Download Pintu App

Solana Hits 100,000 TPS Milestone Amid Surge of ‘Stress Test’ Transactions

Jakarta, Pintu News – Over the weekend, Solana’ s throughput spiked to six figures amid a high load of program call transactions, according to a developer.

Mert Mumtaz, co-founder of Solana (SOL) tool development company Helius, shared on Sunday that Solana became the “first big blockchain” to record 100,000 transactions per second (TPS) on its mainnet.

Solana Sees 107,540 Transactions

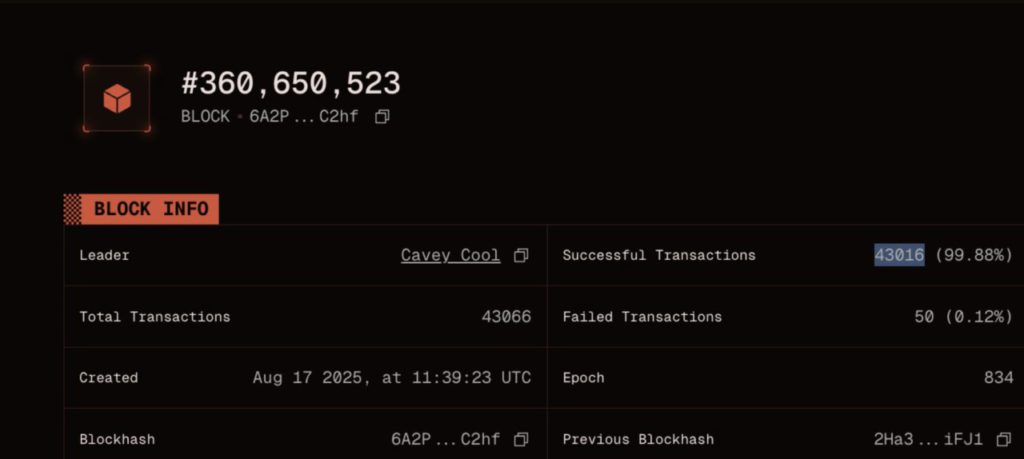

Furthermore, Mumtaz shared that a Solana block on Sunday night recorded 43,016 successful transactions and 50 failed transactions, bringing the total TPS to 107,540.

Read also: Whale Moves 3 Trillion SHIB from Coinbase, Shiba Inu Ready to Expand to Base and Solana!

However, most of these transactions are not token exchanges or trades, but rather “noop” or no-operation program calls, which are instructions that do not perform any meaningful calculations or state changes.

Solana transactions are required to have at least one instruction. For transactions that don’t require real operations, noop programs are used to still meet this requirement. Lightweight program calls like this serve to test the capacity of the network, but do not reflect everyday use such as payments or complex applications.

Mumtaz added that while most transactions are program calls, developers can theoretically estimate that the network is also capable of handling 80-100K TPS for token transactions, oracle updates, and similar operations.

Solana’s Real TPS is Much Lower

Despite recording a spike in TPS, the actual throughput at Solana was much lower than the extreme numbers caused by the program’s call to action.

According to Solscan, the total number of polling stations is currently around 3,700, but this figure is still misleading because about two-thirds of the transactions are voting transactions.

Solana validators must routinely submit voting transactions to participate in consensus, and the hundreds of validators who vote multiple times per slot make the network’s TPS numbers look higher than reality.

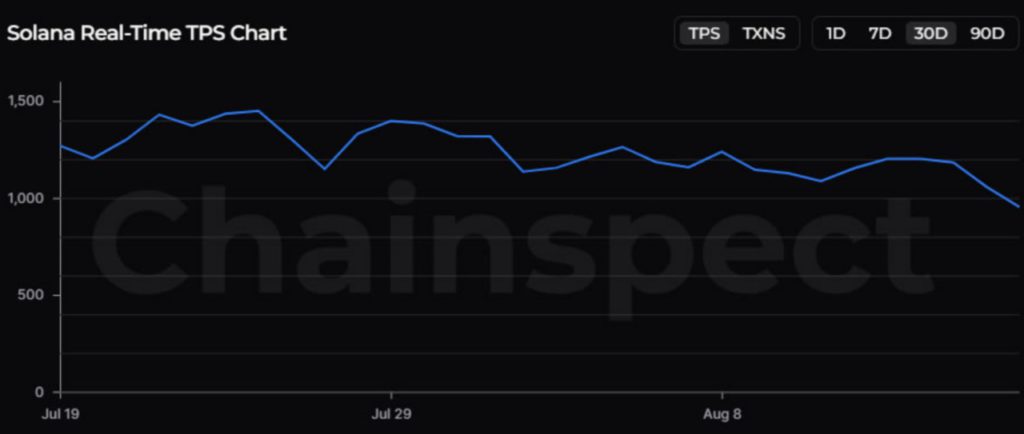

When looking at truly meaningful transactions, Solana’s real throughput is around 1,050 transactions per second, according to Solscan, and around 1,004 TPS according to Chainspect.

Memecoins Still Dominate Solana’s Activities

As reported by Cointelegraph (8/18/25), most of the activity on the Solana network still comes from memecoins. The most popular platform in the ecosystem is Pump.fun, which is engaged in minting and trading meme coins, with a 62% share of the total value locked (TVL), according to Solscan.

Read also: 3 US Economic Events Shaping the Crypto Market This Week

The value of decentralized finance (DeFi) applications on Solana has also increased in recent months, reaching $10.7 billion, close to its record high in January, according to DefiLlama.

Meanwhile, the price of the Solana token (SOL) fell over the weekend as crypto markets softened, returning to $187 from last week’s peak of $208.

From its January peak of $293, SOL is still down about 36%, according to CoinGecko.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Cointelegraph. Solana hits 100K TPS milestone with stress test transaction spike. Accessed on August 19, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.