Download Pintu App

5 Factors Pi Coin (PI) Approaches the Low Point, What are the Risks and Opportunities Amid Crypto Volatility?

Jakarta, Pintu News – The crypto and cryptocurrency market has been rocked again by the Pi Coin (PI) price drop to near all-time low (ATL) at $0.40 (IDR6,580, at an exchange rate of 1 USD = IDR16,452). Soaring volatility, bearish trends, and selling pressure are the main concerns of Pi Network’s investor community. What are the factors behind this decline, and is there any chance of a rebound amidst the uncertainty?

1. Pi Coin price slumps to $0.42, nears all-time low

The Pi Coin price is now trading around $0.42 (€6,909), almost touching the record low of $0.40 (€6,580). This drop reflects high selling pressure and low positive sentiment in the PI market.

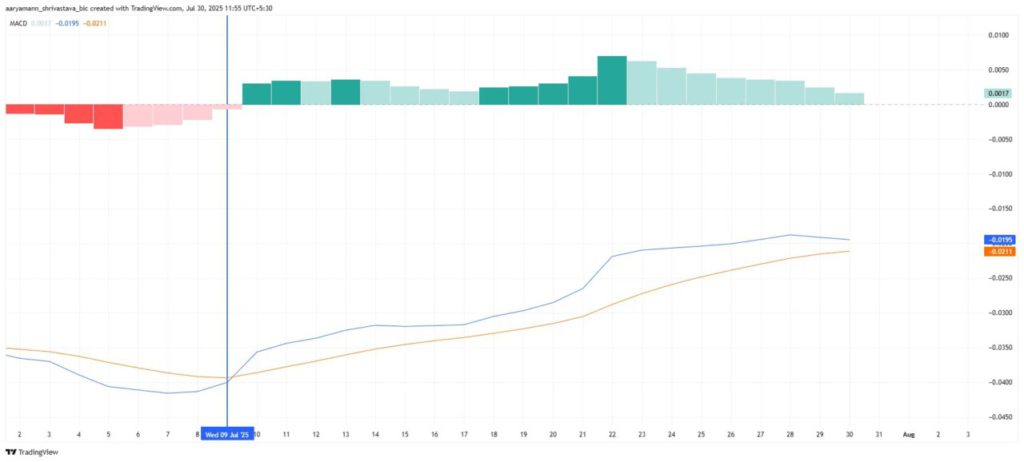

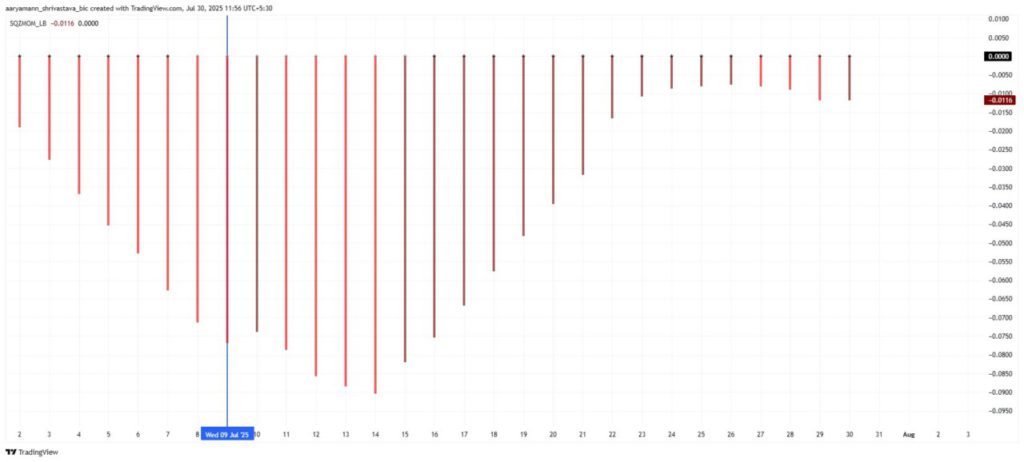

Analysis from BeInCrypto states, the MACD technical indicator suggests bearish momentum is still dominant.

Also Read: 5 Shocking Predictions: Pi Network (PI) Price in August 2025, Potential to Soar or Plummet?

2. Soaring Volatility: Threat or Opportunity?

The high volatility in Pi Coin opens up two sides: the risk of big losses for short-term traders, as well as opportunities for investors who dare to take positions at lower prices. Spikes in volatility often signal a reversal if accompanied by new buying sentiment and volume.

However, as long as the bearish sentiment has not subsided, the risk of a deeper decline remains to be watched out for.

3. Weak Correlation with Bitcoin (BTC)

Interestingly, the price of PI has begun to decouple from Bitcoin (BTC), meaning that PI’s price movements no longer fully follow the main crypto market trends. This condition indicates that there are internal factors in the Pi Network ecosystem that are more dominant to the price.

Investors should be keen to monitor the progress of the Pi Network project and the sentiment of the global community.

4. Support and Reversal Patterns: Signal for a Rebound?

Although negative sentiment dominates, there are some technical patterns that are starting to form as support in the $0.40-$0.42 area. If there is a significant rebound, PI prices could potentially return to the $0.45-$0.50 resistance area (IDR7,403-Rp8,226).

Reversal will only happen if there is a new capital inflow and buying volume increases dramatically in the near future.

5. Recommendations for Investors: Be Careful, Monitor Critical Support

The price drop to an all-time low is tempting to “buy the dip”, but investors must be wary of the risk of further breakdown. Monitor critical support areas and ensure risk management strategies are in place should the market continue to weaken.

It is also important to pay attention to official news related to the Pi Network roadmap, especially the development of the mainnet and the potential listing on major exchanges.

Conclusion

Pi Coin (PI) price amid high volatility is both an opportunity and a challenge for crypto investors. Do in-depth research and don’t rush into a decision just because the price looks cheap.

Also Read: 7 Facts How Ethereum Changed the World of Crypto & Cryptocurrency Over 10 Years!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Pi Coin faces volatility, price now near all-time low. Accessed July 31, 2025.

- BeInCrypto. Pi Coin is Now 10% From an All-Time Low. Accessed July 31, 2025.

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.