Download Pintu App

Standard Chartered Supports Ethereum Treasury Company Over Spot ETF, Why?

Jakarta, Pintu News – The choice of investment method in Ethereum (ETH) is now a hot topic among institutional investors.

Geoff Kendrick, Head of Digital Asset Research at Standard Chartered, recently revealed that companies with Ethereum reserves offer better exposure compared to spot Ethereum ETFs in the United States.

Check out the full information in this article!

Ethereum Exposure Comparison: ETFs vs Reserve Companies

According to Geoff Kendrick, Ethereum purchases by companies holding reserves have equaled the amount purchased by ETFs since the beginning of June. These two groups have acquired about 1.6% of the total circulating Ethereum supply in the past two months.

This points to a new trend in Ethereum investing, where companies like SharpLink Gaming (NASDAQ: SBET) are becoming attractive options as they offer added value through direct exposure to the Ethereum price. Kendrick emphasized that these companies offer regulatory arbitrage that ETFs cannot provide.

With the market value divided by the value of Ethereum held (NAV multiple) having started to normalize, these companies are now trading with a NAV multiple slightly above 1.0. This suggests that they may be a better investment option compared to the spot Ethereum ETF in the US, which has experienced significant fluctuations recently.

Read also: MetaMask and Stripe Prepare to Launch mmUSD Stablecoin, What’s the Project Like?

Ethereum Reserve Company Growth

Since emerging quietly at the beginning of the year, Ethereum reserve companies have raised more than 2 million Ethereum. Standard Chartered projects that another 10 million Ethereum will follow. In the last month alone, these companies have added 545,000 Ethereum-worth about $1.6 billion.

SharpLink Gaming, for example, has purchased 50,000 Ethereum during the period, increasing its total holdings to more than 255,000 Ethereum. Kendrick said that this trend reflects broader institutional interest in Ethereum.

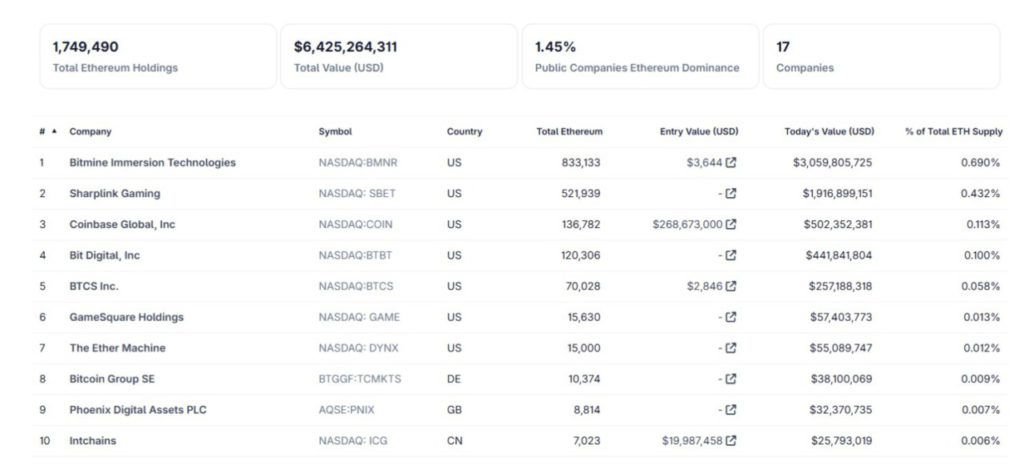

Currently, around 12 public companies hold more than 1 million Ethereum, including BitMine Immersion Technologies, Coinbase, and Bit Digital. Altogether, these public companies now own 0.83% of the total Ethereum supply, according to data from CoinGecko.

Read also: Pendle Presents Boros, a New Tool for Onchain Funding Rate Trading

Ethereum ETF Volatility and Recovery

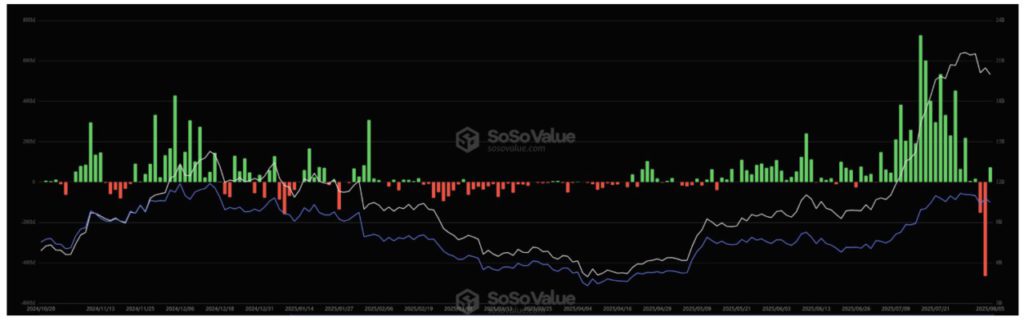

The Ethereum ETF has also had a turbulent few weeks. After experiencing inflows of $5.4 billion in July, ETFs in the US experienced massive withdrawals. On August 1, the ETF recorded a net outflow of $152 million, followed by an outflow of $465 million on August 4-the largest in a single day.

BlackRock’s ETF, ETHA, accounted for $375 million of this amount. However, the market started to recover on August 5, with ETFs attracting a net inflow of $73 million. BlackRock regained the lead, while Grayscale funds experienced moderate redemptions.

Despite the volatility, structural improvements continue to take place, including the SEC’s approval of an in-kind creation and redemption mechanism for crypto ETFs, allowing them to operate more similarly to traditional commodity ETFs.

Conclusion

Investors are now looking forward to SharpLink Gaming’s Q2 earnings report scheduled for August 15th. The report is expected to provide further insights into this evolving asset class and further validate Ethereum reserve companies as a viable asset class for institutional investment.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Standard Chartered Ethereum Treasury vs ETH ETFs. Accessed on August 7, 2025

- Featured Image: Bitcoin Sistemi

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.