Download Pintu App

4 Steps David Bailey Takes to Bring Bitcoin to the Wall Street Institutional Stage

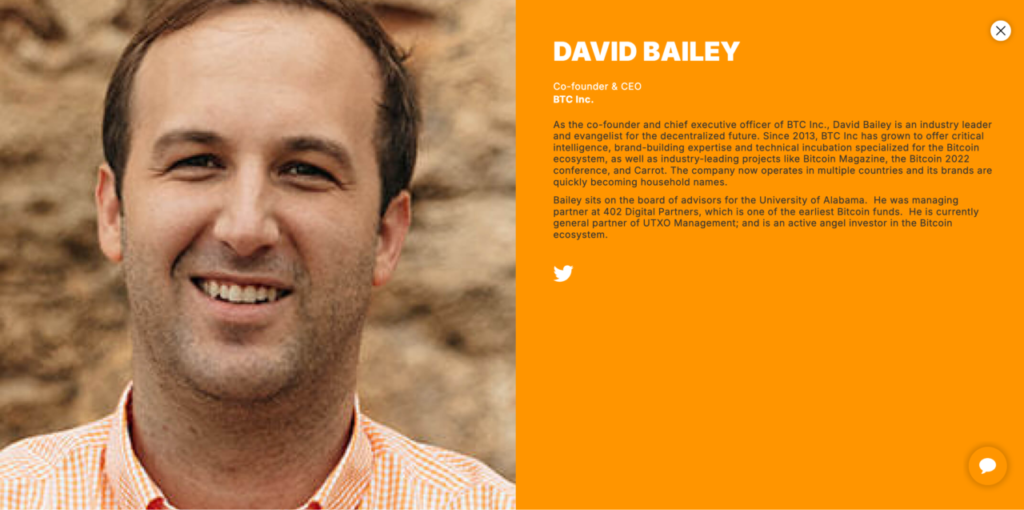

Jakarta, Pintu News – David Bailey is an important figure behind the wave of institutional adoption of Bitcoin. As the CEO of BTC Inc. and founder of Nakamoto Holdings, he is known for structured strategies that put Bitcoin (BTC) into a public company framework.

In essence, Bailey is trying to change the perception of Bitcoin-not just a speculative asset, but part of a structured corporate financial system.

1. David Bailey’s Career Trail in the Crypto World

David Bailey since 2013 founded BTC Inc., the company behind Bitcoin Magazine and organizer of conferences such as Bitcoin 2022-now the most established Bitcoin information and community institution in the industry.

Not only that, he is also active as a general partner at UTXO Management, was a managing partner at 402 Digital – one of the first Bitcoin funds – and sits on the advisory boards of major media outlets such as Maven.

Also Read: Top 3 DePIN Tokens August 2025: These Altcoins Show Positive Performance!

2. Breaking through Wall Street with a $710 Million Strategy

In 2025, David Bailey managed to raise up to $710 million to establish a Bitcoin-first treasury model through Nakamoto Holdings.

This model involves merging with a publicly listed company like KindlyMD, raising capital through PIPEs and convertible bonds, and then using the funds to buy Bitcoin (BTC)-creating a new institutional pathway for digital asset ownership.

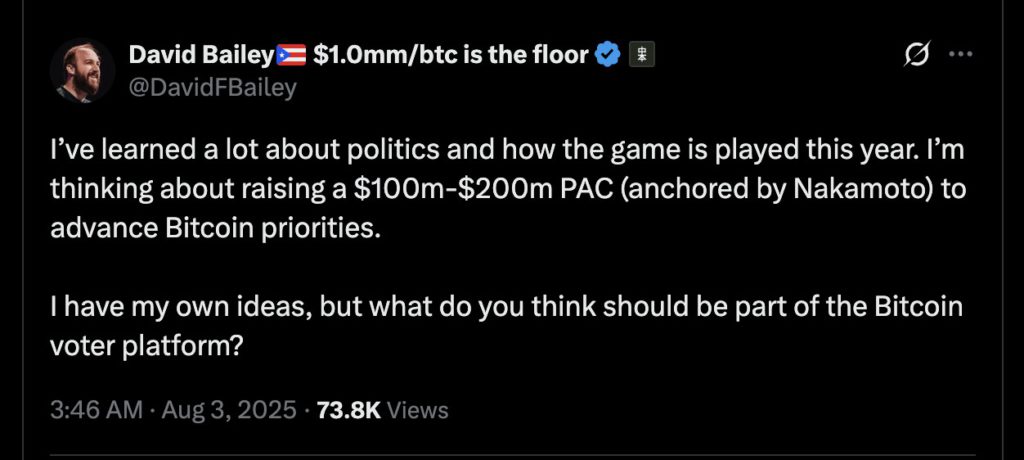

3. $1 Billion “Smash Buy”: Visionary Action in the Market

David Bailey once mentioned on X that he would “smash buy” $1 billion worth of Bitcoin in a single transaction, signaling Nakamoto Holdings’ strong intention to become a big player in the BTC space.

More realistically, the funds available on day one were around $763 million, the result of raising and increasing Bitcoin treasury targets.

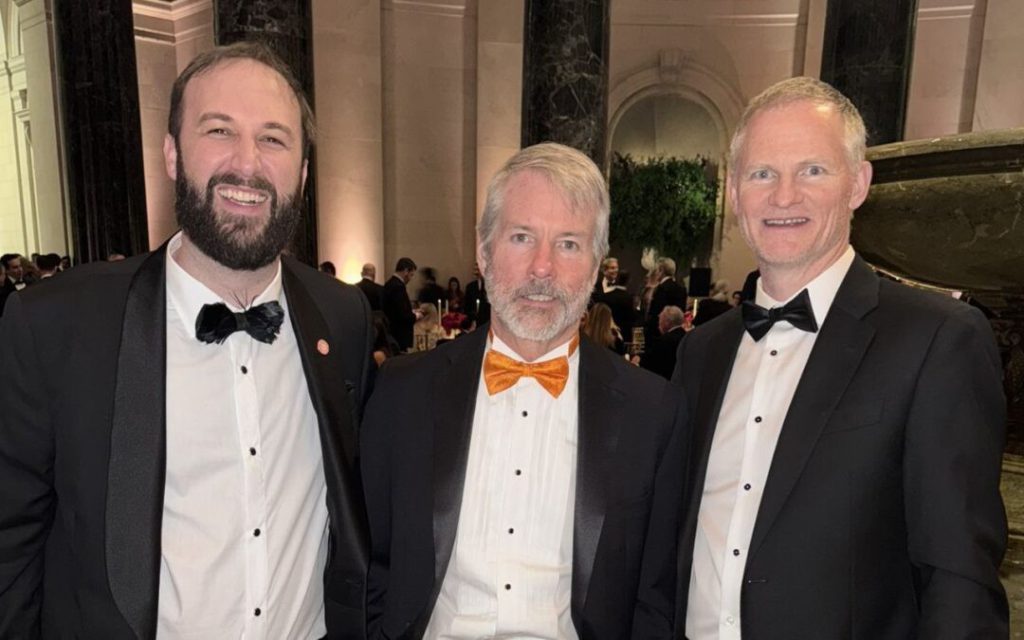

4. Bailey vs Michael Saylor Approach: Two Ways to Bring Bitcoin to Corporations

- Michael Saylor relied on the company’s internal reserves (Strategy) to buy Bitcoin directly-a bold and unconventional corporate approach.

- David Bailey, on the other hand, is shaping the institutional infrastructure: incorporating public companies, utilizing PIPEs, convertible notes-a replicable model that can be brought to a wide range of companies for structured and sustainable Bitcoin adoption

David Bailey played a pivotal role in Bitcoin’s transformation-from a digital asset to a corporate financial instrument. Through his capital strategy and neat structure, he didn’t just buy Bitcoin-he built the framework for institutions and Wall Street to join Bitcoin’s history.

The move is a signal that Bitcoin is moving closer to mainstream finance, not just in the hands of crypto enthusiasts, but on the balance sheets of public companies with credibility and regulation.

Also Read: Top 3 Token Unlock August 2025: Redacted, Dappad, and GameGPT in the Spotlight

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CCN / Onkar Singh. Meet the Man Who Quietly Raised $710 M to Bitcoinize Wall Street. Accessed August 12, 2025.

- Mitrade Insights. Nakamoto CEO David Bailey wants to buy $1 billion worth of Bitcoin. Accessed August 12, 2025.

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.