Download Pintu App

Bitcoin Hits $116K, Holds Firm Despite Trump’s Counter-Tariffs

Jakarta, Pintu News – So far this week, the price of Bitcoin (BTC) has been flat at $116,000, reflecting the cautious attitude of traders amid increasing uncertainty in macroeconomic conditions.

US President Donald Trump’s retaliatory tariffs have already come into effect. Meanwhile, the possibility of new trade-related announcements could potentially trigger new volatility in the crypto market.

Then, how is the current Bitcoin price movement?

Bitcoin Price Up 1.24% in 24 Hours

On August 8, 2025, Bitcoin’s price stood at $116,846, equivalent to IDR 1,900,181,474, marking a 1.24% gain over the past 24 hours. During the day, BTC dipped to a low of IDR 1,860,695,310 and climbed to a high of IDR 1,912,144,849..

According to CoinMarketCap, Bitcoin’s market capitalization now stands at around $2.32 trillion, with trading volume in the last 24 hours up 18% to $64.31 billion.

Read also: Can Bitcoin (BTC) Reach $200K by the End of 2025? Check out 4 Important Signs!

Trump’s Tariff Threat could Pressure BTC

US President Donald Trump’s retaliatory tariffs took effect on Thursday (7/8). Throughout the week, Bitcoin price has been consolidating in the $113,000-$116,000 range, reflecting the hesitancy of market participants waiting for the next big trigger.

In this context, any new trade-related announcement has the potential to trigger new volatility in the crypto market.

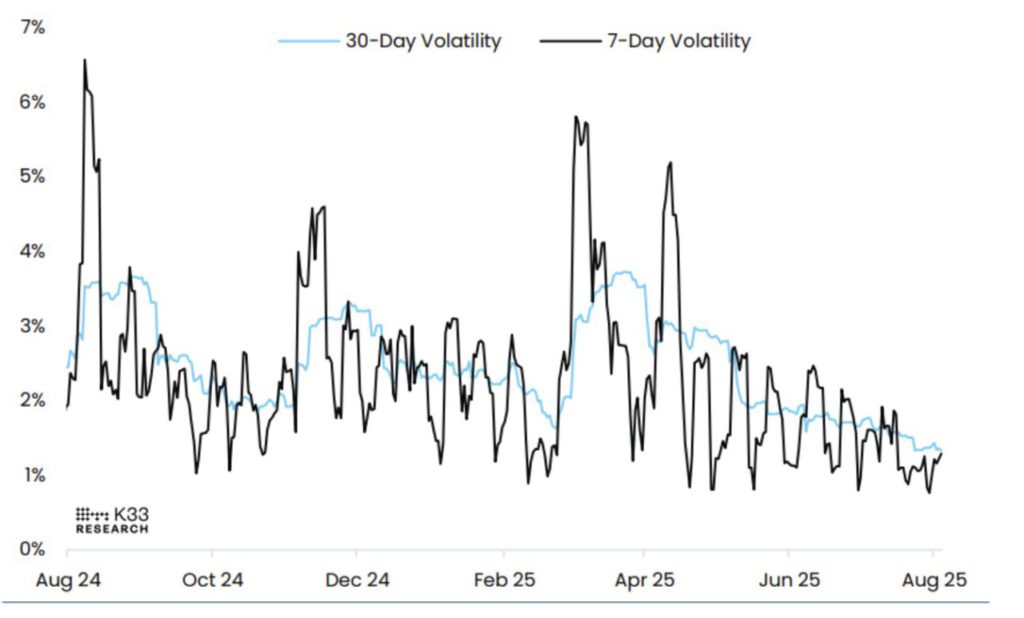

According to K33 Research, BTC’s 30-day volatility remains at a year-low of 1.33%, while 7-day volatility hovers around 1.2% after touching 0.76% on July 30 – the lowest level since September 2023.

Despite the lack of clear direction and low volatility, the expectation that the US central bank(Federal Reserve) will cut interest rates again in September adds a bit of optimism for risky assets like Bitcoin.

Based on CME Group’s FedWatch Tool, market participants rate a more than 90% chance that the Fed will cut interest rates at its next monetary policy meeting in September.

In addition, the Fed is expected to make at least two interest rate cuts of 25 basis points before the end of this year.

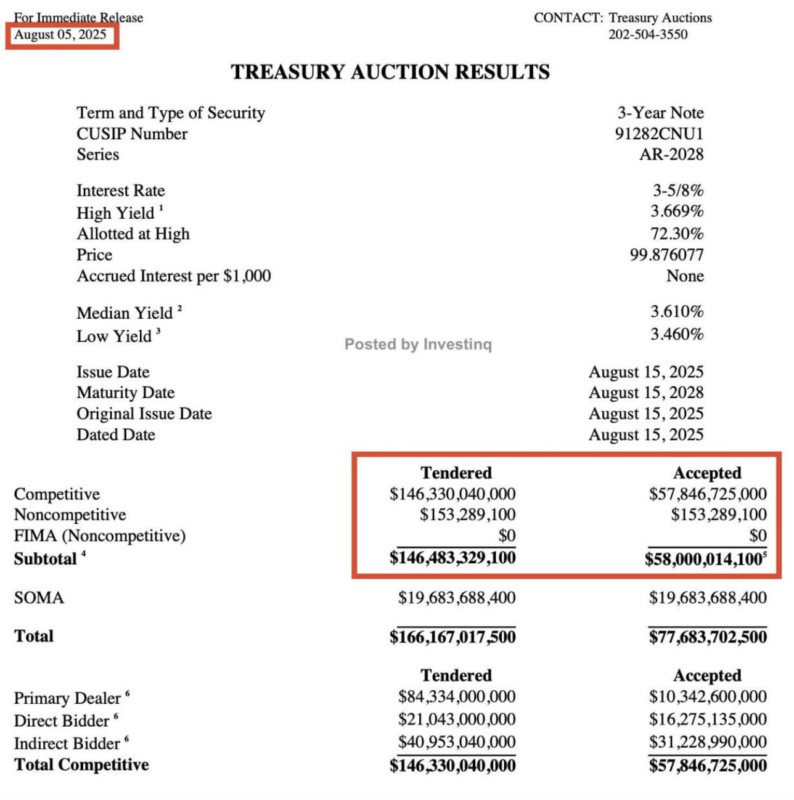

The recent $58 billion US debt auction recorded the lowest foreign demand in a year, forcing domestic banks and investors to absorb the excess supply.

If this trend continues, the Fed could come under pressure to resumemoney printing, which in turn could strengthen Bitcoin’s appeal as a hedge asset.

Institutional Demand Recovers

Demand from institutional investors is showing signs of recovery. Based on SoSoValue data, spot Bitcoin ETFs in the US recorded inflows of $91.55 million on Wednesday (Aug 6), breaking a four-day streak of outflows.

However, the current inflow figure is still lower than the period around July 10, which preceded Bitcoin’s price surge to a new record high of $123,218 on July 14.

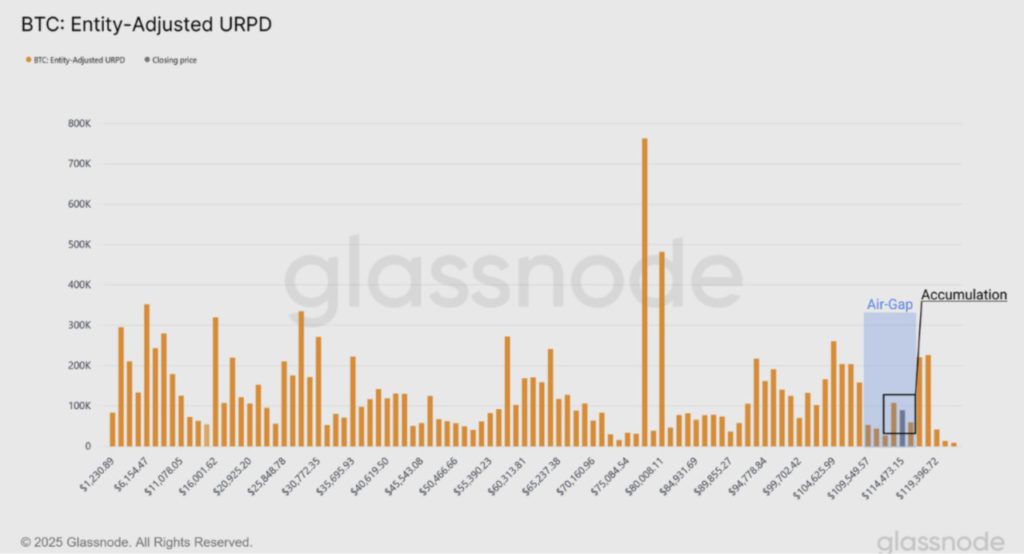

BTC Price Range with Low Liquidity Forms a New Accumulation Zone

Glassnode reported on Wednesday that Bitcoin price has dropped below the lower boundary of the $116,000 accumulation zone and entered the low-liquidity “air gap” area in the $110,000-$116,000 range.

Read also: Whale raids 1 billion DOGE, short sellers lose $3 million – is this a bullish Dogecoin signal?

Historically, low-liquidity price ranges like this often develop into new accumulation zones, where opportunistic buyers step in to acquire BTC at prices perceived to be cheaper than its last record high.

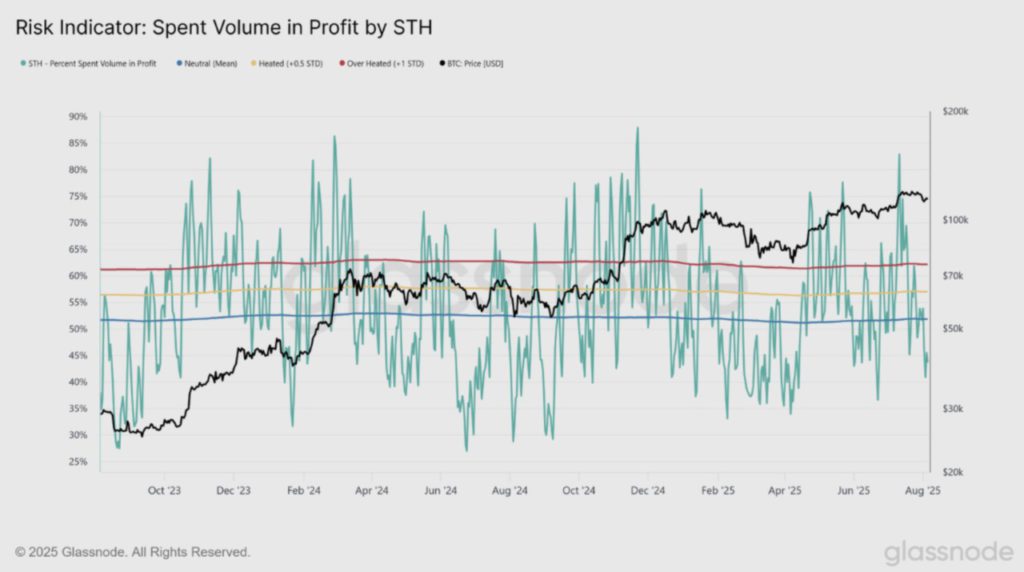

The report also highlights that the proportion of coins held by Short-Term Holders (STH) and sold for profit-taking has decreased, now standing at 45%, below the neutral threshold.

Overall, this suggests the market is in a relatively balanced position, with 70% of STH supply still in profit, and almost equal numbers of coins being sold in profit and loss.

Bitcoin Price Outlook: Consolidation continues

At the end of July, Bitcoin price closed below the lower boundary of its consolidation zone at $116,000 and fell nearly 3% in the following two days, retesting the 50-day Exponential Moving Average (EMA) around $113,182.

Today’s 50 EMA level is almost aligned with the previous record high of $111,980, making it an important support zone. BTC recovered slightly and on Thursday moved around $114,900.

If BTC is able to close the daily price above $116,000, the rally could potentially continue towards the key psychological level of $120,000.

The Relative Strength Index (RSI) on the daily chart is flat around the neutral level of 50, indicating indecision among traders.

However, the Moving Average Convergence Divergence (MACD) indicator is still leaning bearish after spawning a bearish crossover signal on July 23 that is still persisting.

If BTC closes below the 50-day EMA at $113,182, the decline could continue to retest the previous record high of $111,980 reached on May 22.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- FX Street. Bitcoin Price Forecast: BTC consolidates as Trump tariffs go into effect. Accessed on August 8, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.