Download Pintu App

Litecoin Poised to Break New Record Highs in 2025, Is This the Limit?

Jakarta, Pintu News – Litecoin (LTC) looks set to reach new peaks this year as a significant increase in funds enter the derivatives market. Nonetheless, some technical indicators suggest that the possibility of a downward price withdrawal is still open, which adds to the existing bearish sentiment. In this situation, investors and traders should be on the lookout for potential changes in market direction.

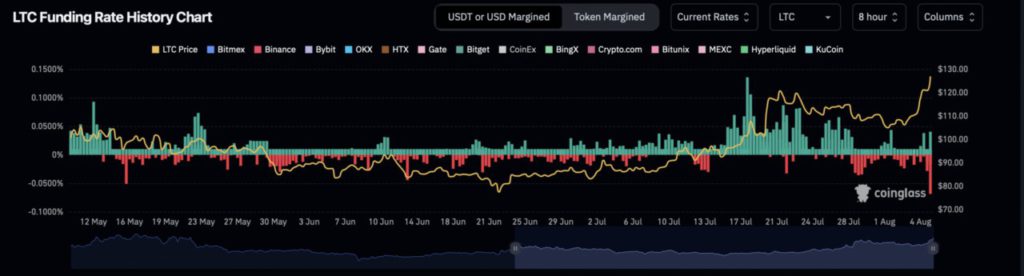

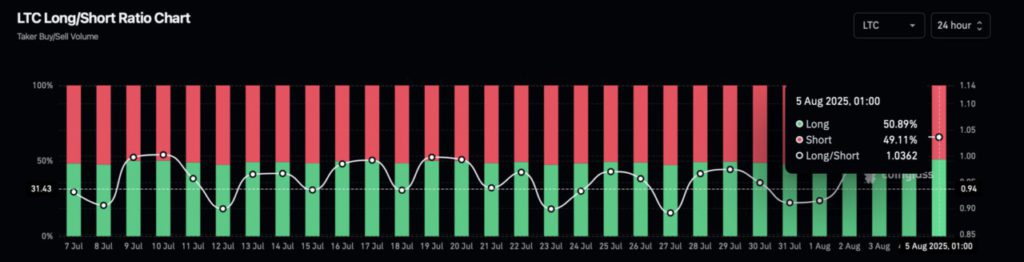

Short Positions Start to Take a Hit

In the past 24 hours, short positions in the Litecoin derivatives market suffered heavy losses, reaching $3.48 million, as opposed to the $524,790 suffered by long positions. This shows the dominance of traders who are optimistic about LTC price increases. This could be an early indication of a trend reversal that may push LTC prices even higher.

Meanwhile, the losses experienced by short positions indicate that selling pressure is starting to ease. If these conditions continue, LTC may experience a more stable and sustainable price increase. However, it’s important to remember that the cryptocurrency market is highly volatile and changes can happen suddenly.

Also Read: Top 3 Crypto that Grew Up to 120% in the First Week of August, Got Your Token?

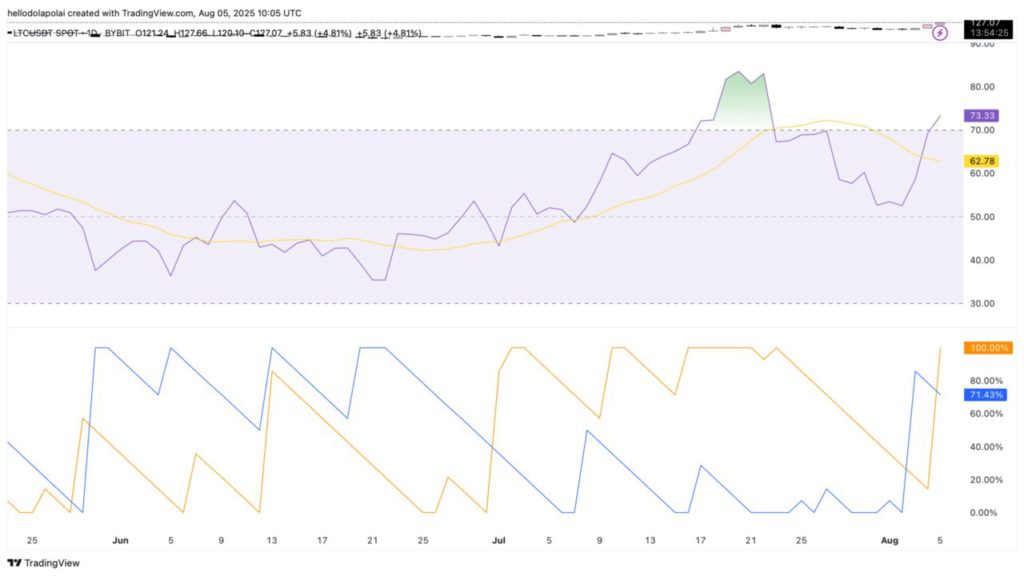

Technical Indicators Show Potential for Decline

According to the Relative Strength Index (RSI) and Aroon indicators, LTC is in an overbought condition with the RSI having surpassed the 70 mark. This signals that the buying momentum may have peaked and market exhaustion could be imminent. This condition is usually followed by a price drawdown.

Although the exact timing of this drawdown cannot be predicted with certainty, investors should prepare for the possibility of a price drop in the near future. Observation of these indicators will be crucial to determining the right investment strategy in the face of dynamic market fluctuations.

Litecoin Reaches Critical Bid Level

Litecoin has now reached a key supply zone that has previously resisted price increases on two occasions this year. This zone is a critical resistance area that if not broken could lead to a significant price drop. Currently, with momentum and trading volumes increasing by 230% to reach $1.97 billion, the rally still looks strong.

If this momentum can be sustained, LTC may reach back to the 2025 peak of $141.15 and may even surpass the December 2024 peak of $147. However, if the number of sell orders in this supply zone overcomes LTC’s momentum, the asset may experience a major price drop, returning to the immediate support zone and potentially triggering a liquidation cascade that would affect long positions.

Conclusion

With the various dynamics at play in the Litecoin market today, market participants should remain vigilant and prepared for any eventuality. Keeping an eye on technical indicators and changes in market dynamics will be crucial in navigating possible price fluctuations. As an investor or trader, understanding and responding quickly to these signals can be key to maximizing profits and minimizing losses.

Also Read: Are These 3 Altcoins Likely to Print All-Time High in August 2025?

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. LTC rallies with $437 mln inflow; will this level cap its 2025 breakout?. Accessed on August 6, 2025

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.