Download Pintu App

Ethereum Jumps to $4,600 on August 13 — Is a New All-Time High on the Horizon?

Jakarta, Pintu News – The price of Ethereum (ETH) has risen nearly 20% in the past seven days, easily breaking the much-watched $4,000 level. On August 12, ETH was trading at $4,310, just 11.7% below its record high of $4,878.

However, the peak may be closer than imagined, as there are two powerful groups preparing to push it there, according to a report by BeInCrypto.

Then, how is Ethereum’s current price movement?

Ethereum Price Rises 7.77% in 24 Hours

On August 13, 2025, Ethereum climbed to around $4,640 — roughly IDR 75.6 million — marking a 7.77% jump in just 24 hours. Over the course of the day, ETH swung between a low of IDR 69.8 million and a high of IDR 75.6 million.

At the time of writing, data from CoinMarketCap shows that Ethereum’s market capitalization stands at around $559.97 billion, with daily trading volume rising 30% to $60.16 billion within the last 24 hours.

Read also: These 3 Cryptos Are Closing In on All-Time Highs and Taking Center Stage

Spot Buyers Keep Ethereum Supply Tight

One of the most important indicators to keep an eye on during a strong uptrend is the reserves on exchanges, which is the total amount of ETH held on centralized exchanges. When reserves are high, the potential for selling pressure is also greater.

Conversely, when reserves are low, supply becomes tight and a surge in demand can push prices up quickly.

On July 31, ETH reserves on exchanges hit an all-time record low of 18.72 million ETH. As of August 12, the amount was still at almost the same range of 18.85 million ETH, even though the price of ETH had jumped sharply.

This points out an important point: even though the price of Ethereum is near the highest level in recent months, the balance between buyers and sellers tends to lean in favor of the buyers.

It’s worth noting that aggressive selling did take place, but the low reserves on the exchange meant that buyers moved faster than sellers.

Historically, it has been difficult for ETH prices to sustain rallies when reserves increase. The fact that current reserves are holding near record lows while prices are close to breaking the last major resistance suggests there is strong buying interest from the spot market.

Derivatives Traders Pile Up Positions

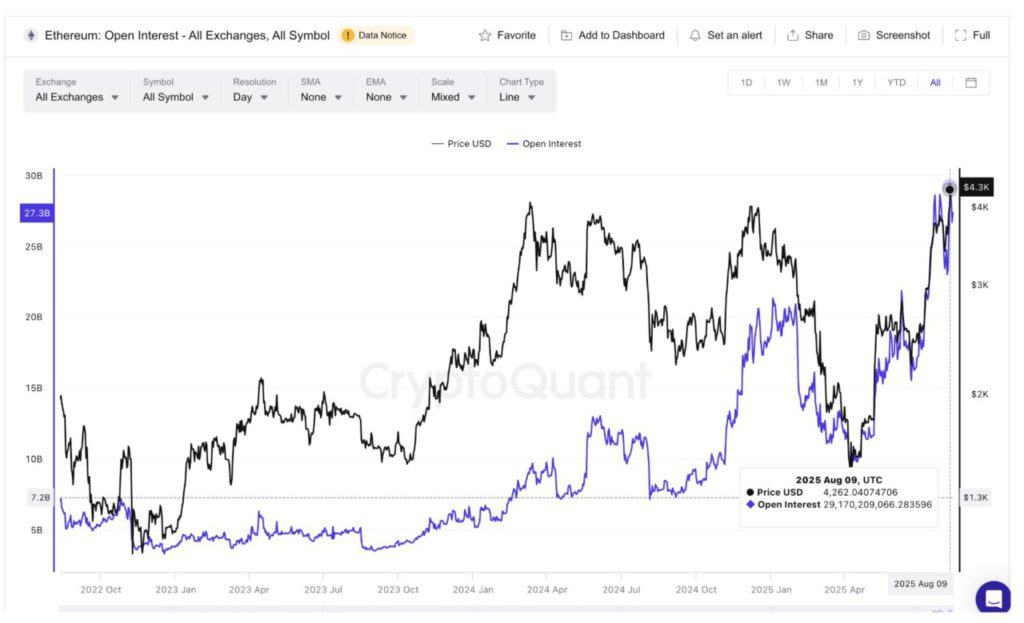

If the spot market is the foundation, then the derivatives market is the trigger. Open interest-thetotal value ofopen futures and perpetual contracts-reached a record high of $29.17 billion on August 9 and has remained in that range ever since.

Read also: Crypto Market Cap Rises: 7 Altcoins in the Spotlight, What’s Up?

Why is this important? High open interest increases the potential for chain movements to occur. If the Ethereum price breaks through an important resistance level, leveraged short positions may be forced to close, triggering a short squeeze that amplifies upward momentum.

Conversely, if control shifts to the bears, large leverage can also accelerate price declines. But at the moment, with supply in the spot market tight, conditions point more towards a potential upward squeeze.

The combination of exchange reserves at a record low and open interest at a record high suggests that two groups-spot buyers and derivatives traders-are aligned in conditions that could trigger a sharp rise.

Ethereum Price Levels are Important to Watch: One Jump Could Trigger a New Record

From a technical standpoint, Ethereum is currently moving in a bullish continuation pattern(ascending triangle), with key resistance at $4,468, which is the 2,618 Fibonacci extension level of its latest rally.

If the price manages to break this level cleanly, the previous record high of $4,878 will be within easy reach.

With Fibonacci levels acting as resistance bases on the uptrend line, Ethereum price has managed to break out of the bullish triangle pattern several times on its way to the highest levels in recent months.

If the bulls manage to cross $4,468, the next breakout zone is the Fibonacci target around $4,893, which would essentially mark a new price record. On the contrary, the nearest support is at $4,043; if this level is lost, the risk of a deeper drop could open up.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Ethereum Exchange Reserves Sink-Is All-Time High Imminent? Accessed on August 13, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.