Download Pintu App

What is Wrapped Token: Definition and Benefits for the Cryptocurrency World

Jakarta, Pintu News – Amidst the rapid development of the crypto and blockchain world, an important innovation has emerged that provides a solution to a classic problem: limited interactions between networks. This innovation is known as wrapped tokens, which are digital assets that allow cryptocurrencies to be used outside of their original network.

Wrapped tokens expand the flexibility of the cryptocurrency ecosystem, paving the way for more liquidity and interoperability. So, what exactly are wrapped tokens and why are they increasingly vital in the world of DeFi (Decentralized Finance)?

What is Wrapped Token and Why is it Important?

Wrapped tokens are representations of native cryptocurrencies (native tokens) that are issued on a different blockchain than their home network. For example, Wrapped Bitcoin (WBTC) is a tokenized version of Bitcoin (BTC) that runs on the Ethereum (ETH) network, allowing BTC to be used in Ethereum-based applications such as DEX, lending protocols, and others.

The main function of wrapped tokens is to bridge the gap between previously incompatible blockchain networks. Most tokens can only be used on their home network, but with wrapped tokens, assets like BTC can be utilized in other ecosystems without having to be sold.

This is certainly an important solution in the increasingly decentralized and fragmented crypto era. Wrapped tokens are key in driving cross-platform collaboration and increasing the utility of crypto assets.

Also read: Gold Jewelry Price Today, Monday July 21, 2025

How Wrapped Tokens Work: From Minting to Burning

Wrapped tokens are created through a process called minting, where users send their native assets to a custodian. The custodian can be a smart contract, decentralized organization, or centralized entity responsible for storing the original assets. The custodian then mints the equivalent number of wrapped tokens on the target blockchain, e.g. 1 BTC is converted to 1 WBTC on Ethereum.

To return the wrapped token to its original asset, the process is called burning. The user sends the wrapped token back to the custodian, who then burns (destroys) the token and returns the original asset.

This process ensures that the number of wrapped tokens in circulation always matches the reserve of original tokens stored. It also keeps the value of the wrapped tokens 1:1 with the value of the underlying asset.

Also read: 3 Potential Airdrops in Mid-July 2025 According to CryptoRank

Advantages of Wrapped Tokens for the Cryptocurrency World

Wrapped tokens bring various strategic benefits, especially in terms of interoperability and liquidity. By using wrapped tokens, assets such as Bitcoin (BTC) can be used in other ecosystems such as Ethereum (ETH), expanding the range of usage and enabling participation in DeFi applications without the need to sell BTC.

In addition, wrapped tokens often operate on networks with lower transaction fees and higher speeds than the original network. For example, Ethereum has more active DeFi services than Bitcoin, so BTC users using WBTC can enjoy features such as yield farming, lending, and automated trading. Wrapped tokens also help enlarge the market by increasing trading volume between platforms.

Wrapped Token vs Native Token: What’s the Difference?

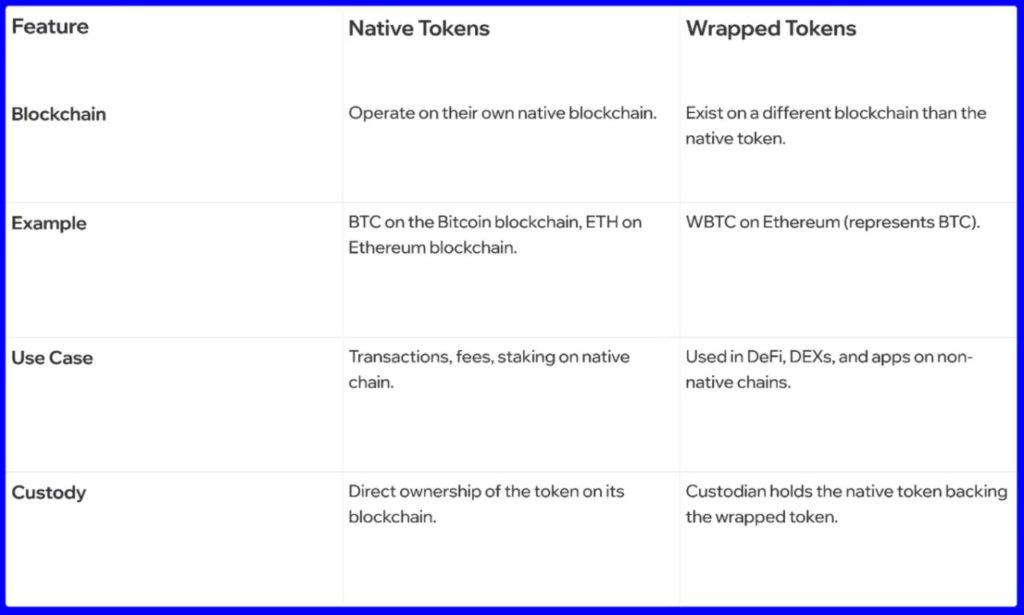

Native tokens are native crypto assets that are used on the blockchain network they were created on. For example, Bitcoin (BTC) only runs on the Bitcoin blockchain, and Ethereum (ETH) only runs on the Ethereum network. Native tokens are used to pay gas fees, support network security, and play a role in consensus mechanisms such as mining or staking.

Meanwhile, wrapped tokens are “tokenized” versions of the original asset that can be used on other blockchains. Wrapped tokens like WBTC follow the token standards of the network they belong to, such as ERC-20 on Ethereum. This allows them to be integrated with services and applications that native tokens cannot access. The main difference lies in the flexibility of use and reach across networks.

The Importance of Wrapped Tokens in the DeFi Ecosystem

In the world of DeFi, wrapped tokens play an important role in opening up access for users of different blockchains. For example, BTC owners can now participate in the Ethereum ecosystem without selling their assets, simply by converting BTC into WBTC. They can earn interest, trade, or participate in lending protocols using their wrapped tokens.

Read also: Bitcoin Halving & Market Cycle: A Complete Guide to Understanding the Bitcoin Cycle

Wrapped tokens also improve market efficiency by adding liquidity and enriching the decentralized application ecosystem. Users are no longer restricted by specific networks, and developers can create more inclusive cross-chain services. In short, wrapped tokens bridge the previously fragmented world of blockchain and take crypto towards a more connected future.

Conclusion

Wrapped tokens are not just a trend, but a real solution to the limitations of interoperability in the cryptocurrency world. With its ability to bridge different blockchains, wrapped tokens open up new opportunities for investors and users to maximize their assets. Amid the expansion of DeFi and multi-chain ecosystems, wrapped tokens will be one of the important pillars of the crypto industry’s future.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today‘ s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Trust Wallet. What Are Wrapped Tokens? Accessed July 21, 2025.

- Featured Image: Generated by AI

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.