Download Pintu App

Secrets to Using Pivot Points in Trading to Maximize Profits!

Jakarta, Pintu News – Pivot Points is an effective technical analysis indicator for identifying support and resistance levels. It calculates the average of the high, low, and closing price of the previous trading period. By using Pivot Points, traders can gain objective guidance to recognize potential price reversals, trend confirmations, and breakout opportunities.

Definition and Formula of Pivot Points

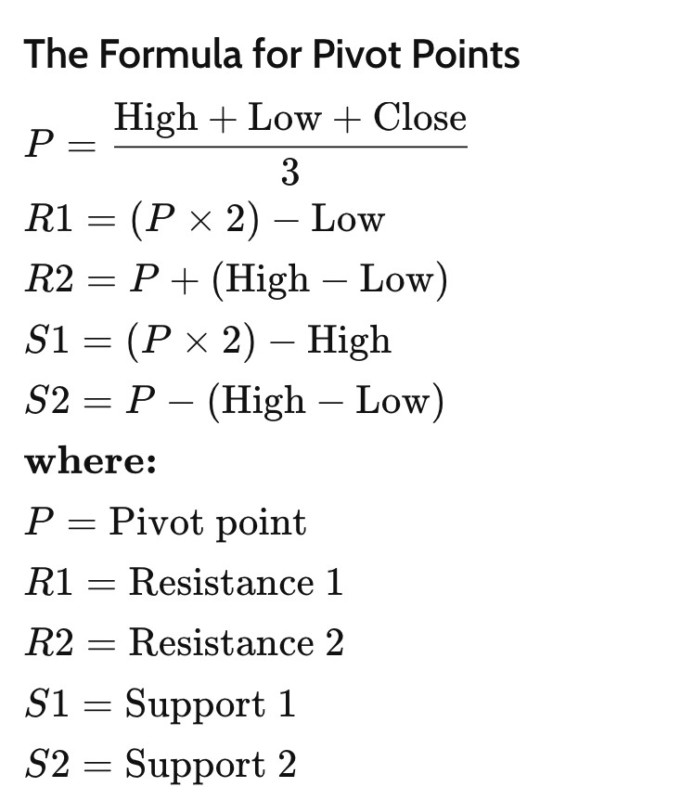

Pivot Points are calculated using price data from the previous trading period. The basic formula for calculating a Pivot Point (PP) is (High + Low + Close) / 3. From these PP values, further support and resistance levels can be derived to aid in market analysis.

The first level of resistance (R1) is calculated by the formula (P x 2) – Low, while the second level of resistance (R2) is P + (High – Low). For the support level, S1 is calculated by (P x 2) – High and S2 is P – (High – Low). This formula gives a clear picture of the potential for further price movement.

Also Read: 5 Shocking Predictions: Pi Network (PI) Price in August 2025, Potential to Soar or Plummet?

Calculation Process and Application in Trading

To start calculating Pivot Points, first collect the high, low, and closing price data from the previous period. After that, calculate the PP values and derive the support and resistance levels. With this information, traders can determine a more appropriate trading strategy.

In application, Pivot Points are very useful for determining price levels that may be a turning point or continuation of an existing trend. Traders use this information to establish buy or sell positions, as well as determine optimal exit points from the market.

Combination with Other Indicators and Advantages of Pivot Points

Pivot Points are often combined with other indicators such as moving averages, MACD, or RSI to improve prediction accuracy. This combination helps in confirming trends and strengthening breakout validation. For example, the use of moving averages can help determine the direction of the trend, which is then reinforced by signals from Pivot Points.

The main advantage of Pivot Points is their ability to provide a clear and objective reference point in an often unpredictable market. This assists traders in making faster, data-driven decisions, reducing risk and increasing profit potential.

Conclusion

Pivot Points are an invaluable tool in a technical trader’s toolbox. By understanding and applying this indicator correctly, traders can improve the accuracy of their predictions and the effectiveness of their trading strategies. Although simple in its construction, Pivot Points offers deep insights into market dynamics that can aid in making more informed trading decisions.

Also Read: 7 Facts How Ethereum Changed the World of Crypto & Cryptocurrency Over 10 Years!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Investopedia. Pivot Point. Accessed on August 1, 2025

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.