Download Pintu App

Toyota Launches Blockchain to Turn Vehicles into Digital Assets!

Jakarta, Pintu News – Toyota Blockchain Lab has recently released a white paper discussing the Mobility Orchestration Network (MON), a blockchain-based system designed to turn vehicles into real assets that can be traded on financial markets.

Built on Avalanche’s multi-chain architecture, MON aims to create a digital identity for vehicles through NFTs, allowing investors to treat vehicle fleets like structured portfolios that can be securitized into tokens.

Toyota Redefines the Vehicle as a Network of Trust

This proposal positions vehicles no longer as standalone assets, but rather as nodes in a network that involves manufacturers, owners, insurance companies, operators, and regulators.

Read also: Pi Network Launches Hackathon 2025 Soon, Will this be the Turning Point of Pi Coin?

MON aims to combine legal, technical, and economic evidence into a verified digital identity linked to each vehicle through non-fungible tokens (NFTs).

Toyota said this system can allow investors to treat vehicle fleets as structured portfolios that can then be securitized into tokens. MON also seeks to provide a transparent foundation for financing electric fleets, autonomous taxis, and logistics operations by connecting data on vehicle ownership, usage, and maintenance records.

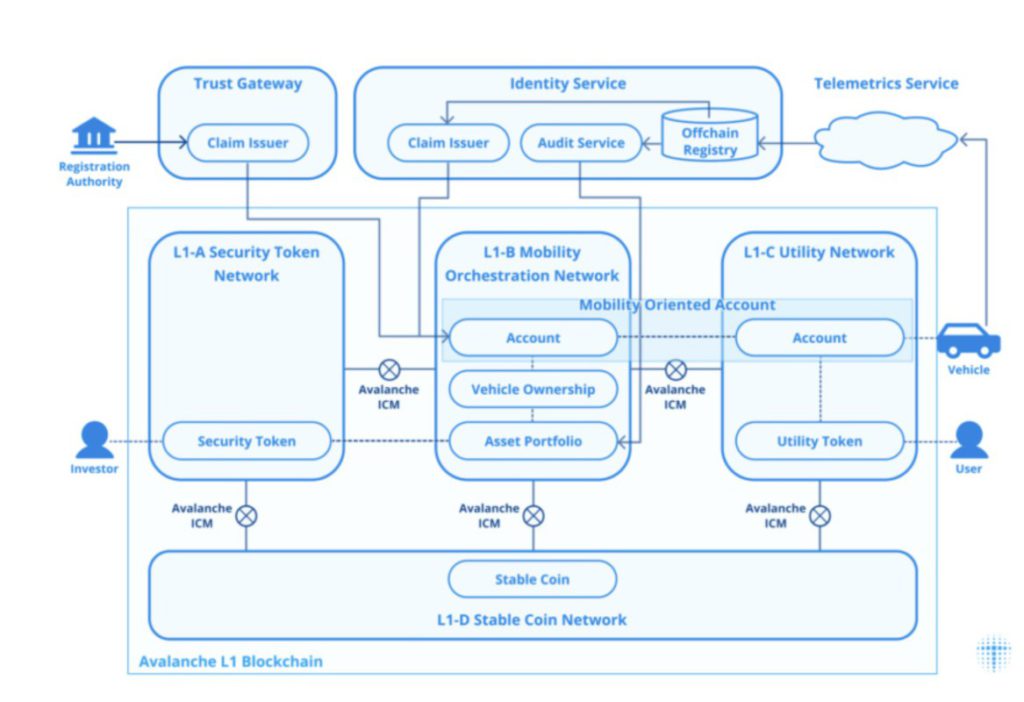

The Avalanche architecture (AVAX) forms the backbone of the MON prototype, chosen for its ability to run multiple interconnected L1 chains. Unlike most EVM-compatible platforms, Avalanche supports “infinite L1s,” allowing enterprises to divide the network as needed-from trust, to utilities, to securities, to payments.

As Avalanche highlighted in X, this multi-chain design is in line with the needs of an industry that demands scalability and compliance.

Naohiko Ueno, a contributor to the Toyota Blockchain Lab, emphasized the importance of this collaboration in her post:

“Avalanche × TOYOTA Blockchain Lab. With strong support from many parties, this step has finally materialized. As Ava ambassadors, it feels like we have truly advanced to the next stage.”

How MON works in practice

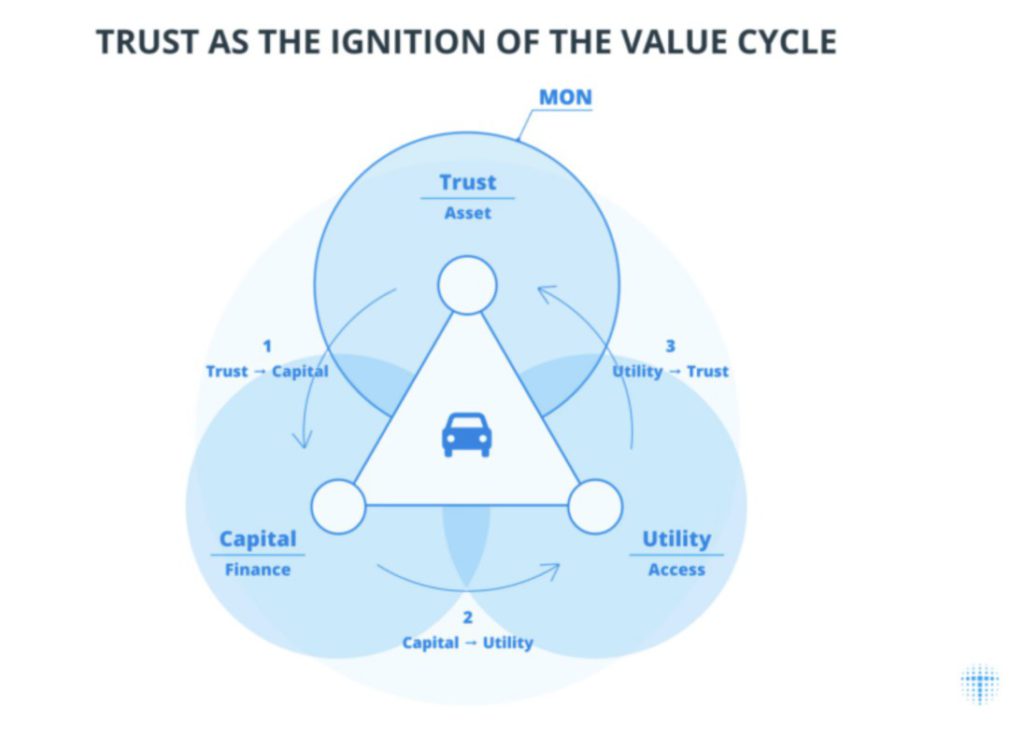

The white paper describes three main “bridges” to overcome fragmentation:

- Trust Bridge – Combines institutional proofs such as registration, insurance and compliance with technical proofs from OEMs and operational metrics. These form the foundation of any Mobility Oriented Account (MOA).

- Capital Bridge – Connects a portfolio of verified vehicles with financial networks, enabling tokenization into securities and unlocking new capital flows.

- Utility Bridge – Integrating real-world usage, from ride-hailing services to charging records, to ensure operational results reinforce financial confidence.

Toyota’s prototype runs on four Avalanche L1s:

- L1-A Security Token Network – Issuing securities backed by a portfolio of vehicles.

- L1-B MON Core – Manage property rights and MOAs.

- L1-C Utility Network – Handles real-time vehicle operations.

- L1-D Stablecoin Network – Supports payment and transaction settlement.

Key services offered include Identity Service to connect real-world data with blockchain-based proofs, as well as Trust Gateway to bridge off-chain institutional records, such as registration or insurance certificates.

Read also: Whale Chainlink Activity Increases, Could LINK Price Reach $30?

Citing a BeInCrypto report, Toyota’s broader Web3 experiment, including digital assets and metaverse initiatives, which confirms that MON is a continuation of Toyota’s ongoing blockchain strategy.

Broader Implications for Mobility and Finance

Toyota emphasized that MON is not meant to be a single global chain, but rather a protocol that allows regional ecosystems to interoperate.

Each local MON will adhere to national regulations, yet use a common trust language to support cross-border asset flows.

The lab highlighted MON’s potential to expand beyond financing, including its impact on secondary markets such as used cars, leasing, and insurance by simplifying data verification.

Previously, Toyota through its affiliate KINTO has also highlighted the use of blockchain, including the trial of NFT-based safe driving certificates in May 2024.

Although MON is still at the proof-of-concept stage, analysts note Toyota’s move as one of the most detailed attempts at combining automotive assets with blockchain-based finance.

MON is seen as accelerating investment in electrification and autonomous mobility by upholding trust in the legal, technical and economic realms.

As stated by Toyota Blockchain Lab:

“Mobility is not a static asset, but rather a network of shared responsibility. MON provides the foundation for expanding this trust globally.”

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Toyota Unveils Blockchain Framework to Turn Vehicles Into Tradeable Digital Assets. Accessed on August 21, 2025

- Blockchain Reporter. Toyota Proposes Blockchain Layer to Orchestrate Trust Across Mobility Ecosystems. Accessed on August 21, 2025

- Crypto News. Toyota Explores Blockchain to Turn Cars into Tradable RWAs. Accessed on August 21, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.