Download Pintu App

xStocks Records $2 Billion Cumulative Trading Volume, TSLAx Leads Stock Tokenization Market?

Jakarta, Pintu News – Tokenized stocks trading platform, xStocks, has recorded a new milestone with cumulative trading volume surpassing IDR 32.62 trillion ($2 billion) in just about a month since its launch.

This achievement was largely driven by the high interest in Tesla’s tokenized stock (TSLAx), which led the list of most popular assets on the platform.

Check out the full information in this article!

xStocks Trading Volume Surges

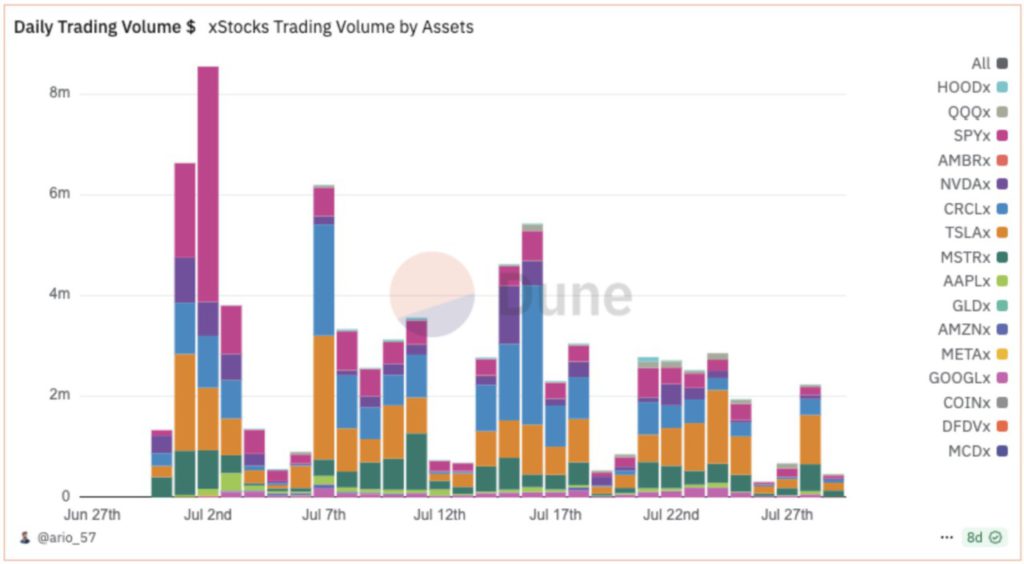

Based on Dune Analytics data, xStocks achieved a cumulative trading volume of IDR 32.62 trillion as of August 6, 2025. This figure includes transactions on centralized exchanges (CEX) and decentralized exchanges (DEX), including Raydium and Kraken.

The assets with the highest trading volume are xTSLA, Circle, and SPYx, which track Tesla shares, Circle, and the S&P 500 index, respectively. As of July 27, 2025, the cumulative trading volume of xTSLA alone has reached IDR 341.8 billion ($20.9 million).

Most of the trading volume still comes from centralized exchanges, at IDR31.29 trillion ($1.92 billion). Meanwhile, on-chain trading and on DEXs accounted for around IDR1.63 trillion ($100 million) since xStocks launched in late June 2025.

Also read: Gold Jewelry Price Today, Friday August 8, 2025

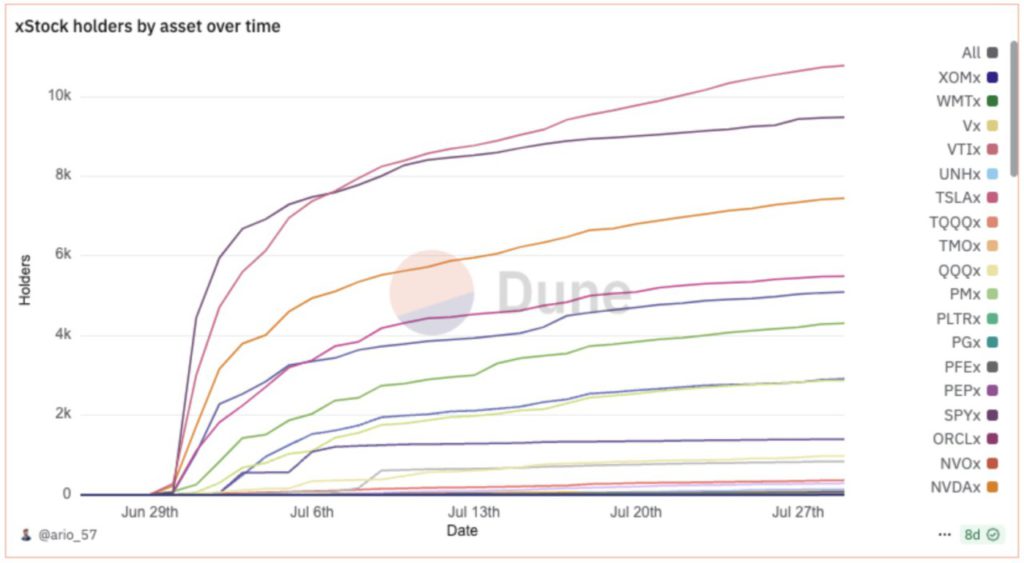

Tesla’s Tokenized Holdings Reach 10 Thousand Holders

This surge in trading volume also goes hand in hand with the increasing number of holders of Tesla tokenized shares (TSLAx). As of August 6, 2025, the total number of tokenized shareholders on xStocks stood at 24,542 accounts, with TSLAx leading the way at 10,777 holders.

The S&P 500 tokenized asset took second place with 9,483 holders. The dominance of TSLAx shows the high appeal of Tesla among crypto investors who are interested in utilizing the liquidity and flexibility of trading shares in tokenized form.

Since its launch on the Solana (SOL) network, xStocks has dominated the tokenized stock market, accounting for 95% of the total market share. This not only strengthens xStocks’ position, but also confirms Solana’s dominance in the stock tokenization ecosystem.

Read also: Babylon Launches Trustless Bitcoin Vault, Opening New Avenues for BTC in DeFi and Staking?

Strategic Partnerships Strengthen the xStocks Ecosystem

xStocks’ success is also supported by a series of strategic partnerships with major platforms. Currently, xStocks has partnered with Raydium, Jupiter, and XT.com. In addition, its services have also been listed on several well-known centralized exchanges such as Kraken and Gate.io.

This partnership allows xStocks to expand its market reach while strengthening the trading liquidity of tokenized stocks. The cross-platform integration also provides users with the opportunity to trade tokenized assets more cost-efficiently and with wider access across both crypto and traditional financial ecosystems.

Conclusion

Achieving a trading volume of IDR 32.62 trillion in a short period of time confirms xStocks’ position as a dominant player in the tokenized stocks market. With TSLAx’s high popularity, strategic partnerships, and Solana network support, xStocks seems poised to expand market share and accelerate the adoption of blockchain-based stock trading in the cryptocurrency world.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Crypto.news xStocks tops $2b in cumulative volume as TSLAx leads. Accessed August 8, 2025.

- Featured Image: CoinTrust

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.