Download Pintu App

XRP Sets Sights on $3.40 Following Massive $605 Million Whale Transfer

Jakarta, Pintu News – A $600 million transfer of XRP (XRP) from a whale wallet has caught the market’s attention. The launch of regulated futures trading in Europe has also contributed to the increased interest.

Amid growing demand in the derivatives market, the digital asset is trading above the $3.09 price level. Traders expect the price to rise towards $3.40, which is a key resistance level.

Whale Ripple Releases 200 Million XRP Worth $605 Million

A whale transferred 200 million XRP to an anonymous wallet at the time of the transaction. The amount is equivalent to over $605 million based on the current XRP price. The transfer was detected by Whale Alert when the price of the crypto was around $3.09.

Read also: OpenEden and Binance Wallet Launch Airdrop of 20 Million EDEN Tokens Over 6 Weeks!

Such transactions usually trigger speculation about large institutional moves or tactical storage strategies.

This transaction coincides with a significant event in the crypto trading ecosystem in Europe. Dutch crypto exchange One Trading announced that it has started trading regulated XRP/EUR perpetual contracts.

The Bitcoin (BTC) and Ethereum (ETH) versions of this contract have previously recorded trading positions worth nearly two billion euros.

Retail investors in Germany, the Netherlands and Austria can now trade XRP futures. This trading is done within the framework of the MiFID II (Markets in Financial Instruments Directive II) regulation.

One Trading CEO, Joshua Barraclough, stated that his company will provide access to legally regulated trading, offering a safer alternative to overseas exchanges.

This makes XRP one of the few crypto assets listed on the regulated European derivatives market.

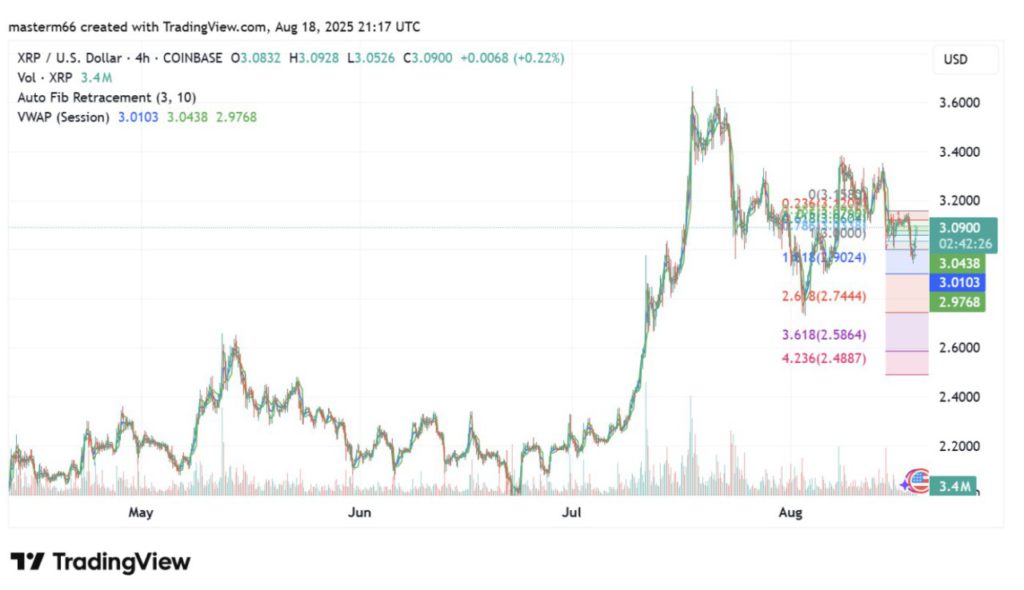

XRP holds above VWAP, targets $3.40

As of August 18, XRP is trading sideways in the $3.09 price range, with the most recent peak being at roughly the same level. The closest support level for the token is at $3.05. The Fibonacci retracement indicator shows some important areas to watch.

The $2.97 price zone is the strongest support level at the moment. However, if the momentum weakens, the next important area on the downside is at $2.74. Conversely, the closest resistance for this altcoin is at $3.20.

If it is able to break the resistance, XRP has the potential to retest the previous high this month at $3.40. Currently, the digital asset is trading above the VWAP line, which is around $3.01, indicating that buyer power is still dominating the trading session.

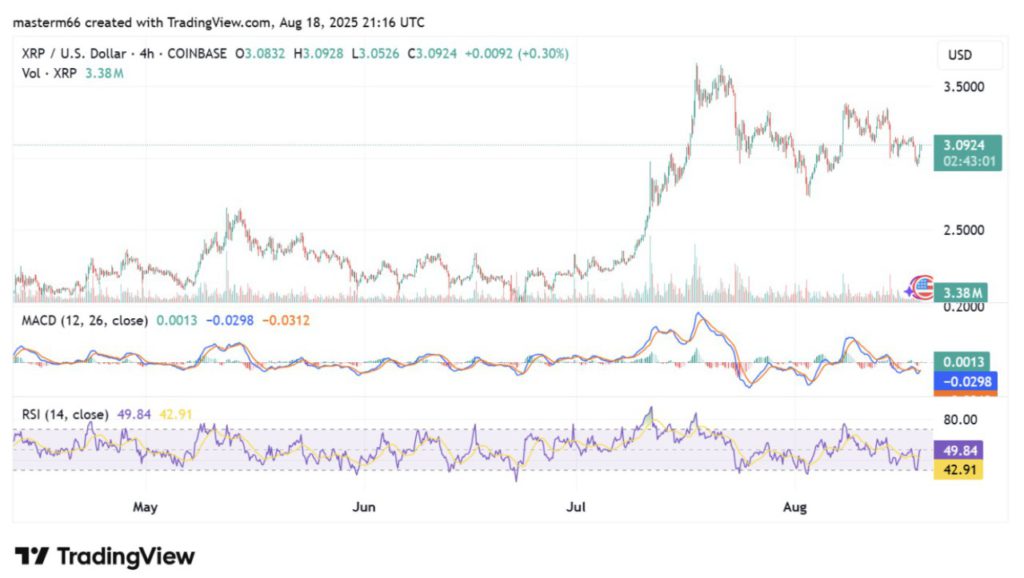

XRP Awaits Breakout

In addition, the MACD line looks flat but remains at a positive value of 0.0013, while the signal line is at around -0.0298. This suggests that the market is in a consolidation or cooling phase.

Read also: XRP Price Potentially Plummets to $2, Read Analysis from Ali Martinez!

Traders view this phase as a pause before the possibility of a stronger price increase occurs.

XRP Derivatives Volume Rises Sharply

Data from CoinGlass (18/8) shows that XRP derivatives trading volume jumped 116% to $9.68 billion. Options volume increased by an even higher 180%, reflecting intensified hedging and speculation activity.

Open interest for options rose by 12.8% to $521.8 million, while open interest for futures edged down by 1.2% to $8.11 billion. This indicates that although some contracts were closed, overall trading activity increased significantly.

This derivative data reflects market participants’ expectations of potentially larger price increases.

However, the short-term movement is highly dependent on XRP’s ability to break the resistance at $3.20. If it manages to pass this level, the price has the potential to rise to the next bullish target at $3.40.

Conversely, if XRP fails to turn the $3.09 level into support, the price could drop towards the VWAP line around $3.01. Even so, strong support remains at the $2.97 level.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- TronWeekly. XRP Eyes $3.4 As Whale Transfers $605 Million. August 20, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.