Download Pintu App

Vanguard Cuts Its Stake in MicroStrategy — What Will the Impact Be?

Jakarta, Pintu News – As of the second quarter of 2025, Vanguard, the largest asset manager, has reduced its shareholding in Michael Sayor’s Strategy (formerly MicroStrategy) by 10%.

The move comes as MSTR shares have seen a decline in volatility and traded in a very narrow range over the past four months, with support at $360.

Vanguard’s decision to cut its stake has sparked questions about the stock’s short-term direction.

Check out the full news in this article!

Share Reduction by Vanguard

Michael Saylor’s Strategy underwent a major institutional shift, with a stake cut by Vanguard, the largest shareholder. MSTR stock has been trading in a tight range for several years, with the $360 support level being continuously tested over the past four months.

Although the company continues to buy Bitcoin (BTC), the stock remains underperforming. Long-term investors are starting to pull out, while hedge funds are taking over trading activity, making technical levels more critical.

The $360 mark has withstood several retests, but failure to hold this level could signal a major shift in market sentiment, according to analysts at 10x Research.

Read also: The US is Seriously Monitoring DeFi: Digital Identity as a Solution to Prevent Crime?

Change in Investment Focus

According to Coingape, the analyst also added that the latest move in MSTR stock comes as companies focused on Bitcoin (BTC) cash are losing their competitive edge. Ethereum (ETH) cash and upcoming crypto initial public offerings (IPOs) are starting to attract new capital, diverting attention from MicroStrategy.

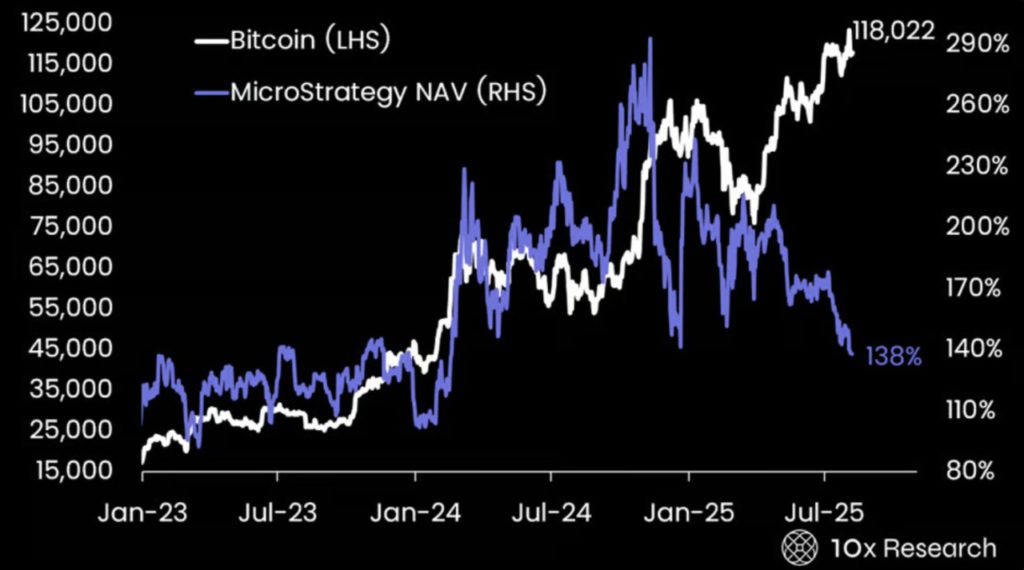

In addition, the analyst warned that a decrease in volatility in both Bitcoin (BTC) and MSTR would reduce the leverage effect of stocks against Bitcoin (BTC). This could further limit the company’s ability to raise additional capital at a premium valuation.

Although Michael Saylor’s Strategy reported strong net income of $10 billion in the Second Quarter, some analysts believe that the stock could rally to $680.

Read also: Qubic Community Targets Dogecoin After Monero Attack, What’s Next?

Bitcoin Acquisition Strategy by Michael Saylor

In a post on the X platform on August 17, Michael Saylor, executive chairman of Strategy, hinted that there would be further Bitcoin (BTC) purchases. While sharing the company’s BTC acquisition chart, Saylor wrote “Insufficient Orange”.

Other publicly listed companies such as Metaplanet are also continuing with their BTC acquisition plans. Today, Metaplanet announced the purchase of an additional 775 BTC, bringing their total holdings to 18,888 BTC.

Conclusion

The stake reduction by Vanguard in Michael Saylor’s Strategy marks a pivotal point in the stock market dynamics of MSTR.

With the shift in focus from Bitcoin (BTC) to other cryptocurrencies and IPOs, as well as the decline in volatility, investors may need to re-evaluate their strategy towards this stock.

However, with strong earnings reported and further Bitcoin (BTC) acquisition signals, the future of this stock is still full of untapped potential.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Coingape. Vanguard Trims Stake in MicroStrategy by 10% as MSTR Stock Struggles. Accessed on August 19, 2025

- Featured Image: Bloomberg

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.