Download Pintu App

Will New Capital Take Ripple (XRP) to New Heights?

Jakarta, Pintu News – July has been an exciting month for the Ripple (XRP) ecosystem with several milestones marking significant growth.

From new account activations to record values locked in the system, Ripple (XRP) is showing strong signals that there is new capital flowing in. This analysis will dig deeper into what happened in Ripple (XRP) during the month of July.

Check out the full analysis in this article!

New Records in the Ripple (XRP) Ecosystem

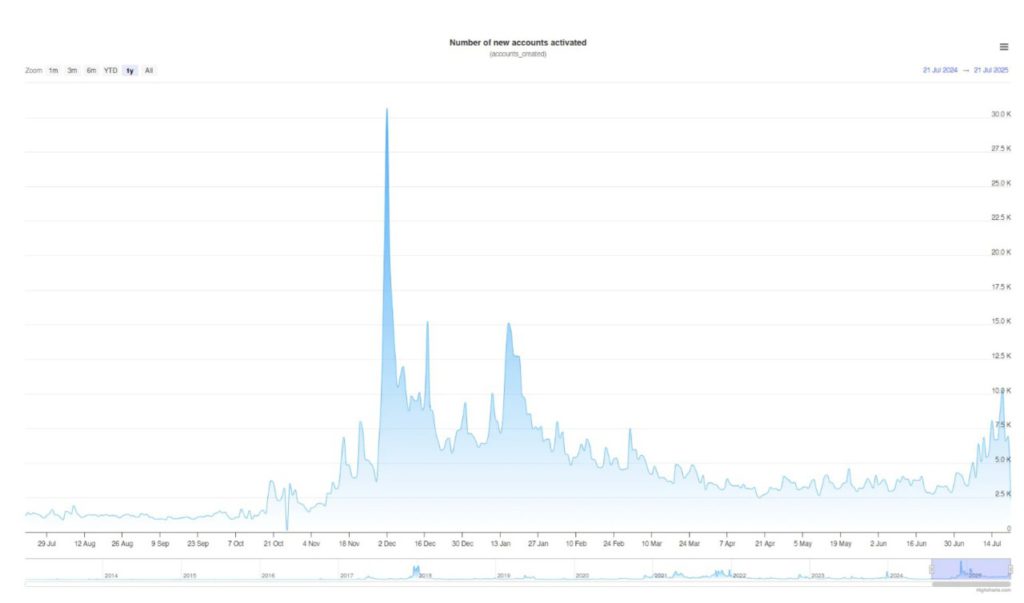

On July 18, Ripple (XRP) recorded over 10,000 new accounts activated in a single day, the highest number since February. While it is yet to break the highest daily record recorded in December 2024 with over 30,000 accounts, this upward trend shows growing interest from new investors.

Many of them are expected to become long-term holders. In addition, the number of daily active wallet addresses has jumped to 50,500, a 100% increase from the previous month and the highest since February.

This increase indicates an increase in activity within the network. The Total Value Locked (TVL) on Ripple (XRP) also reached a new record high, exceeding $92 million, with a large contribution coming from decentralized exchanges (DEXs) within the ecosystem.

Also read: Charles Schwab Prepares to Rival Coinbase in Bitcoin and Ethereum Trading, Here’s the Strategy!

Ripple’s (XRP) Dominance Increases

The Ripple (XRP) Dominance Index (XRP.D) has surpassed 5% and is nearing its peak in 2025. This index depicts how much priority investors give to Ripple (XRP) compared to the total crypto market capitalization.

Some investors even predict that XRP.D could reach 15% by 2025, and there is hope that it will reach 30%, as it did in 2017. With a market capitalization of over $211 billion, Ripple (XRP) now ranks 78th globally in terms of market capitalization, surpassing large companies such as Shell, Blackstone, and Siemens.

However, recent analysis from BeInCrypto warns that Ripple (XRP) futures have hit an all-time high, while there are signs of short-term profit-taking emerging, which could pose a liquidation risk for over-leveraged positions.

Also read: Recorded 498% Price Increase in a Year, Is XRP a Good Investment in 2025?

Future Potential and Risks

The increase in the number of accounts and wallet activity shows that there are more users interested in investing and participating in the Ripple (XRP) ecosystem.

The launch of the official Mainnet Sidechain EVM XRPL by Ripple in early July has also created new opportunities to lock in value in liquidity pools, which directly helped boost the TVL of DEX. However, investors should remain aware of potential risks.

Increases in the value of futures contracts and signs of short-term profit-taking can pose liquidation risks, especially for highly leveraged positions. These circumstances require careful market monitoring and effective risk management strategies.

Conclusion

July has been an eventful month for Ripple (XRP) with many milestones indicating new capital flows and increased interest from investors. While there is significant growth potential, it is important for investors to remain aware of the risks involved. Going forward, Ripple (XRP) may continue to attract attention in the crypto market.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. XRP: Fresh Capital Flowing. Accessed on July 22, 2025

- Featured Image: Crypto Times

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.