Download Pintu App

Solana Set to Soar – Is a Return to the $206 Peak on the Horizon?

Jakarta, Pintu News – As of July 28, the price of Solana (SOL) was at $186. On a weekly basis, SOL recorded an increase of 2.93%.

According to the TronWeekly report (28/7), SOL price movement remains solid above the important $180 level. Market participants are starting to become active again with increased confidence in the direction of Solana’s movement.

Solana Forms a Double Bottom Pattern at $140

BitGuru highlights the formation of a double bottom pattern at the $140 price level. This pattern was followed by a sharp upward movement. SOL broke through the $169.32 point and surged to $206.47.

Read also: Pi Coin Just Crashed 5% Today — Is This the Beginning of a Bigger Drop?

After that, there was a healthy consolidation. The price has now stabilized at an average of around $186. This consolidation indicates an accumulation of strength on the part of the buyers (bulls).

Analysts showed a W-shaped pattern, which usually signals a potential trend reversal. SOL prices briefly touched a low of $125.99 and bounced back.

Now, the asset is facing an area of resistance in the range of $150 to $160. The pattern suggests a potential continuation of the upside. The bulls are starting to take over the direction of the market movement.

Bullish Market Indicators for Solana

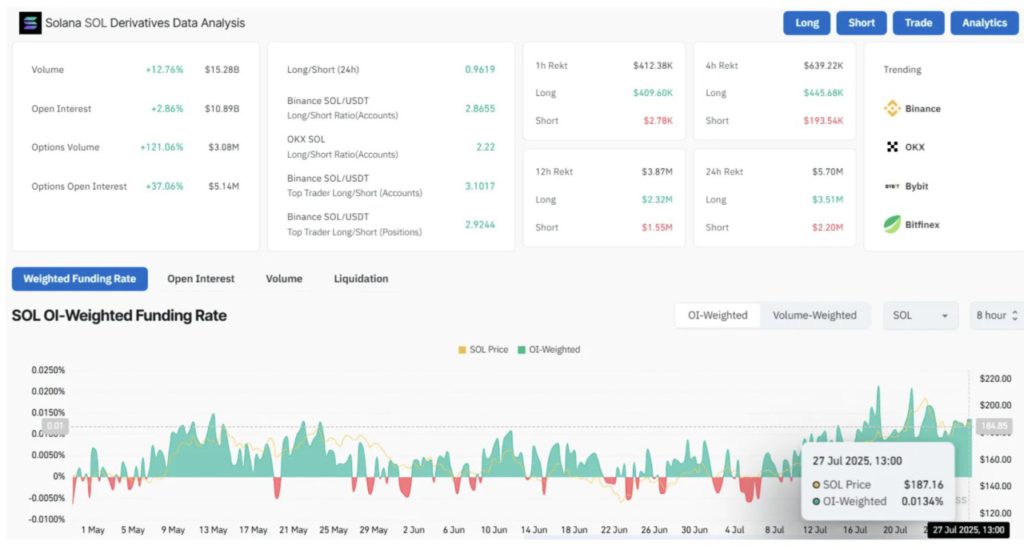

Data from CoinGlass shows that open interest increased by 2.86%, reaching $10.89 billion.

The funding rate was also in positive territory at 0.0134%. This indicates that traders have a bullish view of the market. Trading volume also increased by 12.76%, with the current value reaching $15.28 billion.

All these indicators reinforce the belief that market confidence in Solana is growing.

Solana’s RSI Shows Stable Market Strength

Solana’s Relative Strength Index (RSI) stands at 51.44, which is in the neutral category. This indicates that the asset is neither overbought nor oversold.

Read also: 3 Trending Crypto that will Explode in August!

The current RSI trend displays mild market pressure. This movement is likely to be accompanied by increased volume momentum.

The MACD line is at 0.29, slightly higher than the signal line at 0.28. The histogram value is also slightly positive at 0.01.

This structure signals the occurrence of a small bullish crossover. Although it is still early, this signal has the potential to attract more momentum. Further confirmation could come if the price breaks above $190.

Volume is also an important indicator. Liquidity levels are high with the value of transactions reaching $4.39 billion in the last 24 hours. Buyers’ activity increased, especially in the support area.

This increased volume could push SOL past key resistance levels. The current zone of interest is in the range of $190 to $195.

If a breakout occurs and the price is confirmed to break above $195, then there is a possibility that the price will again test the $206 level. However, if the price fails to hold above $180, the potential for further gains could be delayed. Currently, the market structure shows a bullish bias, although it needs further confirmation.

Overall, traders are now observing strong closing prices as well as increased volume. Short-term bullish signals are starting to appear.

Technically and from an on-chain perspective, Solana is showing positive performance. The market is waiting for the next move with a focus on resistance levels and trading volume.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Tron Weekly. Solana Eyes Bullish Reversal, Can It Regain $206? Accessed on July 29, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.