Download Pintu App

Ethereum at 10 Years Old: Achievements and Unending Controversy

Jakarta, Pintu News – Ethereum (ETH) is celebrating a decade of existence with a record of uninterrupted uptime. However, amidst the celebrations, there are still heated debates about scalability and decentralization involving its community. Although derivatives data shows an increase in market activity, skepticism still colors Ethereum (ETH)’s 10-year journey.

The Digital Footprint that Never Stops

In its 10 years of operation, Ethereum (ETH) has managed to record non-stop uptime, a feat rarely achieved by centralized services like Facebook, AWS, and Cloudflare that have experienced downtime. A viral post from Ethereum Foundation and Optimism contributor Binji emphasized that this success is not due to a CEO or customer service, but rather the hard work of the entire community.

Ethereum (ETH) continues to operate despite challenges such as forks, crashes, market bubbles, lawsuits, hacks, wars, and other internet dramas. This ability to keep operating non-stop demonstrates the resilience and uniqueness of Ethereum (ETH) compared to other services that often rely on centralized infrastructure that is vulnerable to disruptions.

Also Read: Top 4 Cryptos to Buy in Q3 Altcoin Season, Bitcoin’s Dominance Declines!

Unflagging Criticism

Despite its many achievements, Ethereum (ETH) still continues to receive criticism, especially with regard to issues of scalability and decentralization. Some observers think that Ethereum (ETH) still has a long way to go to truly scale and support global applications without sacrificing the principle of decentralization.

The debate has been heating up on social media, with various parties expressing their concerns about the future of the network. These criticisms show that while Ethereum (ETH) has come a long way, there is still significant room for improvement. The community is constantly working on solutions that can address these issues without compromising its existing advantages.

Promising Market Surge

Recent data shows that aggregate Open Interest for Ethereum (ETH) has reached $57.73 billion, a record high. This increase occurred towards the end of July, signaling a significant surge in market activity.

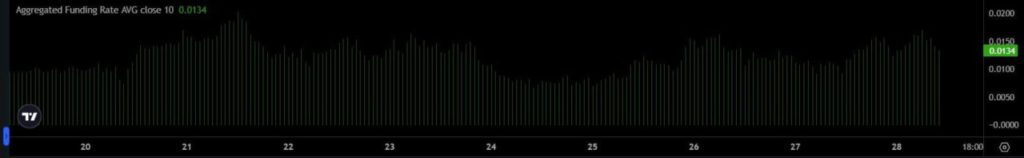

In addition, the Funding Rate reaching 0.0134 shows that traders are increasingly leaning towards long positions, despite concerns about regulation and network architecture. This surge shows that the market is bullish on Ethereum (ETH), signaling strong confidence from investors despite the challenges.

Conclusion

To summarize, Ethereum (ETH)’s 10-year journey has been full of impressive achievements but has not been free from criticism and challenges. The success in maintaining flawless uptime and the increase in market activity shows the huge potential of Ethereum (ETH). However, debates over scalability and decentralization will continue as part of the network’s evolution.

Also Read: 10 Potential 2025 Crypto for 2025 Year-End Profits! Any of your favorite coins?

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. 10 years on, Ethereum still divides the internet but ETH never stops. Accessed on July 29, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.