Download Pintu App

Bitcoin Climbs to $114K but Faces Pressure — Can the $110K Support Level Hold?

Jakarta, Pintu News – As reported by AMB Crypto (8/20), overall BTC demand fell from over 170k BTC to 50k BTC in August. Despite macro risks in the short term, speculators are still targeting prices in the range of $120K – $130K.

Bitcoin (BTC) demand from ETFs and treasury companies saw a sharp decline, which accelerated the price correction from $124k to $112.5k.

According to Julio Moreno, Head of Research at CryptoQuant, weakening demand is the main factor behind this price drop.

From an early August high of over 170K BTC, market interest has more than tripled, to just 50K BTC at the time of writing. Even so, analysts are also warning of additional macro pressures in the near future.

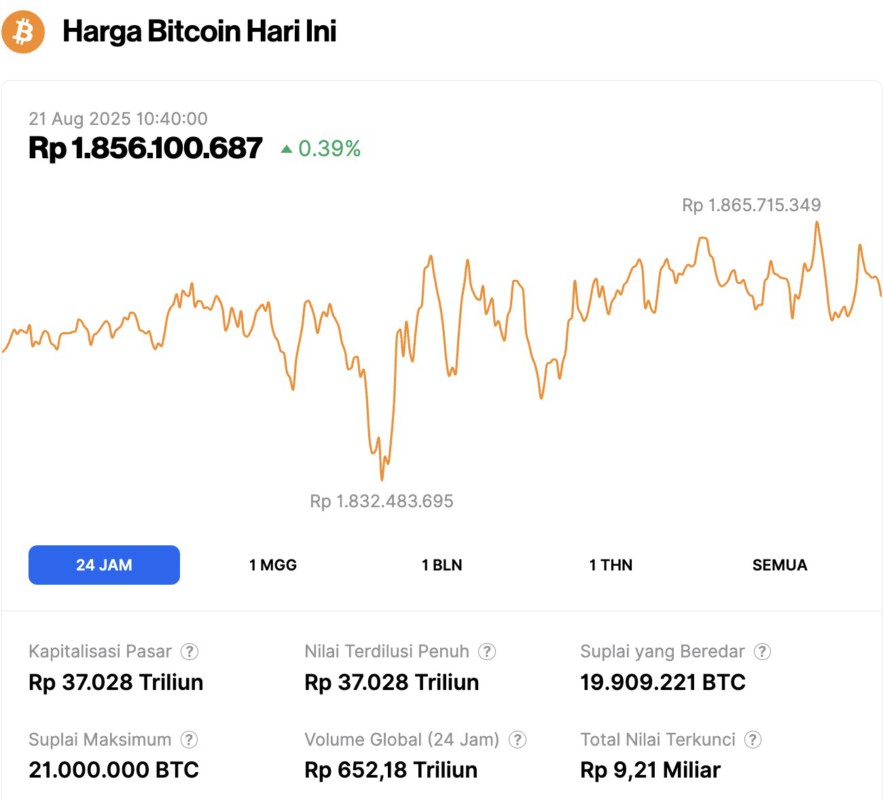

Bitcoin Price Up 0.39% in 24 Hours

On August 21, 2025, Bitcoin was trading at $114,171, or about IDR 1.86 billion, marking a modest gain of 0.39% over the past 24 hours. Within the same period, BTC dipped to a low of IDR 1.83 billion and climbed to a high of IDR 1.87 billion.

At the time of writing, Bitcoin’s market capitalization is estimated at IDR 37,028 trillion, while its 24-hour trading volume slipped 9% to IDR 652.18 trillion.

Read also: Crypto Market Plummets — 3 Altcoins You Should Be Wary Of and the Reasons Why

Powell’s Stance and Liquidity Concerns

Expectations regarding a possible Fed rate cut in September will again be in the spotlight ahead of Federal Reserve Chairman Jerome Powell’s speech on August 22 at the Jackson Hole Symposium.

Wall Street analyst Tom Lee predicts that Powell will tend to take a hawkish stance. However, he thinks the market will still rally afterward.

On the other hand, the potential tightening of dollar liquidity could hamper BTC’s bullish movement in the next few weeks, according to David Duong, Coinbase’s Head of Research. A similar view was also expressed by Delphi Digital who gave a cautious warning.

Duong explained that the US Treasury is likely to raise about $400 billion in debt from the market. This could dampen sentiment for BTC and crypto assets in the short term. However, he added:

“This explains why Bitcoin lost its momentum along with many stocks. But we believe the market direction will be clearer by September.”

Will $110K BTC Support Hold?

The question now is, can the $110k support level hold amidst the macro pressures?

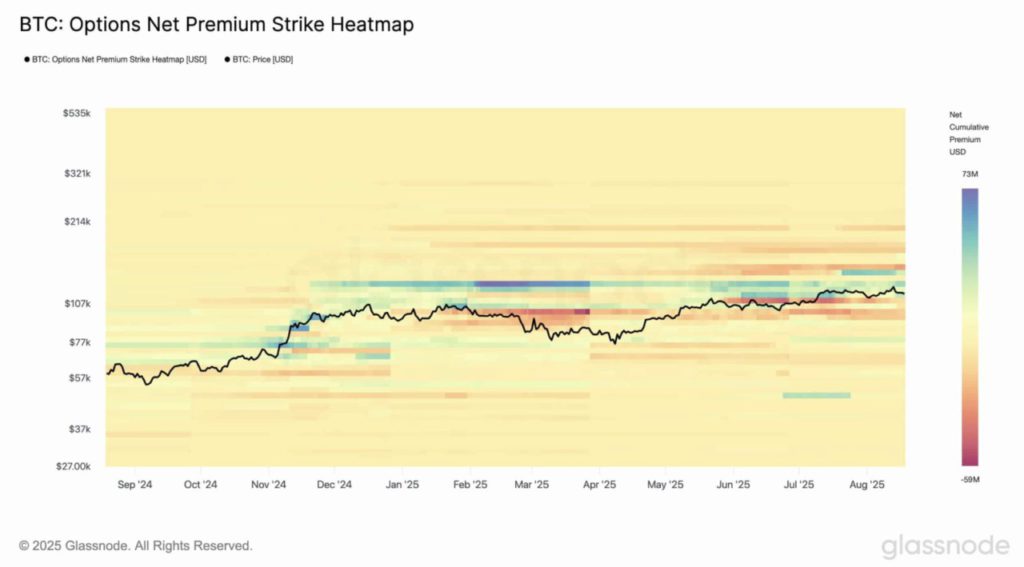

Interestingly, options traders took the opposite position. Glassnode data noted that positions in the options market reached a record high. Speculators are accumulating call options (bullish bets) with targets of $120k – $130k, so this level is seen as an important upside target.

Read also: Altcoin Season to Happen in September 2025? Here’s Pantera Capital & Coinbase’s Analysis!

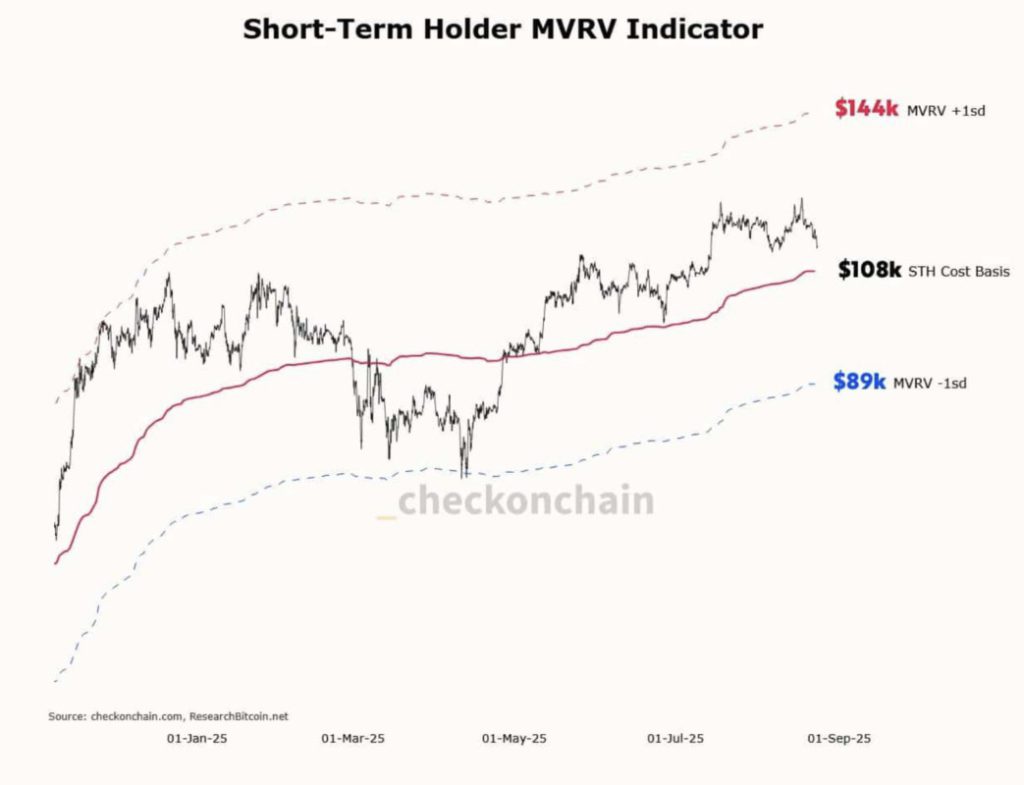

However, the downside risk could be even greater if BTC breaks the Short-Term Holder (STH) Cost Basis at $108K. This level has previously served as a significant support or resistance point.

Thus, if the $110K support fails to hold, the $108K area could be the next level to watch for a possible rebound, albeit under heavy macro pressure.

Overall, bullish circles – especially in the options market – see the latest correction as an opportunity to enter at a discount in the hope of a rally towards new highs.

Whether this optimism can be sustained or whether it will be crushed by macro pressures remains to be seen.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- AMB Crypto. Will Bitcoin’s $110k support hold against Powell’s hawkish stance? Accessed on August 21, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.