Download Pintu App

Dogecoin Climbs 3% Today (Aug 21): Poised for a Breakout as Key Levels Hold Strong

Jakarta, Pintu News – Dogecoin (DOGE) is trading at around $0.21 on August 2025, after rising 1.02% on August 20. However, the token has declined about 10% in a week and 22% over the past month.

According to the analyst, the price movement pattern shows the potential for a major breakthrough with a sharp rise or fall of around 40%.

The market structure forms a descending triangle, with previous resistance levels around $0.24 and support around $0.22. Analysts emphasize that patterns like this are often a sign of significant movement.

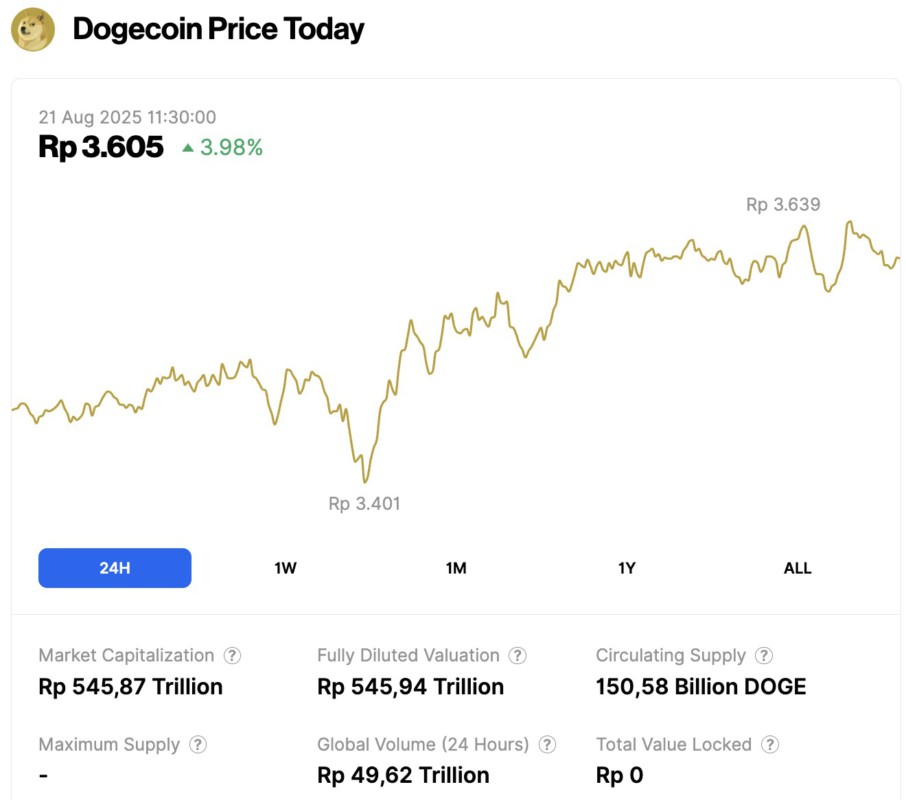

Dogecoin Price Rises 3.98% in 24 Hours

On August 21, 2025, Dogecoin gained 3.98% over the past 24 hours, trading at $0.2228, or roughly IDR 3,605. During the same period, DOGE fluctuated between IDR 3,401 and IDR 3,639.

At the time of writing, Dogecoin’s market capitalization is estimated at IDR 545.87 trillion, while 24-hour trading volume climbed 4% to IDR 49.62 trillion.

Read also: ETH Climbs 3% Today, Rebounding from $4,100 with Whales Showing Resilience!

Dogecoin Price Under Pressure in Triangle Formation

Analyst Ali Martinez recently described the DOGE condition as a descending triangle pattern, which forms when the price prints lower highs while holding above the horizontal support.

As of August 20, Dogecoin was trading at around $0.21 in this structure.

Trading activity looks sluggish, with volumes continuing to decline during the consolidation phase. According to analysts, this kind of pattern usually precedes a spike in volatility, and a big move is expected when the triangle reaches its apex.

If buyers regain control of the market, the Dogecoin price could potentially rise up to $0.29. However, if support fails to hold, the risk is a drop towards $0.19, a level that corresponds to an important point in the Fibonacci retracement.

Technical Signals Guide Short-Term Outlook

According to Coin Republic, the 12-hour chart (20/8) highlights the Fibonacci retracement levels that influence market sentiment. The 0.5 retracement level around $0.22 is the current support area.

According to analysts, this level often serves as a turning point in price corrections. Meanwhile, resistance appears at 0.618 retracement around $0.23, the area where the last rally was briefly held back.

If the 0.5 retracement level fails to hold, the price is expected to drop towards the 0.236 retracement at around $0.19. The Bollinger Bands and MACD (Moving Average Convergence Divergence) indicators also signal potential volatility.

Bollinger Bands used to widen during big moves, while a change in direction on the MACD often signals a momentum reversal. These technical tools suggest the market is preparing for the next significant move.

Volume trends also support this expectation. Analysts note that low activity usually reflects market indecision, but when combined with a price pressure pattern, such conditions often trigger sharp price spikes.

Read also: Will Dogecoin Rally to $5 by 2030? A Deep Dive Analysis

Analysts Maintain Dogecoin’s Long-Term Price Target

In the larger time frame, analysts see a series of higher lows forming since early 2025. This pattern indicates that the long-term uptrend is still maintained despite recent price pressures.

Shan Specter, a market analyst, stated that Dogecoin still maintains a constructive structure. He thinks this consolidation phase could serve as a reset before the next expansion.

Specter projects Dogecoin’s price cycle target to be in the range of $0.70 to $1.30. He also highlights the consistent support from Elon Musk, which continues to be a major factor in maintaining long-term investor interest.

The weekly chart supports this view. The MACD indicator shows that momentum is starting to flatten, but the pattern of higher lows keeps the price structure firm. Meanwhile, the Bollinger Bands signal that volatility could potentially pick up again by the end of the year.

Outlook Focused on Breakout Direction

The Dogecoin price is currently facing a crucial test. The descending triangle pattern is seen as a short-term direction setter, while the structure on the larger time frame continues to show a constructive trend.

If the bulls (buyers) are able to take control, analysts expect the price to make a comeback towards $0.29 before further evaluation. However, if the support is broken by the sellers, the next important level is around $0.19.

As of August 20, Dogecoin was worth about $0.21. Analysts emphasize that the upcoming breakout will be the deciding factor in the direction the token moves in the next few months.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- The Coin Republic. Dogecoin Price Near Breakout As Key Levels Hold. Accessed on August 21, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.