Download Pintu App

Bitcoin Price Hits $119K on August 13, 2025, as Analysts Point to Bull Flag Pattern

Jakarta, Pintu News – The price of Bitcoin (BTC) on August 12 was at $119,209, down 1%. In that period, the price of BTC showed signs of recovery after the release of US CPI data.

Furthermore, an analyst stated that the price has the potential to surge up to $141,000 if BTC manages to break out of the bull flag pattern. Then, how is the current Bitcoin price movement?

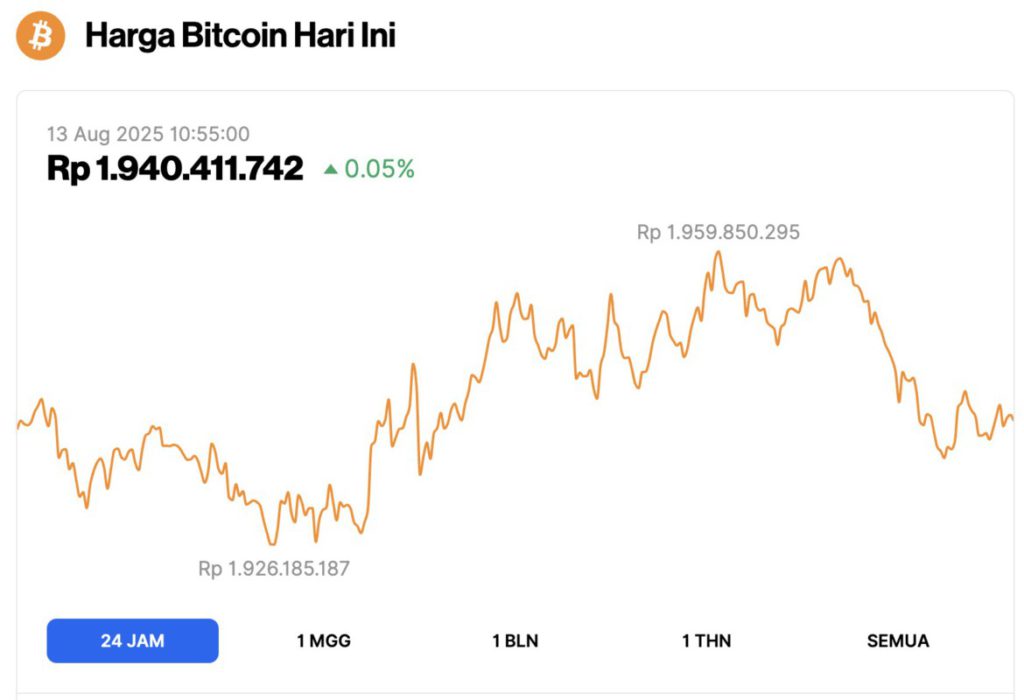

Bitcoin Price Up 0.05% in 24 Hours

On August 13, 2025, Bitcoin was trading at $119,706, equivalent to IDR 1,940,411,742, marking a modest 0.05% gain over the past 24 hours. Throughout the day, BTC dipped to a low of IDR 1,926,185,187 and climbed to a high of IDR 1,959,850,295.

According to CoinMarketCap, Bitcoin’s market capitalization now stands at around $2.38 trillion, with trading volume in the last 24 hours falling 6% to $73.73 billion.

Read also: Ethereum Jumps to $4,600 on August 13 — Is a New All-Time High on the Horizon?

Crypto Analyst Highlights Bitcoin’s Bull Flag Pattern

The price of BTC is back in the spotlight. Just the day before, its value had touched $122,000. The majority of predictions from analysts are leaning towards the positive(bullish) direction.

One of them came from Crypto Rand, who said that after the incredible moves over the weekend, Bitcoin price is likely to continue climbing. This means altcoins should still wait for momentum.

In addition to his optimistic outlook, Crypto Rand also highlighted the bull flag pattern that emerged in the first half of this year.

The distance from the lowest to the highest point of the pattern determines how high the price can go. Based on this analysis, he estimates a potential rise of up to $141,000.

Bitcoin Price Predictions by Analysts: BTC Potential to Touch $370,000?

Meanwhile, Gert Van Lagen is even more optimistic, with a price target of $370,000. He bases his prediction on a staircase-like pattern of gradual increase.

In his latest post on X, he mentioned that, based on this pattern, BTC has a chance to reach $370,000. However, such high targets are more suitable as long-term projections for 2025 and beyond.

However, Lagen also warns of a negative scenario. According to him, the price is still at risk of dropping to $94,000 – a level that, if reached, would invalidate predictions of a $370,000 run.

Before touching $94,000, there is a possibility of a short-term drop to $115,000. This view is in line with Scient analysts, who predict that the decline will occur after the price experiences arejection at a certain level.

Read also: These 3 Cryptos Are Closing In on All-Time Highs and Taking Center Stage

CPI Data Release Could Trigger Volatility

There is one main reason why BTC experiences quite volatile price movements, and that is the release of CPI data.

Previously, due to the import tariffs, many expected the data to show that inflation was again a big issue and would affect the price movement of BTC. However, that did not happen.

According to the CoinGape report (12/8), the CPI data was recorded at 2.7%, lower than the market estimate of 2.8%. This figure is also the same as last month’s CPI, which was 2.7%.

With this result, Bitcoin has the potential to continue moving up. The lower-than-expected CPI data has eased market concerns regarding inflation.

As such, traders remain optimistic that prices will continue to rally and break previous record highs. Some analysts even predict BTC could reach $147,000.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Bitcoin Price Forecast After US CPI Data Release – $94,000 or $141,000 Next? Accessed on August 13, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.