Download Pintu App

Bitcoin (BTC) Price Today: Stable at $119.3K, Ethereum (ETH) Approaches Record High! (8/13/25)

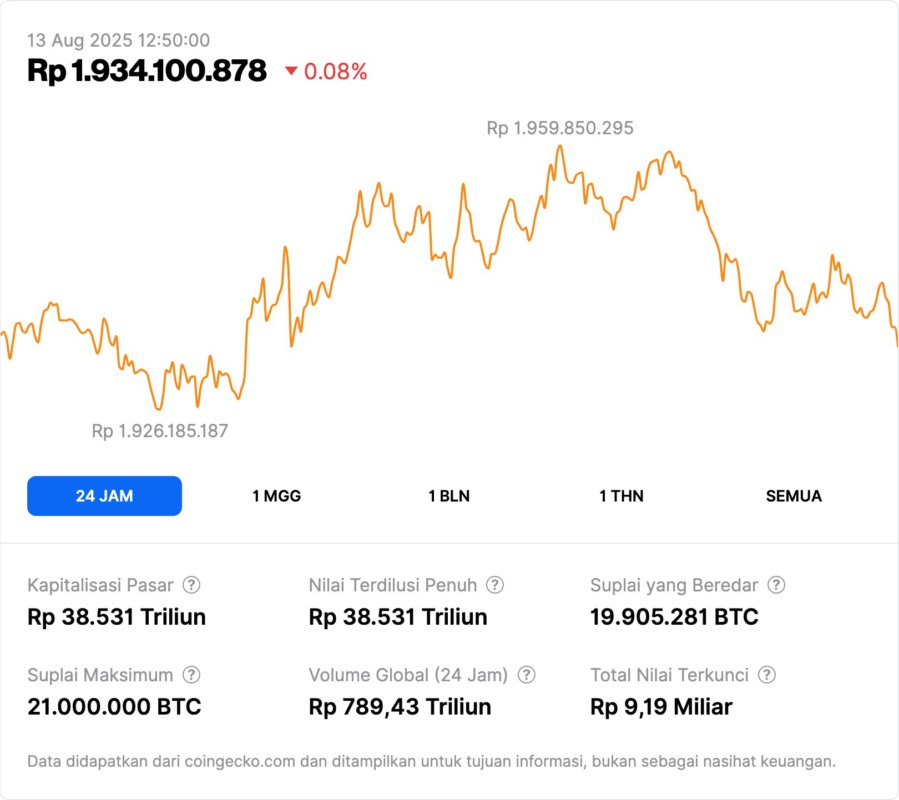

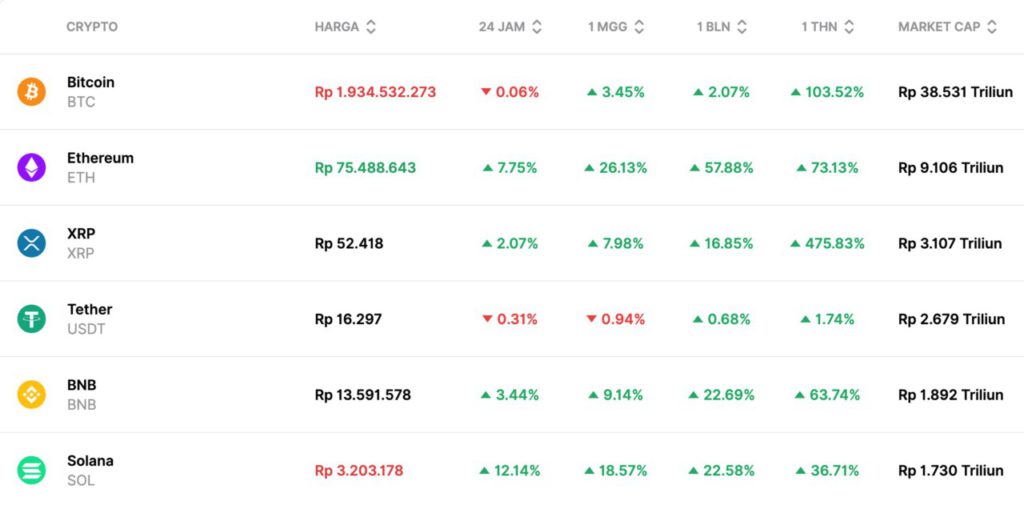

Jakarta, Pintu News – Bitcoin (BTC) remained stable at $119.3K (approximately Rp1.93 billion) on August 13, 2025, while Ethereum (ETH) approached its highest price recorded in November 2021, touching $4,680 (approximately Rp75.8 million) thanks to a surge in interest from major corporations.

This rally came after US consumer inflation data showed a lower-than-expected rise, which strengthened speculation about a possible interest rate cut at the Federal Reserve’s September meeting.

In this article, we’ll take a closer look at the factors driving BTC and ETH prices and how large companies are playing a role in driving the Ethereum rally.

1. Bitcoin Stays Steady at $119.3K

Bitcoin (BTC) price rose 0.5% to $119,361.4 as of 01:11 a .m. ET (05:11 GMT).

Although the price of BTC hasn’t seen a huge spike in recent days, Bitcoin remains a stable and strengthening asset, given that many investors see it as a hedge against inflation and global market uncertainty.

Bitcoin, which still dominates the cryptocurrency market, has remained stable despite other altcoins, such as Ethereum, showing sharper price spikes.

This shows that despite Bitcoin’s relatively stagnant price, there remains strong interest from large investors and institutions to continue investing in Bitcoin.

Also Read: Alpaca Finance (ALPACA) Price from Initial Release, Highest Peak (ATH), and Year-to-Date Development

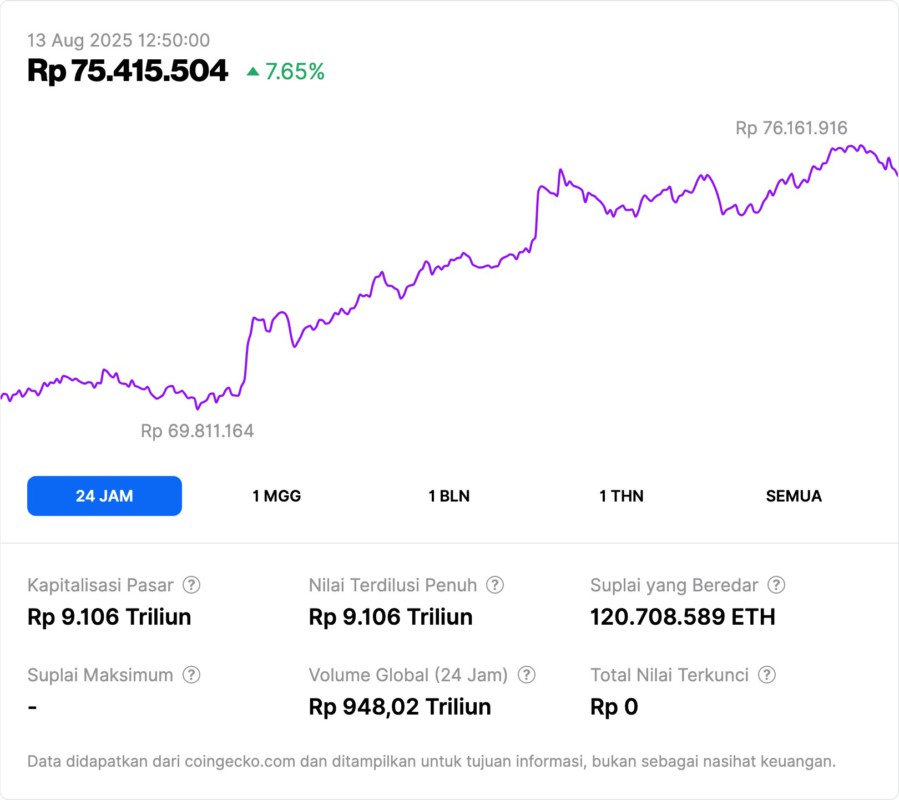

2. Ethereum Approaches Record Highs

While Bitcoin (BTC) remained relatively stable, Ethereum (ETH) recorded an impressive surge.

On Wednesday, Ethereum managed to reach a price of $4,680.23 and is close to its all-time high recorded in November 2021, which was $4,868 . 8.

This surge was largely driven by institutional interest and purchases by large corporations.

This further demonstrates the growing confidence in Ethereum as a long-term asset and platform that dominates the world of DeFi (Decentralized Finance) and NFTs (Non-Fungible Tokens).

3. Ethereum Purchases by Large Companies

Along with the price spike, there has been a huge increase in Ethereum purchases by large corporations.

Bitmine Immersion Technologies, the world’s largest Ethereum holder, recently revealed that it holds more than 1.15 million ETH worth approximately $4.9 billion .

The company also plans to raise $24.5 billion through a share issue to buy more ETH .

In addition, 180 Life Sciences Corp, which recently changed its name to ETHZilla, also bought 82,186 ETH worth about $349 million at an average price of $3,806.71 per coin.

This decision further strengthens Ethereum ‘s role as a crypto asset that is highly valued by major corporations.

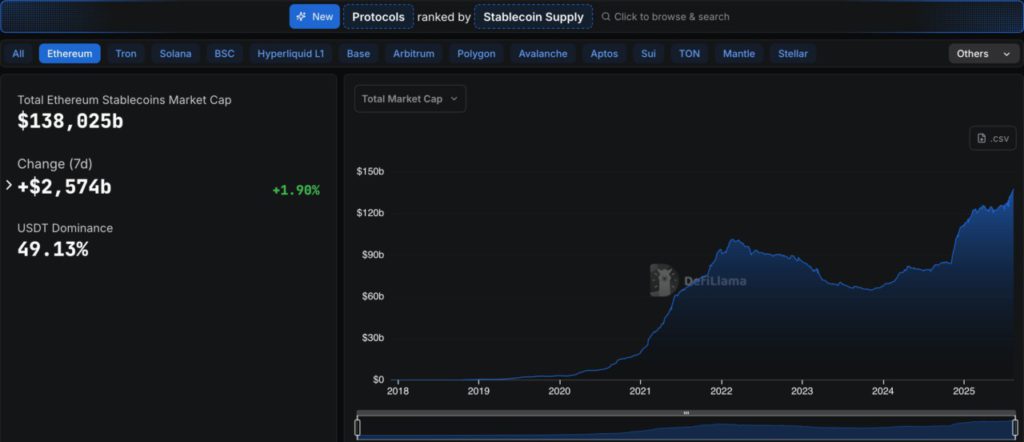

4. Stablecoin buying factors driving ETH surge

Ethereum also continues to dominate the stablecoin market, with around 49% of all stablecoin liquidity residing on the Ethereum blockchain.

This provides strong support for Ethereum, as the stablecoin’s movements often precede the purchase of more volatile cryptocurrencies, including ETH itself.

With the growing demand for stablecoin transactions on Ethereum, the demand for ETH to fuel transactions and the DeFi ecosystem is growing. This creates a favorable cycle in the Ethereum market, which supports the ongoing price rally.

5. Another Altcoin’s Rally Precedes Bitcoin’s

Several other altcoins have also performed very well. XRP, Cardano (ADA), and Solana (SOL) have all recorded bigger price spikes compared to Bitcoin, with Solana jumping up to 13% in recent days.

This suggests that investor interest in altcoins is growing, driven by optimism about the crypto market as a whole.

This increased attraction to altcoins also has the potential to put pressure on Bitcoin to continue to strengthen in order to continue dominating the market, while Ethereum, with its strength in the DeFi and NFT sectors, continues to register a surge.

Also Read: Moo Deng Price Initial Release, Highest, Year to Date

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Amber Warrick / Investing.com. Bitcoin Price Today: Steady at $119.3K, Ether Near Record High on Corporate Buying. Accessed August 13, 2025.

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.