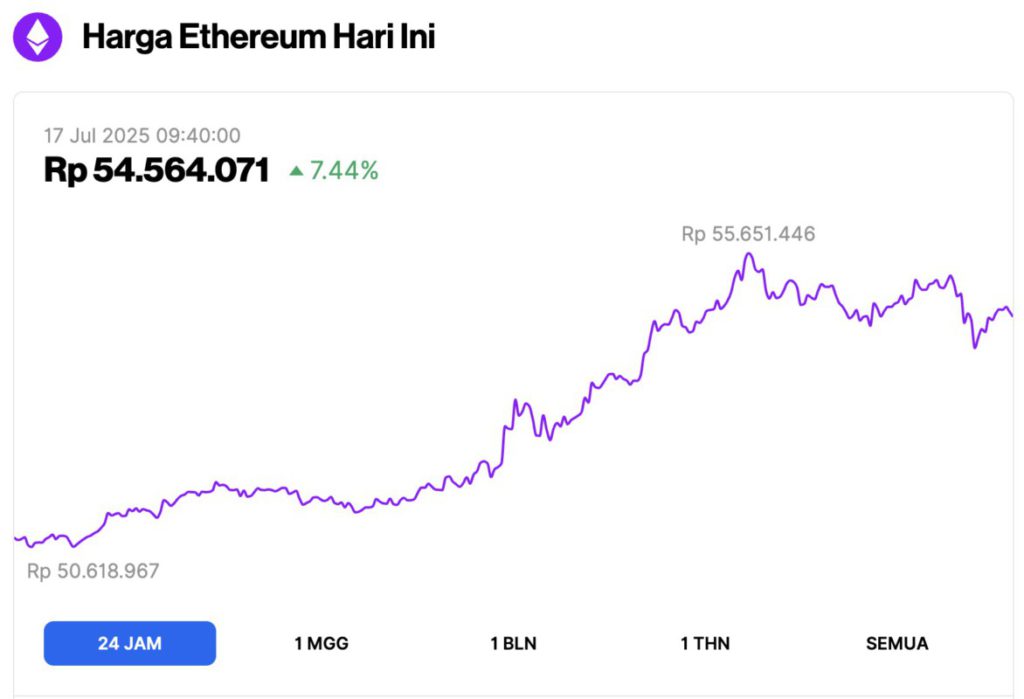

Ethereum Price Up 7.44% in 24 Hours

As of July 17, 2025, Ethereum was trading at approximately $3,350, or around Rp54,546,071 — marking a 7.44% gain over the past 24 hours. Throughout the day, ETH dipped as low as Rp50,618,967 and climbed to a high of Rp55,651,446.

At the time of writing, data from CoinMarketCap shows that Ethereum’s market capitalization stands at around $404.43 billion, with daily trading volume rising 25% to $47.3 billion within the last 24 hours.

Read also: 3 Crypto that will Rise Today (7/17/25): Memecoin Shows Bullish Signal, Time to Buy?

Ethereum’s Bullish Momentum Strengthens

Crypto analyst, Nilesh Rohilla, highlighted this ETH breakout as an important technical event. ETH has also moved above its 50-week moving average, reinforcing its bullish momentum.

Ethereum price now finds solid support at $2,650 and $2,900, while resistance above is at $3,450, $3,700, and $4,100.

Another strong signal comes from the Relative Strength Index (RSI), which has broken out of its previous range. Rohilla says that this indicator has preceded rises of 70% to 120% in previous cycles.

Ethereum’s current structure reflects previous rally patterns from past accumulation zones. A breakout above $4,100 could mark the start of a parabolic phase in the fourth quarter of 2025.

On-Chain Scarcity Drives ETH Surge

Rohilla notes that more than 35 million ETH has now been staked. This has created a growing supply shortage, putting upward pressure on prices.

As DeFi usage surges, staking continues to reduce the circulating supply, strengthening Ethereum’s long-term value proposition.

The GENIUS Act may facilitate the development of ETH without explicitly mentioning ETH.

Read also: Whale Era Satoshi Moves 80,000 BTC to CEX as Bitcoin Hits Record Highs!

If stablecoins are launched under their direction by PayPal and Circle, then increased on-chain demand could benefit ETH. Clarity on regulation will attract more institutional players towards Ethereum.

Ethereum is trading around $3,108, which is up almost 4.97% this week. BlackRock’s iShares ETH Trust now holds over 2 million ETH, which equates to about 1.65% of the circulating supply. This is after huge fund flows, including a $386 million increase in a single day, which is the best so far in 2025.

Ethereum eyes $3,600 as technical strength increases

Ethereum is testing 61.8% Fibonacci retracement, an important technical level. As analysts predict that if ETH breaks above $3,220 and $3,470, the next targets are at $4,000 and $3,500.

If ETH surpasses the resistance around $3,100, the price could jump 17% to $3,600.

Over the past 24 hours (16/7), the total liquidated ETH futures amounted to $136.5 million, evenly split between long positions of $82.63 million and shorts of $53.87 million.

If the bulls fail, ETH might find support at $2,850 or even bounce off $2,500.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today‘ s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- TronWeekly. Ethereum Price Forecast: Will It Explode Toward $4,000 Next? Accessed on July 17, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.