Download Pintu App

Bitcoin price crash today, will the crypto market correct?

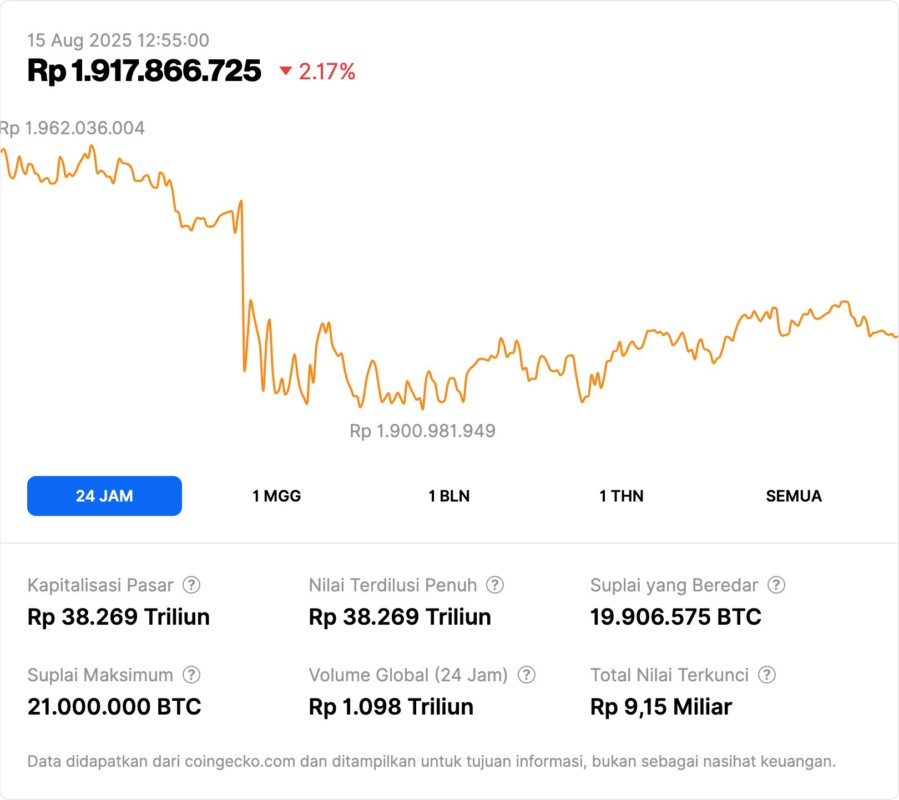

Jakarta, Pintu News – The cryptocurrency market was shocked by the sudden movement in Bitcoin (BTC) on August 14, 2025. After recording an all-time high of $124 , 500, the price of Bitcoin suddenly plummeted by more than $5,000 in a matter of minutes, breaking the $118,000 barrier.

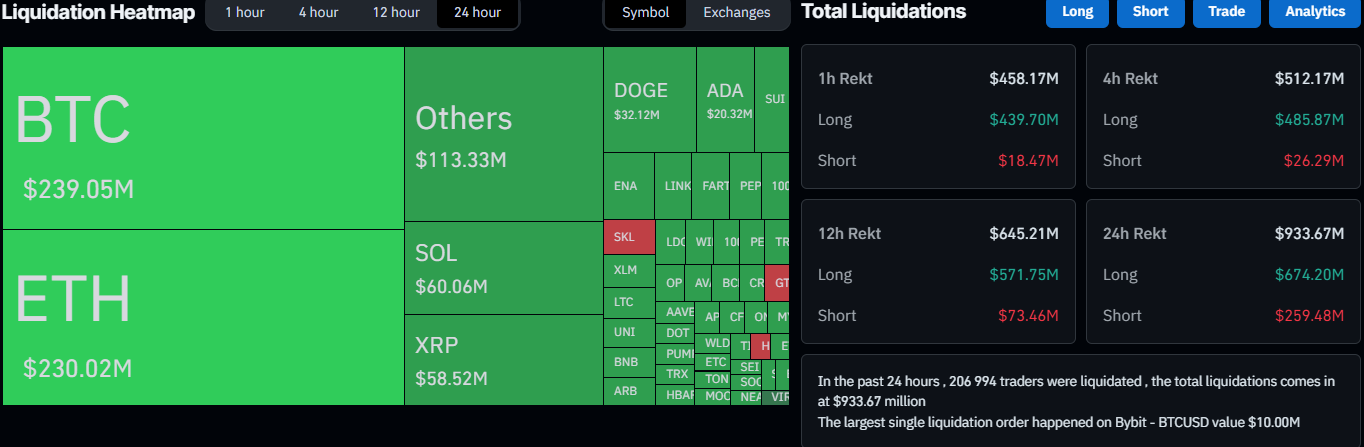

The sharp price fluctuations saw more than 200,000 traders liquidated in a single day, with the total value of liquidations approaching $1 billion . Apart from Bitcoin, most altcoins also experienced a sharp decline, causing huge losses for over-leveraged traders.

1. What Caused the Bitcoin Price Crash?

Bitcoin (BTC) experienced a sharp decline despite previously recording a high of over $124,500. This movement happened very quickly, making the price drop more than $5,000 in a short period of time.

Analysts noted a double rejection pattern at the $120,000 level, indicating that Bitcoin was having difficulty breaking through the strong resistance. The low trading volume during the breakout attempt indicates a lack of buying interest, which further worsens the market conditions.

2. Altcoins Join the Decline

Not only Bitcoin, but most altcoins have also followed suit, with Ethereum (ETH), XRP, Solana (SOL), and Dogecoin (DOGE) all falling by 2-3% in a short period of time. Altcoins that had previously made significant gains are now reversing course following Bitcoin’s lead.

This phenomenon suggests that the cryptocurrency market is undergoing a massive correction, which has a direct impact on assets with high volatility. For traders who have large leveraged positions, this drop is especially detrimental.

Also Read: 10 Crypto Airdrop Telegram 2025: How to Claim Free Tokens from Telegram to DeFi

3. What Caused the Great Liquidation Crisis?

Since the big sell-off by Bitcoin, the value of liquidations in the cryptocurrency market has soared to more than $930 million in the past day. Most of these liquidations were caused by over-leveraged positions that could not survive when the price reversed downwards.

Data from CoinGlass shows that over 207,000 traders were caught in losing positions as a result of these sharp price movements. These liquidations demonstrate the high level of speculation in the market and its vulnerability to sudden price movements.

4. External Factors that May Affect the Market

Despite the positive news regarding Russian and Ukrainian diplomacy that is likely to promote geopolitical calm, many analysts believe that the recently announced surge in inflation is a more influential factor in the price decline. High inflation, recorded as the largest in three years, puts pressure on risky assets such as cryptocurrencies.

This global economic uncertainty exacerbated market conditions, causing many investors to choose to secure their assets and reduce exposure to the highly volatile cryptocurrency market.

5. Liquidation and its Impact on the Crypto Market

As liquidation intensifies, the cryptocurrency market looks increasingly depressed. This massive liquidation process has led to many long positions opened by traders failing to hold, and this has pushed prices further down. With nearly $460 million in liquidations taking place in the last few hours, the crypto market looks increasingly vulnerable to further declines.

Investors’ decision to sell or close their positions to avoid further losses creates more selling pressure. Meanwhile, the whales or big players in the market are seizing this opportunity to distribute their assets before the price drops further.

6. What Should Investors Do Amid Market Uncertainty?

For investors, a volatile market like this requires them to be cautious. Bitcoin’s rapid price decline could signal that the market is entering a major correction phase.

Investors should monitor important technical levels on Bitcoin and Ethereum, and consider reducing exposure to high-risk leveraged positions. Using good risk management, such as stop-losses, is also crucial to protect capital in these highly volatile markets.

Also Read: 7 Ethereum (ETH) Developments to Anticipate in 2025

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Jordan Lyanchev / CryptoPotato. Bitcoin Suddenly Crashes Under $118K as Liquidations Surge Toward $1B. Accessed August 15, 2025.

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.