Download Pintu App

$2 Billion Fresh Money Injection, Bitcoin Ready to Fly Again? Analyst: Big Crypto Rally Signals!

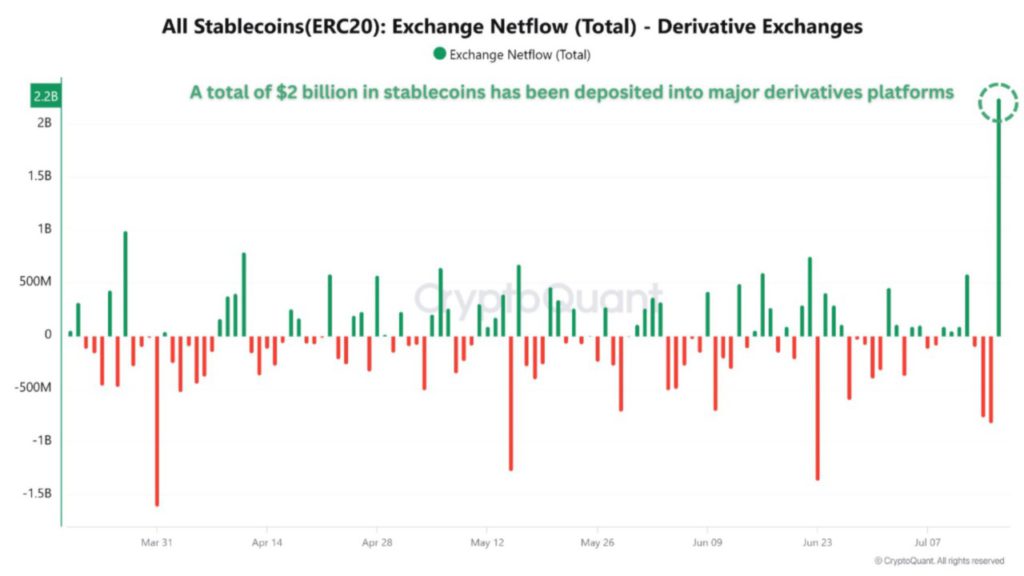

Jakarta, Pintu News – Bitcoin (BTC) price is currently hovering around US$116,000-US$120,000 (around Rp1.89-Rp1.96 billion). However, market analysts are predicting a new surge following a US$2 billion (Rp32.6 trillion) inflow of stablecoins to major crypto derivatives platforms. This is seen as a potential trigger for further price rallies in the cryptocurrency market.

US$2 Billion Liquidity Injection Drives Crypto Rally

According to analysis by CryptoQuant cited by NewsBTC, more than US$2 billion worth of stablecoins, mainly Tether (USDT), were recently deposited into crypto derivatives exchanges. This massive inflow is seen as a signal that institutional traders are preparing to open leveraged positions, particularly on Bitcoin and other altcoins.

Historically, large inflows of stablecoins have often preceded bullish phases in the crypto market. Stablecoins are typically used to open long positions in futures and perpetual contracts, so a large influx of fresh funds could potentially push Bitcoin’s price to new record highs.

Also Read: Bitcoin Price Has Skyrocketed, Here Are 5 Tips to Choose a Safe and Reliable Crypto Exchange!

Signal Open Interest & Coinbase Premium Index

Another analyst, TraderOasis, highlighted the rise in Open Interest (the number of open contracts) that went hand-in-hand with the rise in BTC price. This concurrent rise indicates a strong bullish sentiment, as more traders are opening new positions in the hope that Bitcoin’s price will continue to rise. However, this situation also increases the risk of volatility in the event of a reversal in market sentiment.

In addition, the Coinbase Premium Index is also above zero, meaning US-based buyers are willing to pay higher prices than the global spot market. This is usually an indicator that demand from the US is high enough to drive a rally, although it’s currently trending steady.

Short-Term Correction Potential Remains

While the injection of jumbo stablecoins is considered bullish, the data also indicates a possible price correction in the short term. BTC deposit activity to exchanges spiked after the price hit a peak of US$123,000 (US$2.01 billion). This phenomenon often marks a local top and can be followed by a temporary price drop.

However, despite the increased profit-taking, Bitcoin price has not experienced a major drop. This shows that underlying demand is still strong in the crypto market, so the opportunity for further upside is still wide open if liquidity flows remain consistent.

Conclusion: Bitcoin on the Threshold of a Breakout?

With a US$2 billion (IDR32.6 trillion) injection of stablecoins and Coinbase’s Open Interest and premium data still positive, the crypto market is currently on the verge of a potential continued rally. Although the chance of a short-term correction remains, analysts believe bullish sentiment continues to dominate the Bitcoin market. For investors, monitoring stablecoin flows and sentiment indicators will be key in making trading decisions going forward.

Also Read: Bitcoin Price Breaks ATH, 5 Smart Investment Strategies to Deal with Market Volatility

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- NewsBTC. Bitcoin Set To Soar?Analyst Sees Fresh $2 Billion Liquidity Triggering Next Leg Up. Accessed July 17, 2025.

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.