Download Pintu App

Ethereum Soars to $3,700 Today – Is a Massive Rally to $4,800 Just Around the Corner?

Jakarta, Pintu News – Ethereum (ETH) has outperformed Bitcoin (BTC) in the past week with a 21% increase in price. This rise coincided with the start of the altcoin season, which caused Bitcoin’s market share to drop to a seven-day low.

These factors fueled speculation that Ethereum price may be on its way to rallying to hit an all-time record high of $4,800.

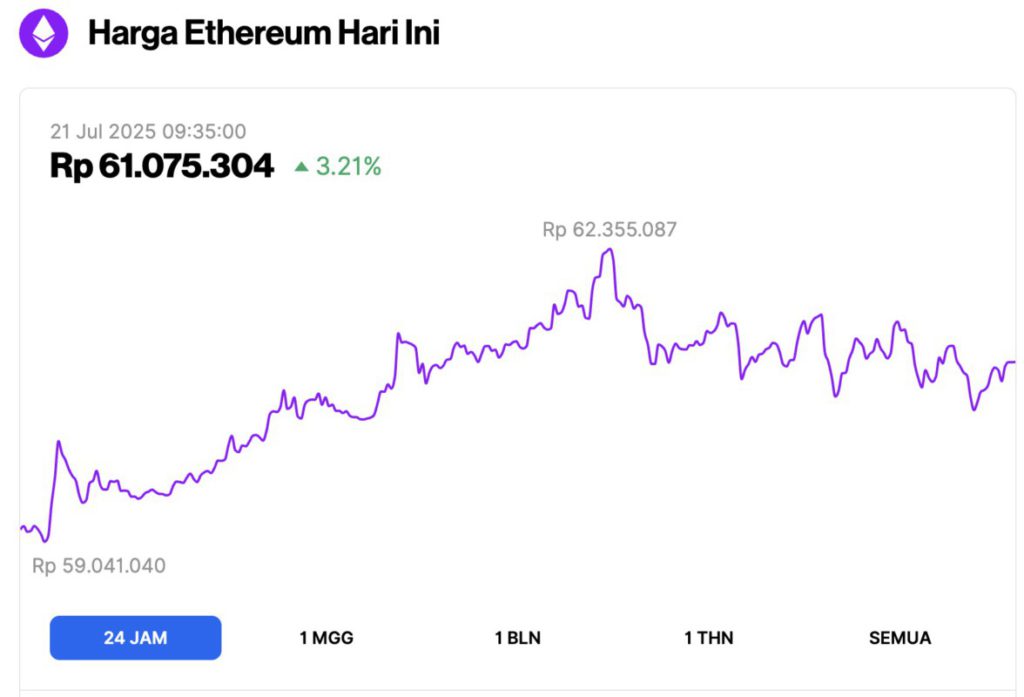

Ethereum Price Up 3.21% in 24 Hours

As of July 21, 2025, Ethereum was trading at approximately $3,745, or around IDR 61,075,304 — marking a 3.21% increase over the past 24 hours. Within that time frame, ETH dipped to a low of IDR 59,041,040 and reached a high of IDR 62,355,087.

At the time of writing, data from CoinMarketCap shows that Ethereum’s market capitalization stands at around $452.23 billion, with daily trading volume rising 82% to $47.21 billion within the last 24 hours.

Read also: 3 Crypto Made in USA Worth Monitoring After the GENIUS Bill Passed!

Ethereum Price Rises as Bitcoin Dominance Falls

Bitcoin’s market share in the total crypto market capitalization of $4 trillion has decreased in recent days.

Altcoins are starting to take over, with many investors turning to other cryptocurrencies that are considered to have higher profit potential. Bitcoin’s market share fell to 61%, the lowest figure since March, as it recorded slower growth.

Looking at patterns from previous years, Ethereum usually takes over when Bitcoin’s dominance weakens. This is starting to show now, with ETH prices up 21% in the past week, while BTC has only gained 0.6% in the same period.

This decline in dominance also sparked talk of the beginning of the altcoin season, especially as the altcoin index rose to 41 – suggesting that investors are starting to move funds from Bitcoin to other crypto assets. This reinforced the optimistic sentiment towards Ethereum’s price predictions.

When investor sentiment towards altcoins is more positive than towards BTC, it is likely that the price of ETH will continue to rise. Investors are turning to this altcoin in the hope that Ethereum will set a new price record high.

ETH Aims for $4,800 as It Faces Key Resistance Levels

While Bitcoin’s decline in dominance is a breath of fresh air for Ethereum prices, the largest altcoin still needs to cross an important resistance level to confirm its strong uptrend potential.

Read also: 3 Cryptos Worth Buying When Crypto Market is Bullish

This resistance is in the price range of $3,600 to $3,900, and has been an unbreakable barrier for the past three years.

If the buying pressure on Ethereum – from both retail and institutional investors – continues, then the ETH price has a chance to break through this resistance. Increased demand from BlackRock investors, who currently buy more ETH than Bitcoin, could be the additional boost needed.

If ETH manages to break this resistance, the next price target is $4,800, which means Ethereum could set another record high price.

In addition, although the price of ETH has been rising in recent weeks, the RSI indicator has not yet reached the overbought level (above 70), which strengthens the chances of a further rally.

To conclude, Ethereum’s price has registered a significant surge in the past week, and this has led to increased interest in altcoins as a whole. As a result, Bitcoin’s market dominance fell sharply, reinforcing the potential for an ETH rally towards $4,800.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today‘ s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Ethereum Price Prediction As Bitcoin Dominance Crashes- Is $4,800 Next? Accessed on July 21, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.