Download Pintu App

Ethereum (ETH) hits $4,800, Solana (SOL) could reach $300, Bitcoin (BTC) is ready to soar!

Jakarta, Pintu News – The price of Ethereum (ETH) has again recorded a price of more than $4,800 for the first time since the peak of the bull market in 2021. This shows the growing strength of the world’s second-largest cryptocurrency by market capitalization.

This represents a significant recovery after several years of underperformance. Ethereum overcame several important resistance levels and now has the potential to reach an all-time high price, which is only slightly lower than $5,000 .

1. Factors Driving Ethereum’s Rise

Ethereum’s price rise is being driven by some strong fundamental factors. Unlike the speculation-driven price spikes of 2017 or 2021, this time around, its growth is driven more by deeper factors.

The expansion of the DeFi protocol, wider adoption of the Ethereum blockchain, and layer-2 implementation are the main drivers. This differentiates this bull run from past speculative bubbles and provides the potential for more sustainable growth.

Also Read: 10 Crypto Airdrop Telegram 2025: How to Claim Free Tokens from Telegram to DeFi

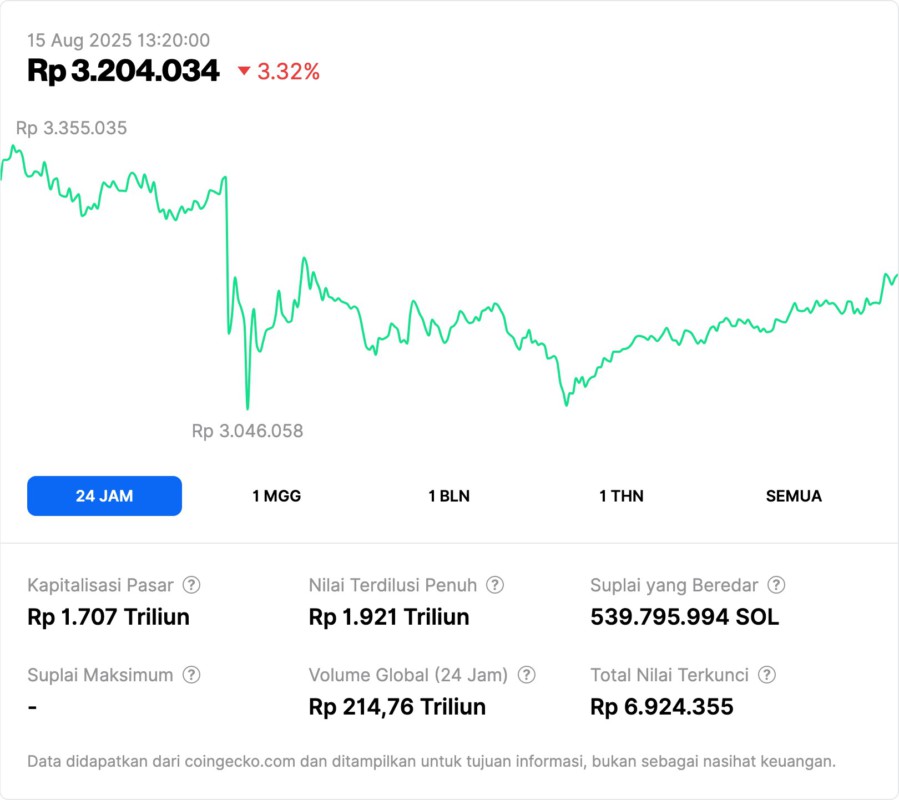

2. Solana (SOL) Ready to Break $300

Solana (SOL) is on a significant upswing and is currently trading at around $209 (approx. IDR3.37 million), close to the key resistance level at $205 (approx. IDR3.31 million). A bigger breakout above $238 (approx. IDR3.84 million) would open up the potential for Solana to continue its run towards $300 (approx . IDR4.85 million).

There are signs that the market is starting to seriously look at Solana as an altcoin with great potential. If Solana manages to break the $238 level with greater trading volume, the journey to $300 will become more realistic.

3. Can Solana Touch $300?

While volatility will certainly be present, the momentum built by Solana shows that $300 is not an impossible target. The price movement supported by the growing trading volume shows that there is real buying interest, not just speculation.

If the SOL price can hold above $205, it will be a positive signal for the bulls. However, if it fails to maintain that level, it is likely that the price will correct towards the support area around $178 .

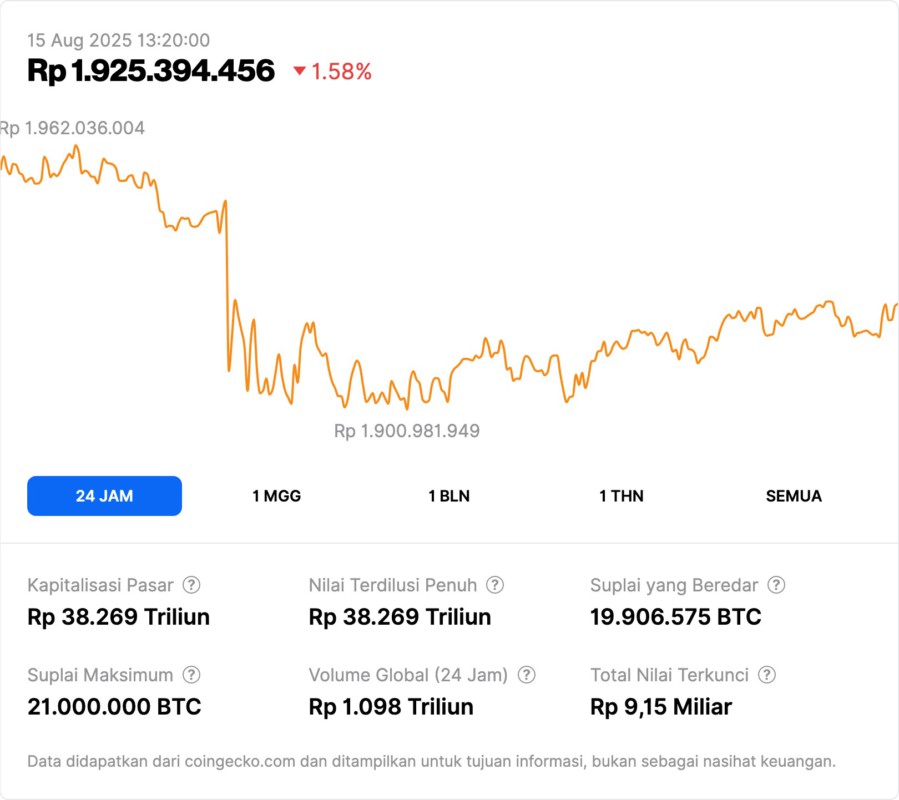

4. Bitcoin (BTC) Achieves a Strong Breakout

Bitcoin (BTC) has just experienced a huge surge in trading volume and managed to break the $121,000 mark (approximately Rp1.95 billion). This is an indication that Bitcoin has the potential to continue rallying and open up opportunities towards the next resistance level at $125,000 – $128,000 (around Rp2.02 billion – Rp2.07 billion).

Bitcoin’s RSI (Relative Strength Index) also shows a position that still allows for further price expansion. This adds to the optimism that Bitcoin could remain on a bullish path in the short term, given the momentum supported by larger trading volumes.

5. What Do Crypto Investors Need to Pay Attention to?

For investors, this is a time of opportunity, but also of risk. With many altcoins moving significantly, it is advisable to pay attention to important technical levels. Ethereum reaching over $4,800 and Solana approaching $300 are signals of the strength of the crypto market.

However, keep in mind that the crypto market is highly volatile and can change in a short period of time. Therefore, it’s important for investors to stay alert to possible corrections that come unexpectedly.

Conclusion

The cryptocurrency market is showing interesting dynamics again, with Ethereum (ETH) breaking the highest price since 2021, Solana (SOL) approaching $300, and Bitcoin (BTC) poised for a breakout. All eyes are now on these price developments, and while the potential for growth is huge, the risk of a correction is also worth keeping an eye on.

Investors need to closely monitor key price levels and trading volumes, and consider wise investment strategies in the face of these high market fluctuations.

Also Read: 7 Ethereum (ETH) Developments to Anticipate in 2025

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Arman Shirinyan / U.Today. Ethereum (ETH): First Time Since 2021, Solana (SOL) Can Hit $300 Next, Bitcoin’s (BTC) Golden Ticket. Accessed August 15, 2025.

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.