Download Pintu App

XRPL Booms as Crypto Analyst Predicts XRP Will Skyrocket 1,300% to $45!

Jakarta, Pintu News – A crypto expert predicts that the price of XRP (XRP) will jump up to 1,300%, as activity on the XRPL (XRP Ledger) increases.

According to the expert, the current situation is similar to the big surge that occurred in 2017. Moreover, on-chain data and real-world deployments suggest that this cycle has the potential to be even bigger.

XRP Ledger Gains Favor as SWIFT Transaction Volume Declines Globally

Recent reports show a significant shift from the use of SWIFT to XRP Ledger (XRPL). SWIFT, a legacy system that has been the backbone of international banking for decades, saw a 15% decline in transaction volume.

Read also: Bitcoin Whale Makes Fantastic Profits, $90 Million in Nine Months!

In contrast, activity on XRPL has increased rapidly due to its advantages in transaction speed, cost efficiency, and elimination of the need for correspondent banking chains.

Ripple CEO, Brad Garlinghouse, at the Apex XRPL Summit predicted that XRPL could take over up to 14% of SWIFT’s global volume in the next five years. Given that SWIFT handles over $150 trillion per year, this projection means that around $21 trillion could move through XRPL.

Interestingly, more and more financial institutions are starting to use XRPL due to its ability to settle transactions in just three to five seconds, clear system structure, and no need for pre-financed accounts.

Increase in activity drives XRP price surge

RippleNet, which operates on top of XRPL, now processes billions of dollars worth of international transactions, helping banks and fintech companies increase cash flow and lower operational costs.

In addition to this positive sentiment, the EVM (Ethereum Virtual Machine) compatible XRPL sidechain was officially launched on June 30.

According to a report on the CoinGape website, within the first week of its launch, more than 1,400 smart contracts were active. To date, more than 1,300 of them are still running.

Meanwhile, Ripple’s stablecoin RLUSD is targeting the $685 billion global remittance market. As the use of RLUSD increases in payments, DeFi, and cross-border remittances, transaction volumes on XRPL are expected to surge.

This increase in activity will drive demand for XRP, which in turn has the potential to increase its price thanks to greater on-chain liquidity.

Expert Predicts XRP Price Could Jump 1,300%

A renowned crypto analyst, The Great Mattsby, recently highlighted that XRP price is showing a re-widening pattern on the monthly Bollinger Bands – a technical pattern that last appeared before XRP’s big surge in 2017.

Read also: PENGU Crypto Price: Pudgy Penguins Explode in Price Again… Could a New Record Be Next?

At that time, XRP skyrocketed up to 1,300% during the breakout. Based on his Gann-based chart analysis, Mattsby estimates that the potential price increase of XRP could reach around $45 per coin.

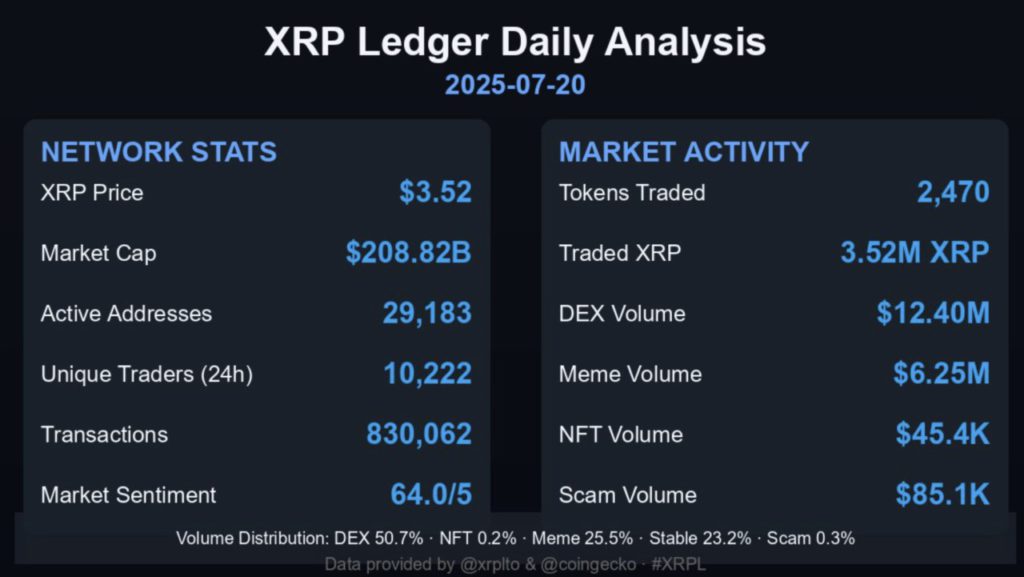

Despite previous challenges, XRP’s price momentum is currently very strong. As of July 21, the XRP price stood at $3.5 with a market capitalization exceeding $207 billion – up more than 63% in the past month. This rise is also in line with the increased activity on the XRP Ledger (XRPL).

Activity on XRPL is growing rapidly. The number of daily active addresses increased by 7 times, and the transaction volume set a record high. Currently, XRPL has over 29,000 active addresses and more than 10,000 unique traders.

Further data shows that daily transactions have surpassed 830,000. Meme coin trading accounted for a volume of $6.25 million.

Stablecoin activity has remained steady at around $5.6 million, while total volume on the decentralized exchange (DEX) on XRPL has reached over $12 million – reflecting healthy liquidity.

In conclusion, as XRPL continues to evolve from just a payment system to a platform for smart contracts and stablecoin remittances, experts believe the price of XRP could soon experience a major surge.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Expert Predicts XRP Price to Hit $45 as XRP Ledger Activity Soars and SWIFT Volume Declines. Accessed on July 22, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.