Download Pintu App

BTC Price Reaches $122,000 and ETH Hits $4,300: What Are the Factors Behind the Rise?

Jakarta, Pintu News – At the end of last week, the cryptocurrency market witnessed a significant increase with Bitcoin (BTC) almost touching the $123,000 mark and Ethereum (ETH) reaching its highest price since December 2021.

According to an analysis by Dishita Malvania, a journalist at Crypto Times, this rise was triggered by increased institutional interest, positive market sentiment, as well as new policy announcements by US President Donald Trump.

Check out the full analysis in this article!

Trump’s new policy triggers hike

Trump’s recent executive order directing the US Department of Labor to consider the inclusion of cryptocurrencies, private equity and other alternative assets in 401(k) retirement plans has been a major catalyst.

The move is expected to open the door to huge new demand from millions of American savers. Augustine Fan, Head of Insights at SignalPlus, emphasized that this policy could trigger significant buying pressure. Analysts believe that this announcement was the main driver behind this week’s market rebound.

Read also: What are the Investment Strategies of Crypto Whales in a $4 Trillion Market?

Institutional and ETF Interest

Institutional interest in cryptocurrencies shows no signs of slowing down. The spot Bitcoin (BTC) ETF recorded net inflows of $253 million during last week, keeping buying pressure strong despite a slight dip after last month’s record highs.

Ethereum (ETH) momentum was even stronger, with the spot ETH ETF attracting $461 million in the same period, surpassing Bitcoin (BTC) inflows. Rachael Lucas, analyst at BTC Markets, noted that the surge in institutional buying has led to significant liquidation of short positions and returned billionaire status to Vitalik Buterin.

Also read: What Happens If Bitcoin (BTC) Breaks $1 Million?

Influence of Economic Data and Interest Rate Policy

Despite the strong performance of the cryptocurrency market, traders are advised to pay close attention to important economic data due for release this week. The US Consumer Price Index (CPI) for July is scheduled for release on Tuesday, followed by the Producer Price Index (PPI) on Thursday.

At the Federal Reserve’s last meeting, Chairman Jerome Powell indicated that a September rate cut is now less certain, with the decision dependent on upcoming inflation figures.

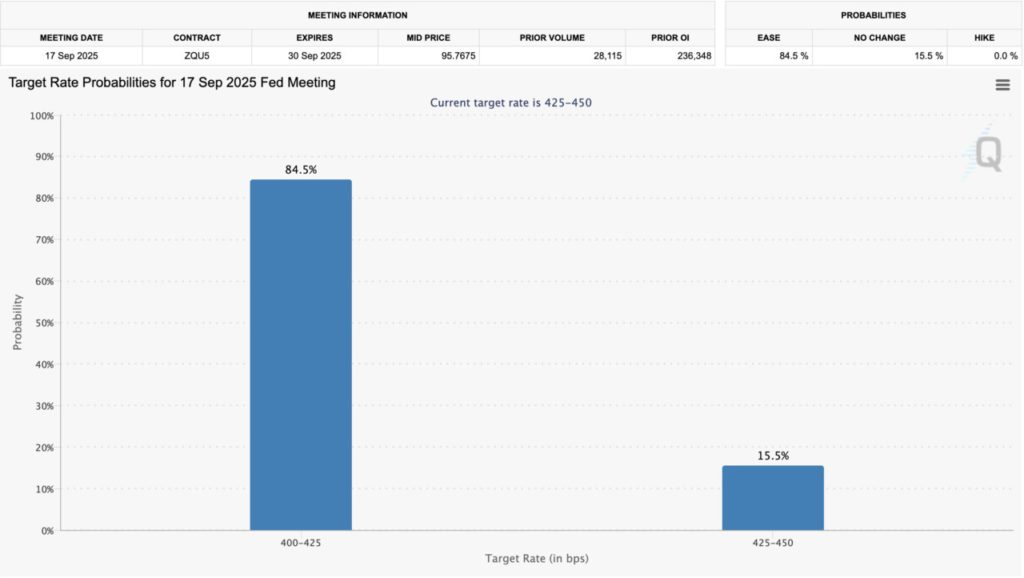

Currently, CME FedWatch data shows an 88.4% chance of a 25 basis point cut to 4.00-4.25% at the September 17 meeting.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today‘ s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Crypto Times. Bitcoin Nears $122k, Ethereum Hits 2021 High on Trump News. Accessed on August 12, 2025

- Featured Image: Securities.io

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.