Download Pintu App

3 Points of Interest about Butterfly Spread: A Minimized Risk Options Strategy for Smart Traders

Jakarta, Pintu News – The butterfly spread strategy is an options tactic that has been gaining attention among traders – including in the crypto and cryptocurrency space. With preset risks and rewards, this strategy provides optimal returns when the asset price remains stable within a certain range. In this article, we’ll explore how it works, its benefits, and variations in an easy-to-understand listicle format.

1. What Exactly is a Butterfly Spread?

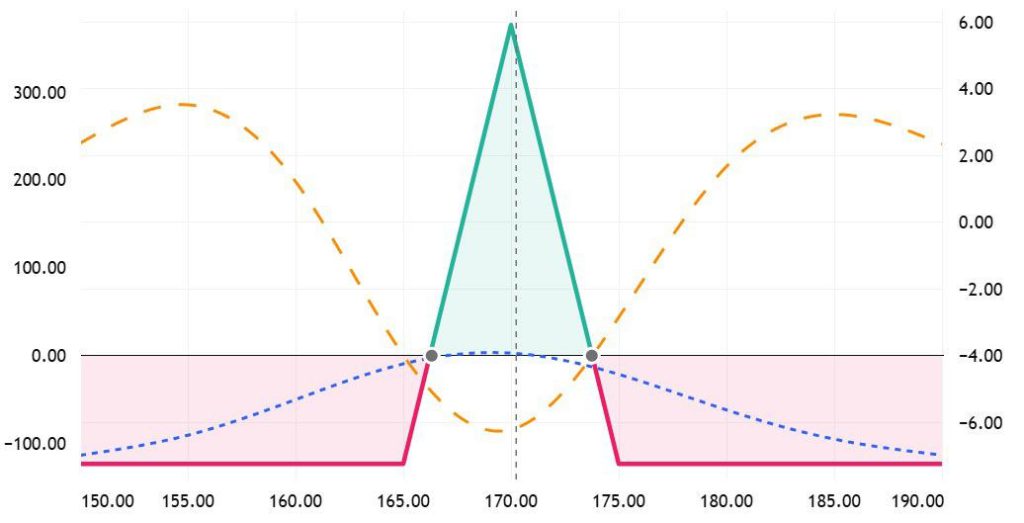

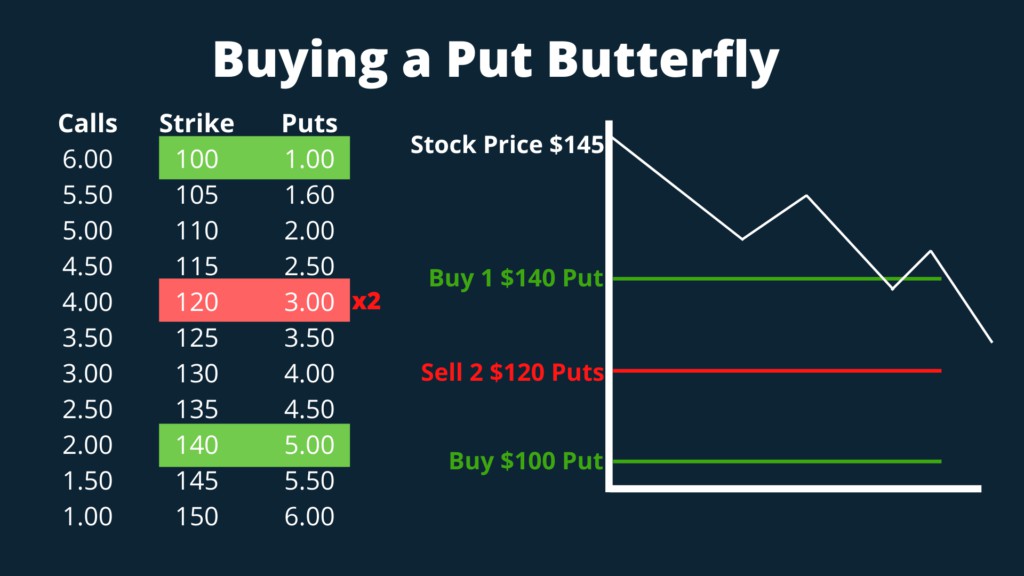

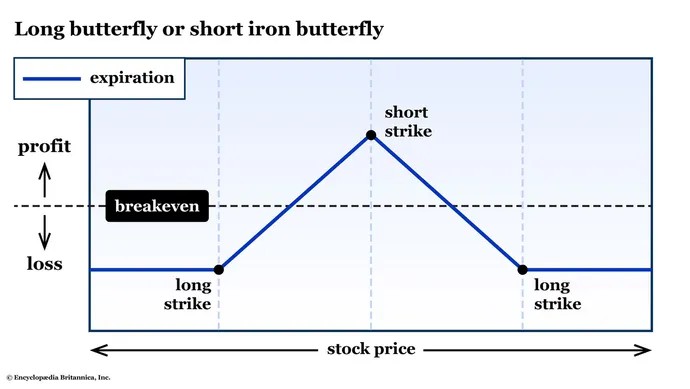

A butterfly spread is an options strategy in which four options contracts with three different strike prices expire on the same date. In a common variant (long call butterfly spread), traders buy one call at the low strike, sell two calls at the middle strike (ATM), and buy one call at the high strike.

This position dictates that the maximum profit occurs when the underlying price is around the middle strike at expiry, while the risk of loss is limited to the premium paid.

Also Read: A Year of DCA XRP: From Rp12 Million to Rp29.78 Million, Here’s the Journey

2. Why is this Strategy Suitable for Sideways Crypto Markets?

As crypto markets such as Bitcoin (BTC) or Ethereum (ETH) often experience periods of consolidation, butterfly spreads are an attractive option. This strategy provides the opportunity to profit when prices move minimally, without extreme speculation.

Traders can go long butterfly when they expect price stability within a tight range, with predictable returns and clear risks. This is a solution for those who want to keep trading without getting caught up in high volatility.

3. Strategy Variations: Modified Butterfly and Iron Butterfly

Modified Butterfly Spread

On the other hand, there are modified versions such as the 1-3-2 butterfly spread, where the number and spacing of contracts are adjusted for more flexibility. This strategy allows traders to shift the focus of the profit area wider or favorite certain areas according to price projections. Although the profit potential increases, so does the risk. This is suitable for those who want a more adaptive strategy than the standard symmetrical structure.

Iron Butterfly

Finally, there is the iron butterfly, a combination of call and put options that are both sold at the middle strike and bought at the far upper and lower strikes. This strategy is effective in low-volatility markets where prices are expected to remain within a narrow range. The benefits: risk and profit are limited, and it can be the best neutral strategy in periods of flat markets.

Butterfly spread is an ideal option strategy for traders who expect stable prices with limited risk and return. It is suitable for use in crypto markets with disciplined execution. Variations such as modified or iron butterfly add strategic flexibility. Keep risk management in mind-especially in a volatile market!

Also Read: 7 Crypto Predictions for 2030

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Investopedia. Butterfly Spread: What It Is, With Types Explained & Example. Accessed August 11, 2025.

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.