Download Pintu App

PI Coin Maintains $0.36 Support Today, Demand Shows Signs of Growth!

Jakarta, Pintu News – On August 21, Pi Network (PI) was trading at $0.3653, after correcting from a high of $0.3747.

Technical indicators as well as exchange reserve data point to a bullish bias, characterized by RSI divergence, a double bottom pattern, and massive outflows of wallet balances on the centralized exchange (CEX), suggesting increased demand.

Then, how is Pi Network’s current price movement?

Pi Network Price Drops 0.7% within 24 Hours

On August 22, 2025, the price of Pi Network was recorded at $0.3611, having corrected 0.7% in the last 24 hours. If converted to the current rupiah ($1 = IDR 16,354), then 1 Pi Network is IDR 5,905.

Read also: Ulu Ventures Backs Pi Network — But Can Pi Coin Recover?

Pi Network’s daily price movement looks quite volatile, with a trading range between $0.3512 to $0.3663.

In terms of market capitalization, Pi Network recorded a value of around $2.84 billion, while its fully diluted valuation was higher at around $4.38 billion. Market activity also looks quite active with daily trading volume reaching $76.59 million.

PI Demand Increases Ahead of Hackathon 2025

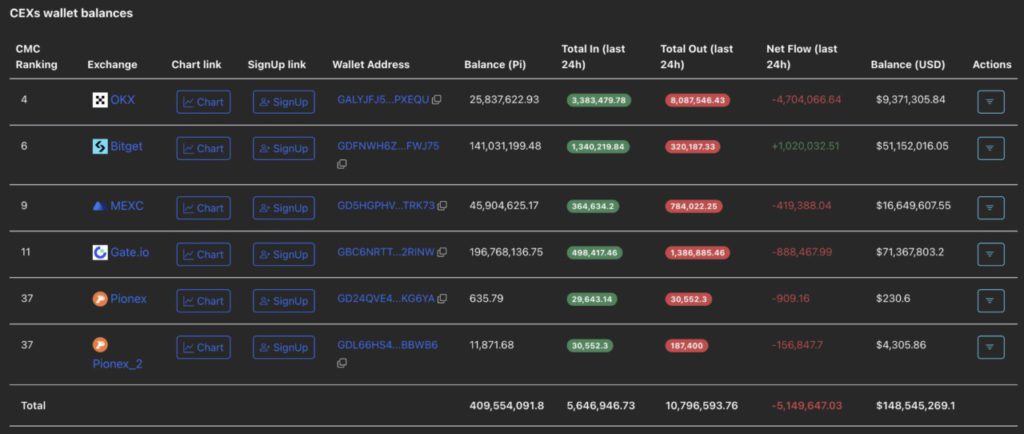

PiScan data shows CEX’s wallet balance recorded an outflow of 5.14 million PI tokens in the last 24 hours, bringing the reserve down to 409.55 million tokens. This large withdrawal equates to a 1.24% drop in the total CEX balance, signaling a surge in demand from investors.

This spike was likely triggered by the start of Pi Hackathon 2025, the ecosystem’s first hackathon event following the launch of Open Network.

Pi Network has a chance to break through the upward channel

Pi Network’s PI token rose about 1.50% on Thursday, extending the 4.92% gain made the day before. The bounce off the $0.3442 support level signals a double bottom reversal pattern that was also previously tested on August 6, with a target towards the 50-day Exponential Moving Average (EMA) at $0.4319.

Read also: Pi Network Trend Declines – Will Pi Coin Plummet Again to the Lowest Point?

Reporting from FX Street (21/8), this descending average line coincides with the resistance line of the falling channel pattern on the daily chart. If the price manages to close strongly above this level, the bullish trend has the potential to strengthen further with a target to the psychological level of $0.5000.

The daily Relative Strength Index (RSI) is currently at 42, close to the centerline as buying pressure increases. The RSI has also recovered considerably from the previous drop in the $0.3442 area, signaling a bullish divergence.

However, the Moving Average Convergence Divergence (MACD) indicator and its signal line are still moving flat and close together, indicating weakening trend momentum.

Conversely, if the price drops back below the $0.3442 support, the double bottom reversal pattern will fail, opening up the risk of a drop towards the $0.3220 support, which is the all-time low.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- FX Street. Pi Network Price Analysis: PI token rises as CEX withdrawals signal bullish demand. Accessed on August 22, 2025

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.