Download Pintu App

Bitcoin (BTC) Surges Near $115,000, Bouncing Back From Recent Slump?

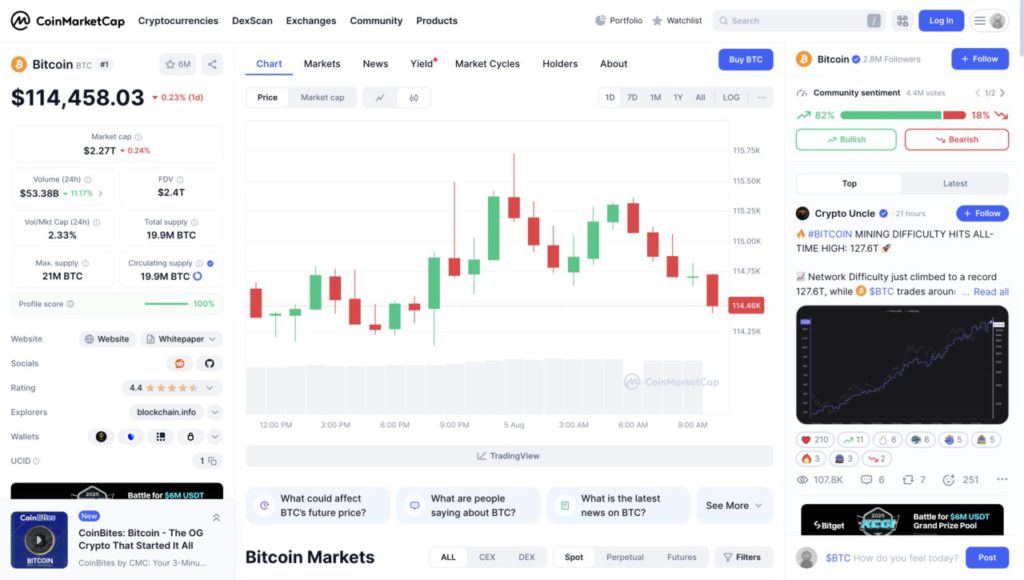

Jakarta, Pintu News – Bitcoin (BTC), the world’s largest cryptocurrency, experienced a sharp rebound to near $115,000 on Monday morning, after being below $113,000 over the weekend. This suggests that traders are re-entering the market to buy at low points after hitting recent record highs.

In July 2025, Bitcoin (BTC) peaked at around $123,000, driven by highly optimistic market sentiment and growing institutional adoption. However, last week saw profit-taking that brought down the price of Bitcoin (BTC) to $112,000, which seems to have found support in that zone.

Check out the full analysis in this article!

Market Analysis and Trader Reactions

According to data from CoinMarketCap, Bitcoin (BTC) is currently trading around $114,458. Min Jung, an analyst from Presto Research, stated that the recent market decline was triggered by risk-averse sentiment following July’s disappointing US non-farm jobs report.

The Bureau of Labor Statistics reported that only 73,000 jobs were added in July, well below expectations of 104,000 jobs. Additionally, data from SosoValue showed that the spot Bitcoin (BTC) ETF experienced outflows of $643 million, snapping a streak of inflows after seven consecutive weeks.

Also read: Coinbase’s UK ad ban sparks crypto debate, says CEO Brian Armstrong

Optimism Among Traders

A well-known crypto analyst at X, BitBull, revealed on Saturday that Bitcoin (BTC) bounced perfectly off the EMA 50 level. This has been a strong support for Bitcoin (BTC), and the recovery shows that the bulls still control the market.

However, he added that if Bitcoin (BTC) breaks below the 50 EMA on the daily time frame, it will see a perfect bottom around $110K to $112K, setting the stage for the next bullish run.

According to CryptoQuant in its weekly insight, after each wave of profit-taking, the market usually enters a period of price consolidation or moderate correction lasting between two to four months.

Bitcoin (BTC) Demand Remains High

Despite the decline, companies like Metaplanet remained optimistic by adding 463 Bitcoin (BTC) to their existing holdings of $1.79 billion.

In addition, market experts are also paying close attention to the strategy of Michael Saylor, who usually announces new Bitcoin (BTC) acquisitions on Mondays.

This shows that despite price fluctuations, institutional interest in Bitcoin (BTC) remains strong and could be a positive indicator for the future of this cryptocurrency.

Conclusion

With the latest rebound and strong support from institutional investors, the future of Bitcoin (BTC) looks bright. Traders and investors are advised to pay attention to the current market dynamics and use the latest information to make informed investment decisions.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Crypto Times. Bitcoin Rebounds Near $115k as Traders Buy the Dip. Accessed on August 5, 2025

- Featured Image: Generated by Ai

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.