Download Pintu App

Bitcoin Plunges to $113K on August 20, 2025, but Analysts Stay Optimistic About a Rebound

Jakarta, Pintu News – Bitcoin (BTC) continued last week’s decline of up to 7%, breaking the key trend line for 2025 and sparking renewed discussion of a possible market cycle peak among Crypto Twitter (CT) users.

Up until August 18, the asset was trading around $115,000, ahead of a number of important macro events, with a pattern very similar to the peak of the 2021 cycle.

However, market positioning and macro conditions suggest that some market participants are still anticipating a possible rebound.

Bitcoin Price Drops 1.26% in 24 Hours

On August 20, 2025, Bitcoin was trading at $113,606, equivalent to IDR 1,850,331,712, marking a 1.26% drop over the past 24 hours. During this period, BTC hit a low of IDR 1,830,260,423 and a high of IDR 1,880,296,452.

At the time of writing, Bitcoin’s market capitalization is approximately IDR 36,805 trillion, while its 24-hour trading volume has risen by 12% to IDR 766.98 trillion.

Read also: 3 Crypto Token Unlocks That Could Impact the Market in the Third Week of August 2025

Bitcoin (BTC) Reflects 2021 Cycle Peak, but Macro Conditions are Different

Swissblock analysts highlight that while the current price movement is similar to the 2021 cycle peak, the current macro regime is very different. The 2021 peak coincided with quantitative tightening (QT) which reduced liquidity in the market.

For 2025, Swissblock emphasizes that the macro landscape will trend towards quantitative easing (QE) and Fed rate cuts, potentially boosting risk assets in the medium term.

“Looking forward to 2025, we face QE and rate cuts. There are technical vulnerabilities, but macro liquidity support offsets. Short-term fragility, but macro liquidity provides balance.”

Bitcoin trader, Byzantine General, and macro analyst Alex Kruger has a similar view.

Byzantine General even projects no major correction and a potential strong bottom at around $110,000.

“BTC is losing EQ, and there is no big volume coming in yet. I’m not too worried about a big correction.”

On-chain data also supports this positive outlook. Based on the BTC peak indicators that CoinGlass collects, there have been no signals of overheat to date.

In other words, despite being in the final phase of the 4-year cycle, BTC still has room to grow.

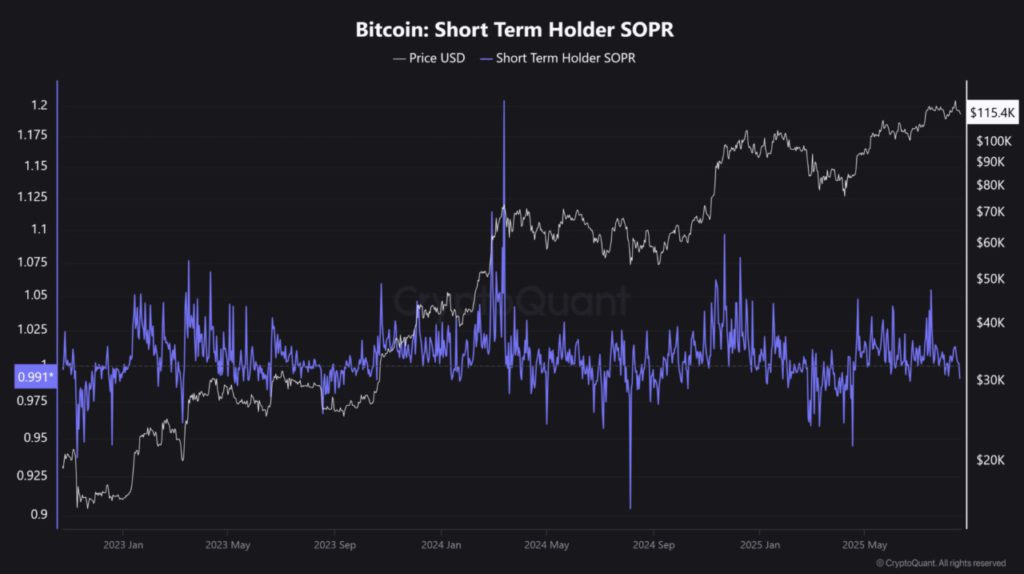

In addition, the short-term holder SOPR (profitability) indicator fell below 1, marking the ‘buy the dip’ zone. This indicator previously showed local bottoms and peaks in 2024 and 2025.

This means that any further declines could be a buying opportunity at a discounted price if BTC goes back up.

Read also: What Do Crypto Whales Buy and Sell During Market Crashes?

What’s Next for BTC?

Interestingly, options data also showed similar rebound potential. 25 Delta Skew declined for the 1-day tenor (green), but rose steadily for the 1-month tenor (blue).

This means that the short-term sentiment is bearish (premium for puts), while the medium-term is positive (premium for calls is increasing at the 1-month tenor).

This short-term bearish sentiment and hedging position is natural ahead of the July FOMC Minutes release on Wednesday.

In addition, Fed Chair Jerome Powell’s speech at the Jackson Hole symposium on Friday will influence the September rate cut decision and BTC price movements.

Whether BTC will hold above $110,000 remains to be seen, given this week’s string of important macro events.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Ambcrypto. Bitcoin drops 7% – But analysts still expect a rebound, not a crash. Accessed on August 20, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.