Download Pintu App

Will Bitcoin (BTC) Repeat its 2,000% Spike After Golden Cross Formed?

Jakarta, Pintu News – Bitcoin (BTC), the world’s largest cryptocurrency, is showing another golden cross pattern on the daily chart. This pattern is often associated with significant price movements in the past. With the appearance of this pattern, many traders and market watchers are wondering if Bitcoin (BTC) will repeat the dramatic rise as in previous cycles.

Golden Cross Pattern and Market Expectations

A golden cross occurs when the 50-day moving average crosses above the 200-day moving average. This pattern is considered one of the best indicators for identifying long-term momentum shifts. This latest pattern was confirmed on May 22, and since then, the price of Bitcoin (BTC) has increased by about 12%. In the past, the same pattern appeared before major rallies in 2017 and 2020, where Bitcoin (BTC) recorded gains of over 2,000%.

Because of this history, this recent signal is getting a lot of attention. Merlijn, a market analyst, highlighted this pattern in a post on X. He described how Bitcoin (BTC) “vertically spikes” whenever this pattern appears. He described how Bitcoin (BTC) “jumps vertically” whenever this pattern appears. He also compared it to the golden cross that formed in October 2024, when Bitcoin (BTC) was trading near $65,000. In the three months after that, the price of Bitcoin (BTC) rose to almost $110,000.

Also Read: XRP Price Surges Again: Momentum Rising, Eyeing Key Resistance

Price Analysis and Next Target

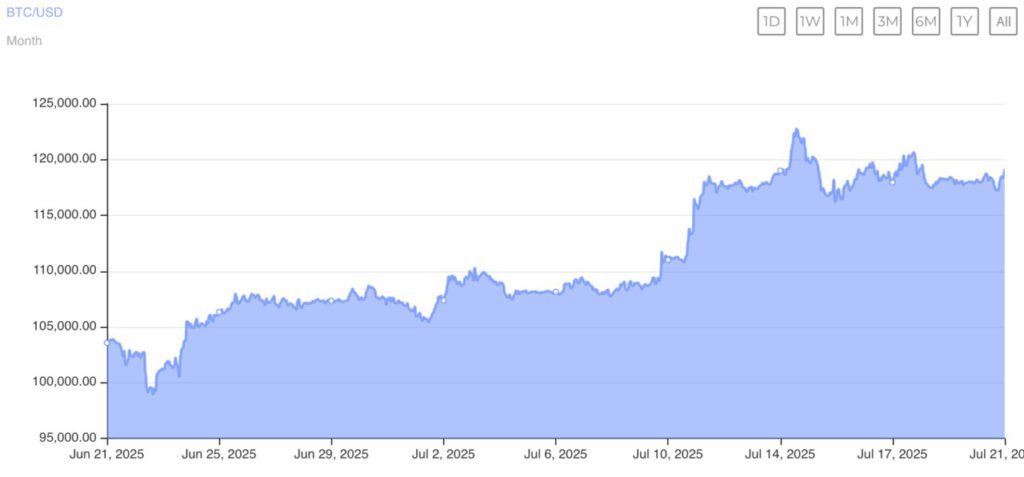

While there is no guarantee that this pattern will repeat in the same way, many traders see it as a key setup. If it follows the pattern of the shorter rally in 2016, the price target could reach as high as $155,000. Currently, Bitcoin (BTC) has reached a new record high of $123,000 on July 15 before experiencing a decline. Bitcoin (BTC) is currently trading at $118,350.28, a decrease of 0.36%.

However, even though a golden cross has formed, Bitcoin (BTC) is facing pressure in the $120,000 range. The currency has tested this level but has not managed to break through it. Analysts state that a clean daily close above this level would be a strong indication that more price increases are on the way.

Market Movements and Future Predictions

Rekt Capital, another market analyst, noted that a post-break retest could confirm a stronger push towards $135,000. He also mentioned that while Bitcoin (BTC) has held steady, money has started to move into altcoins. This shift usually happens when the main trend pauses. Charles Hoskinson, founder of Cardano, also continues to maintain his bold predictions about Bitcoin (BTC).

He still maintains his $250,000 price target for the digital asset. Earlier this year, Bitcoin (BTC) also saw its first golden cross on the weekly chart, which came before the current leg of the bullish rally. Now, with the weekly and daily signals in place, the focus turns to what comes next and whether history will repeat itself.

Conclusion

With the appearance of the golden cross pattern on the daily and weekly charts of Bitcoin (BTC), many are looking forward to whether the cryptocurrency will repeat the outstanding performance of the previous cycle. While the future cannot be predicted with certainty, this pattern gives many investors and traders hope for a potential significant price increase.

Also Read: $2 Billion Fresh Money Injection, Bitcoin Ready to Fly Again? Analyst: Big Crypto Rally Signals!

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today‘ s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Crypto News Flash. Bitcoin Golden Cross is Here: $2000 Run. Accessed on July 21, 2025

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.