Download Pintu App

Weekly Wrap: ETH Breaks $3,800, CoinDCX Hack, Up to Altcoin Treasury Strategy!

Jakarta, Pintu News – This week’s crypto market was filled with notable events ranging from Ethereum’s (ETH) price spike, to a major hack on CoinDCX, to altcoin treasury strategies heating up. Let’s take a deeper dive into what happened in the crypto world over the past week!

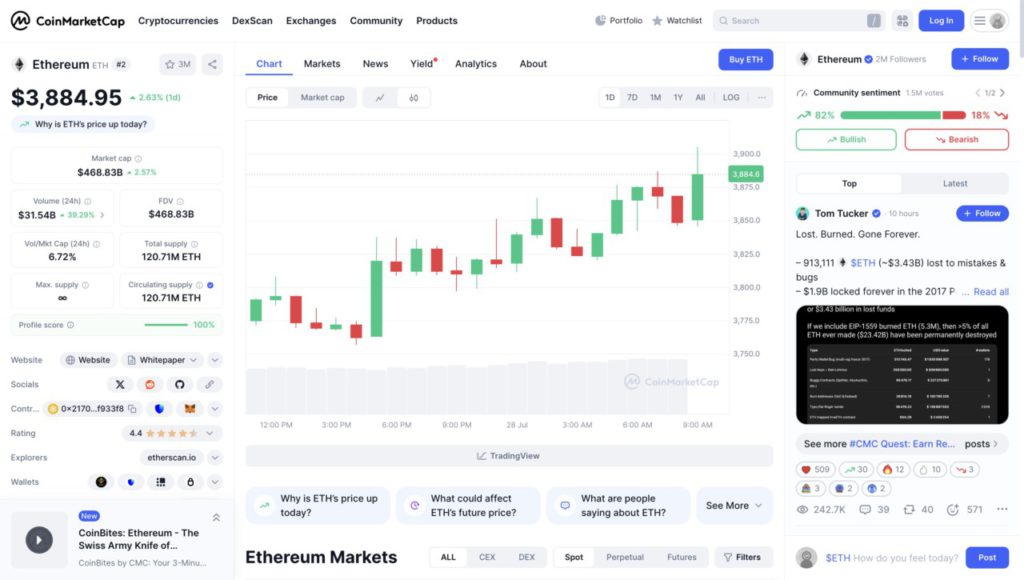

Ethereum (ETH) Surges, Touches Highest Price Since January 2022

Ethereum (ETH) recorded a significant price increase by breaking the $3,800 mark, its highest level since January 2022. This increase was driven by strong institutional interest as well as increased regulatory clarity in the crypto industry.

With an influx of $2.18 billion in ETF funds in just one week and Ethereum holdings by large companies such as Bitmine and Sharplink at over $1 billion each, it shows that the DeFi Ethereum ecosystem is booming.

This rise has not only attracted the attention of retail investors but also large institutions that increasingly see Ethereum as a promising investment asset. This confidence is reinforced by the continuous innovations and integrations in the Ethereum ecosystem.

Read also: 5 Cryptos that will Steal Traders’ Attention in August 2025 – Potential to Rise 200%?

CoinDCX Hack Worth $44 Million, Attack Pattern Similar to Lazarus Group

On July 19, 2025, Indian crypto exchange CoinDCX suffered a major hack with losses reaching $44.2 million. Cybersecurity firm Cyvers attributed this sophisticated attack to North Korea’s Lazarus Group, similar to the WazirX hack that occurred the previous year with a loss of $234 million.

The attack involved pre-attack test transactions and the same cross-chain tactic of laundering funds through Tornado Cash. This case highlights the importance of cybersecurity in the crypto industry and serves as a warning to other exchanges to improve their security systems.

CoinDCX has pledged to improve its security protocols and work with authorities to address these issues.

Also read: These 3 Altcoins Show Strong Accumulation This Week – Altseason Signal?

Altcoin Treasury Strategy, Big Players Start Diversifying

The crypto world is also abuzz with increasingly aggressive altcoin treasury strategies. Bit Origin Ltd started its $500 million crypto treasury with a $10 million purchase of Dogecoin (DOGE), acquiring 40.5 million DOGE tokens.

Meanwhile, SharpLink Gaming increased their Ethereum (ETH) reserves, totaling 360,807 ETH worth over $652 million, solidifying their position as one of the largest Ethereum treasury holders.

This move shows that major companies in the crypto industry are starting to diversify their assets to reduce risk and increase potential future profits. It also signals a new era in crypto asset management at the corporate level.

Conclusion

This week is full of interesting dynamics in the crypto market. With the upcoming Federal Open Market Committee (FOMC) meeting, the market may see more price movements. Investors and market watchers should continue to be on the lookout for the influence of monetary policy on the crypto market.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Crypto Times. Weekly Wrap: Ethereum’s Meteoric Rise, $44M CoinDCX Hack, Altcoin Treasuries, and More. Accessed on July 28, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.