Download Pintu App

6 Harsh Warnings from Robert Kiyosaki: American pension funds vulnerable to collapse, crypto a solution?

Jakarta, Pintu News – Robert Kiyosaki, author of the legendary financial book Rich Dad Poor Dad, has taken the financial world by storm again with his latest warning about pension funds in the United States. In the face of ballooning national debt, soaring inflation, and a traditional pension system that is considered fragile, Kiyosaki advises people to turn to crypto assets such as Bitcoin (BTC).

According to him, only with a diversification strategy and the adoption of cryptocurrencies can people protect their financial future. Here are 6 important points from Kiyosaki’s warning that must be observed by all generations, including crypto investors in Indonesia.

1. Traditional US Pension Funds on the Edge

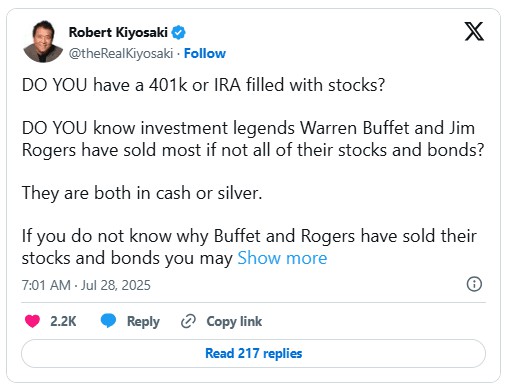

Kiyosaki highlights that conventional retirement funds such as 401(k) and IRAs are increasingly insecure. The United States debt has now crossed the $34 trillion mark (equivalent to Rp557,430,000,000,000,000,000), adding pressure to the stability of the financial system.

Many workers rely on these programs without realizing that the value of their money could be eroded by inflation and the risk of state default. Complete reliance on old instruments is considered very dangerous in the midst of economic uncertainty. This is why Kiyosaki advises the younger generation to start thinking about alternative investment solutions.

Also Read: Top 4 Cryptos to Buy in Q3 Altcoin Season, Bitcoin’s Dominance Declines!

2. Bitcoin (BTC) and Crypto Become the Modern Safe Haven

According to Kiyosaki, Bitcoin (BTC) and crypto are not just trends, but hedge assets in the digital age. He believes crypto can offer protection from currency devaluation and a potential global financial crisis.

Bitcoin (BTC), with its limited supply, is considered more robust against inflation than the dollar, which continues to be printed indefinitely. He even predicts the price of Bitcoin could reach $1 million (Rp16,395,000,000,000) in the next few years, as public confidence in cryptocurrencies increases.

3. Investment Diversification is the Key to Survival

Kiyosaki emphasizes the importance of not putting all your eggs in one basket. Portfolio diversification, including into cryptocurrencies such as Ethereum (ETH), Ripple (XRP), or Pepe Coin (PEPE), can lower the risk of losing all assets due to one major event.

Learning from the history of the 1929 crisis, Kiyosaki wants investors to be more adaptive to the times and not be afraid to experiment in new sectors like crypto. That way, they are better prepared for change and new opportunities.

4. Economic Crash Threats and Survival Strategies

Kiyosaki openly compares the current economic conditions to the era of the 1929 stock market crash. He highlighted that the “biggest crash in history” could happen at any time due to the fragile monetary system and ballooning government debt.

Therefore, anticipatory steps by setting aside some assets in crypto are considered to be the most logical defense strategy. Investors are reminded not only to rely on high returns, but also to pay attention to the security aspects of assets.

5. Crypto Adoption by the Younger Generation is Accelerating

In America, the phenomenon of millennials and Gen Z is starting to increase their exposure to crypto as future savings. They view cryptocurrency as a flexible and potentially high-yielding asset.

This change in mindset is also starting to penetrate Indonesia, where the growth of the crypto community and the use of blockchain technology is accelerating. This condition is in line with Kiyosaki’s message for the younger generation to be ready for an increasingly digital financial future.

6. The Role of Education and Awareness in Crypto Investing

Kiyosaki emphasized that financial education and understanding the risks are essential before jumping into the crypto world. He advises people to keep learning, keep up with the latest news, and understand the basics of blockchain technology and cryptocurrency investment.

Investors must also be selective in choosing crypto assets, and ensure the security of the wallet and trading platform used. With the right education, the chances of success in the crypto world will be even greater.

Conclusion

Robert Kiyosaki’s warning about the threat of traditional pension funds is a signal for everyone to start thinking more visionary and adaptive. Diversifying into crypto such as Bitcoin (BTC) and other digital assets could be a solution for wealth protection and growth in the future.

Also Read: 10 Potential 2025 Crypto for 2025 Year-End Profits! Any of your favorite coins?

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Bitcoin.com News. Robert Kiyosaki Sounds Alarm on America’s Retirement Plans, Points to Bitcoin Safety. Accessed July 29, 2025.

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.