Download Pintu App

Price of 1 Pi Network (PI) in Indonesia Today (07/18/25)

Jakarta, Pintu News – The price of 1 Pi Network (PI) today, Thursday July 18, 2025, was recorded at Rp7,290 (referring to the exchange rate of $1 = Rp16,315), showing a slight recovery after bearish pressure over the past few days. Despite the weakness, PI recorded a slight increase of 1.33% in the last 24 hours.

But behind this rise, market indicators are showing signs of deep concern. Investor sentiment plummeted to its lowest point in three months, while the Chaikin Money Flow (CMF) indicator recorded the largest outflow of funds since the beginning of the year, reflecting the market’s steadily eroding confidence in the future of this crypto.

Check out the full analysis in this article!

Price of 1 Pi Network (PI) in Indonesia Today (07/18/25)

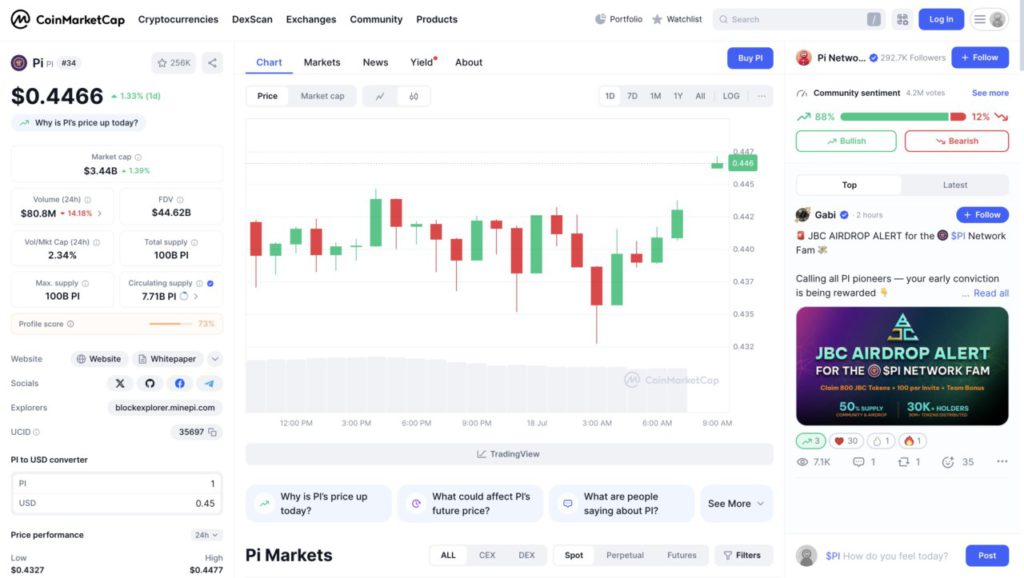

The Pi Network (PI) price chart today, Friday July 18, 2025, shows a slight recovery after being under pressure in recent days. The PI price increased by 1.33% in the last 24 hours and is now at $0.4466 or around IDR 7,290 (at an exchange rate of $1 = IDR 16,315). Although the increase is not significant, it gives an early signal that buying interest is starting to reappear amidst the consolidation trend.

The chart shows a fairly volatile price movement pattern, with red and green candlesticks alternating over the past two days. Although daily trading volume decreased by 14.18% to $80.8 million (around Rp1.3 trillion), community sentiment remains strong with 88% of users showing a bullish view.

This rise is also likely driven by the news of the JBC token airdrop announced in the PI community, which could be a trigger for short-term investor enthusiasm. However, technically, PI still needs to cross the $0.45 (IDR7,351) resistance level to confirm a more solid trend reversal.

Read also: Shytoshi Kusama Ready to Launch AI SHIB Whitepaper, New Breakthrough?

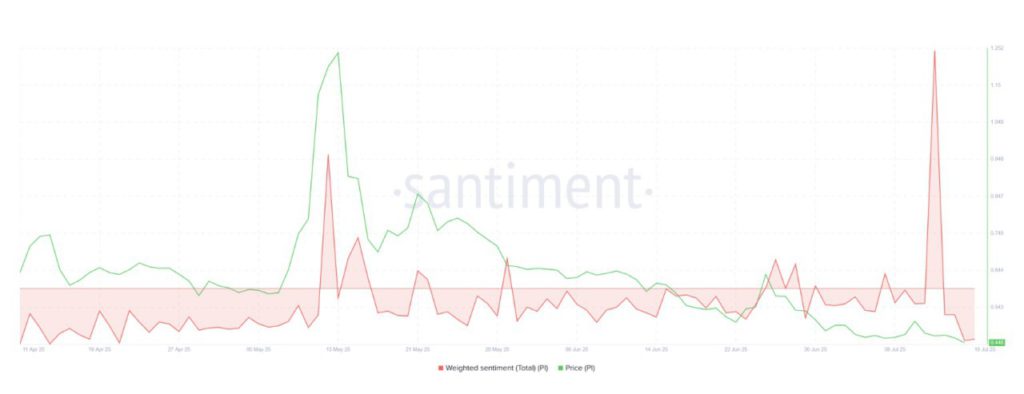

Investor Sentiment Plunges

In recent weeks, investor sentiment towards Pi Coin (PI) has continued to weaken dramatically. Data shows that weighted sentiment-an indicatorreflecting investor optimism or pessimism-has fallen to its lowest level in three months. This indicates that market confidence in PI’s future performance is dwindling.

This caused many investors to start reducing their exposure to these crypto assets. As a result, selling pressure continued to increase and accelerated the downward trend in prices. Without any boost from positive sentiment, it is very difficult for PI to get out of this correction zone in the near future.

Read also: Tether Prints $2 Billion USDT and Send $1 Billion to Binance: What’s the Impact?

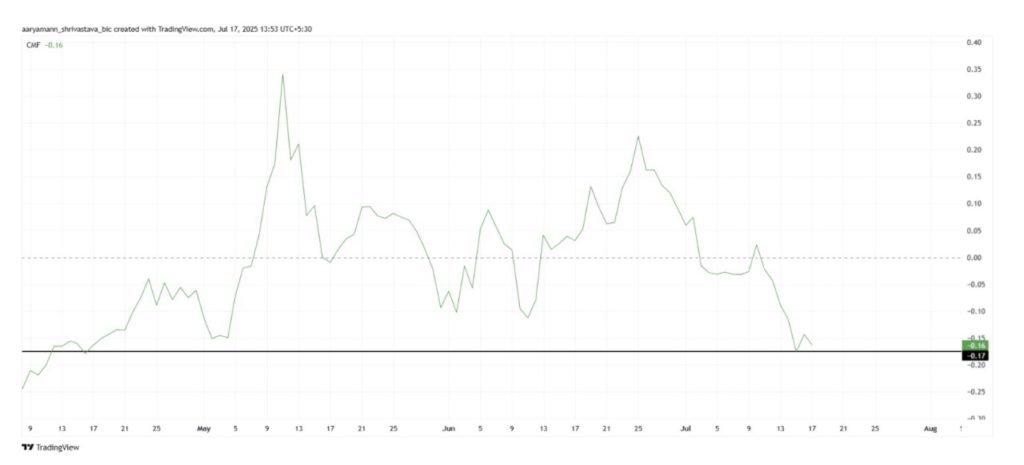

Mass Fund Exit: CMF Hits Bottom

Not only has sentiment deteriorated, technical indicators also show that Pi Coin is experiencing a massive outflow of funds. The Chaikin Money Flow (CMF) indicator is now at a three-month low, meaning that more funds are leaving PI than are coming in. This is a classic sign that investor confidence is in crisis mode.

If this condition persists, it will be difficult for Pi Coin to regain market interest. The lack of fund inflows weakens price momentum and makes PI vulnerable to further declines. Unless there is a trend reversal or significant positive news, it is likely that selling pressure will continue to dominate.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today‘ s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Pi Coin Continues To Bleed Money As Skepticism Hits 3-Month High. Accessed July 18, 2025

- Featured Image: Coinpedia

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.