Download Pintu App

Strategy Invests Another $18 Million in Bitcoin as MSTR Stock Climbs

Jakarta, Pintu News – Strategist Michael Saylor, formerly known as MicroStrategy, is back to buying more Bitcoin (BTC) to add to his Bitcoin reserves.

This move comes amidst Bitcoin prices aiming for a new all-time high. Meanwhile, MSTR shares have bounced back after closing at $395 last week.

Strategy Buys 155 BTC Worth $18 Million

In a press release, the company announced that it had purchased 155 BTC worth $18 million at an average price of $116,401 per Bitcoin, resulting in a BTC yield of 25% since the beginning of the year (YTD).

Read also: US CPI Countdown: Is Bitcoin About to Shatter Its All-Time High?

The company’s total BTC holdings now stand at 628,946 BTC, acquired at a total cost of $46.09 billion at an average price of $73,288 per Bitcoin.

Interestingly, this purchase is one of the smallest this year. The previous record for the smallest purchase was in March, when it was 130 BTC worth $10.7 million. This figure is also smaller than the 245 BTC purchase made in June.

According to documents filed with the SEC, the funds for this Bitcoin purchase came from the sale of STRF shares. The company sold 115,169 shares and collected net proceeds of $13.6 million.

Saylor himself had hinted at this purchase the day before in his trademark style on X, stating that profits would continue to flow as long as someone didn’t stop buying BTC – indicating that they had added to their Bitcoin holdings again.

This purchase comes just a week after Strategy made its largest acquisition of the year, 21,021 BTC for $2.46 billion. The company has also made a $4.2 billion STR offer and plans to use the net proceeds to buy more BTC in the future.

MSTR Shares Rise 3% as Bitcoin Price Rises

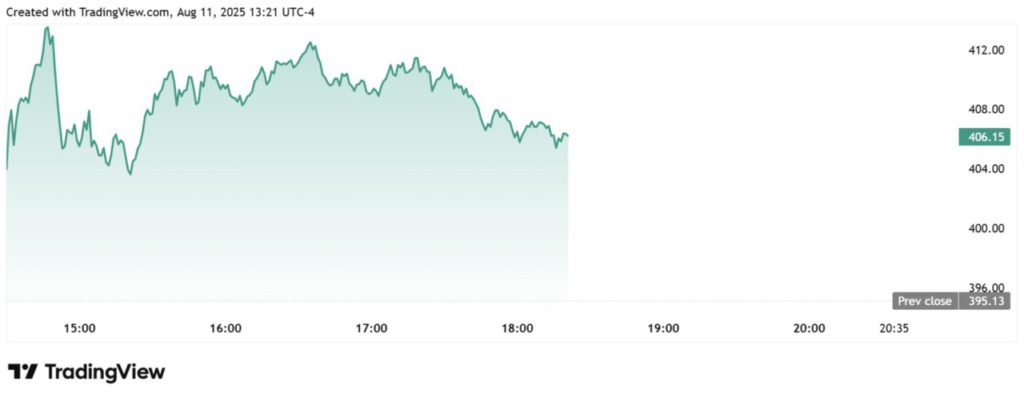

Following the announcement of the latest Bitcoin purchase, MSTR shares have rallied today. TradingView data shows the share price is currently hovering around $406, up 3% from last week’s close of $395.

Read also: Mysterious Institution Buys almost $1 Billion Ethereum in 1 Week!

This increase comes after Bitcoin’s price rally over the weekend. According to a report by CoinGape, the price of BTC broke the $122,000 level this morning and is aiming for a new record high.

Due to the company’s large exposure to Bitcoin, MSTR stock movements have a strong positive correlation with BTC. So far this year, MSTR stock has gained more than 31%, even outperforming the performance of the largest crypto asset.

Interestingly, yesterday marked five years since Strategy adopted a Bitcoin-based business model. Over that period, MSTR stock has been the best performing large asset, recording an average annualized return of 100%.

Saylor himself joked that if they had bought Bitcoin earlier, the profits could have been greater. Even so, his company was a pioneer in adopting the BTC backup strategy, which a number of other companies are now starting to follow.

To date, Strategy has raised $46 billion through the issuance of Bitcoin-based stocks and credits. Its latest product is STRC stock, the BTC-based security with the largest initial public offering (IPO) this year, which raised over $2.5 billion.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today‘ s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Michael Saylor’s Strategy Adds BTC as Bitcoin Climbs. Accessed on August 12, 2025

- Cointelegraph. Strategy adds $18M in Bitcoin on fifth anniversary of BTC strategy. Accessed on August 12, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.