Download Pintu App

XRP Price Breakout Analysis Early August 2025: Is a Big Rally Coming? Here’s the Chart!

Jakarta, Pintu News – The price of XRP (XRP) has taken center stage in the crypto market in recent days, after approaching the psychological level of USD 3.00 or around Rp49,125 (exchange rate 1 USD = Rp16,375). With a 35% surge over the past month, but a weekly correction of more than 5%, traders are now wondering if a big rally is imminent or if it will reverse.

Exchange Liquidation and Inflow Map: Short Squeeze Signal?

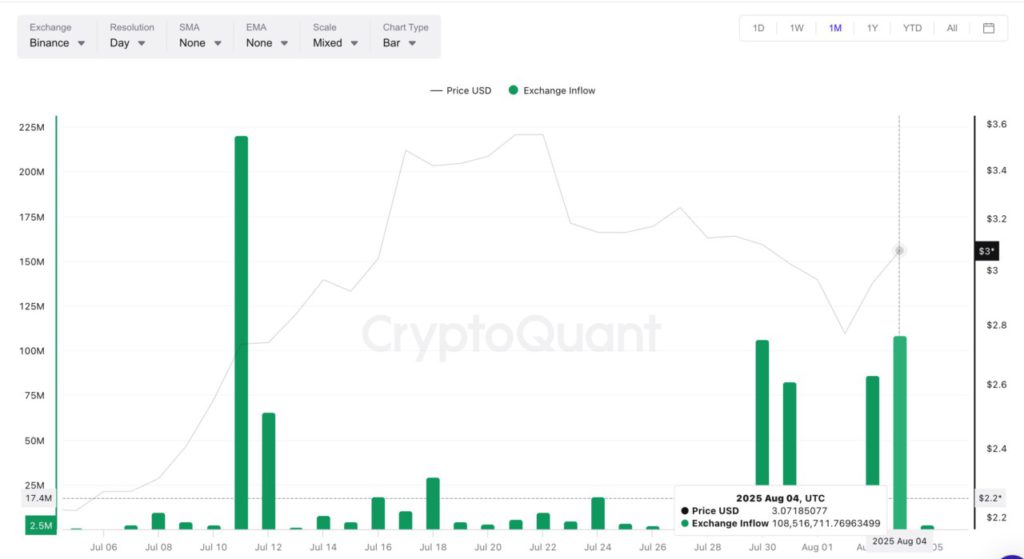

One of the main reasons why XRP hasn’t really rallied is that selling pressure is still high on exchanges. After July 30, XRP inflows to exchanges began to increase, indicating traders were ready to sell if the price broke USD 3.00 (IDR 49,125). A similar pattern occurred on July 11, where inflows spiked but the price actually rose through USD 3.60 (IDR 58,950) before eventually falling.

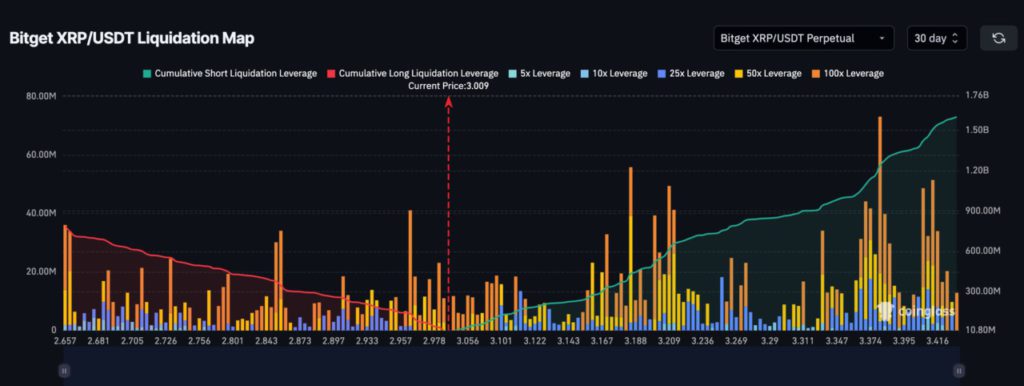

Interestingly, Bitget’s liquidation map data shows that the market position is still dominated by shorts. The value of shorts reached USD 1.6 billion (IDR 26.2 trillion), far above the long position of USD 784 million (IDR 12.8 trillion). This imbalance indicates that if there is a sudden price increase, it could trigger a short squeeze – that is, a mass liquidation of short positions so that the price of XRP is pushed up sharply to the range of USD 3.40 (IDR 55,675).

Similar conditions occurred on July 24-27 when the price of XRP rose from USD 2.95 (IDR 48,011) to USD 3.30 (IDR 54,038) without a clear trigger. This led to speculation of market manipulation, although it has not been confirmed.

Also Read: Top 3 Crypto that Grew Up to 120% in the First Week of August, Got Your Token?

Whale Role: Selling Pressure Starting to Ease?

Another important factor in the price movement of XRP is the behavior of whales-the large owners of XRP in the crypto market. Whale-to-exchange flow data shows that when the price fell below USD 3.00 (IDR 49,125) on July 30, whale inflows to exchanges reached more than 55,000 XRP. But afterward, the inflow dropped to 38,226 XRP on August 3, and 34,140 XRP on August 4, although the price remained stable above USD 3.00.

The decline in whale inflows could mean two things: either the whales have stopped selling (reduced selling pressure) or they are waiting for a new moment to offload their assets. Both scenarios are considered bullish in the short term. However, if whale inflows pick up again when prices break USD 3.08-3.30 (IDR50,635-Rp54,038), the potential selling pressure could hamper the continued rally.

Chart Structure and Important Breakout Areas

Technically, the price of XRP is currently within a falling broadening wedge pattern, which is a chart pattern that often appears before bullish breakouts. This pattern is characterized by two broadening and falling trend lines, with the price moving in between. A breakout above USD 3.19 (IDR 52,756) is an early confirmation that XRP has the potential to challenge strong resistance at USD 3.30 (IDR 54,038).

The USD 3.30 level is also important as it coincides with the Fibonacci retracement area and the largest short liquidation cluster. If this level is successfully broken, there is a high probability of mass liquidation of shorts which could bring XRP prices to rally higher. The next target is around USD 3.45 (IDR 56,093), where almost all short positions on Bitget’s liquidation map will be liquidated, confirming a sustained rally.

Conversely, if the price fails to hold above USD 3.00 and breaks below USD 2.72 (IDR 44,530), the bullish scenario could fall and the price could potentially drop deeper.

Conclusion

XRP’s price breakout depends heavily on the dynamics of liquidation on exchanges, whale behavior, and market reaction at the key resistance area of USD 3.30. With market sentiment still dominated by short positions and whale selling pressure starting to decrease, the potential for a rally in the near term remains open. However, traders need to stay alert to the possibility of a quick reversal if the crucial support level is broken.

Also Read: Are These 3 Altcoins Likely to Print All-Time High in August 2025?

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeinCrypto. When Will XRP Rally Next? One Chart Suggests It Might Be Anytime Soon. Accessed August 6, 2025.

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.