Download Pintu App

3 Altcoins Stealing the Spotlight Among Investors Right Now

Jakarta, Pintu News – With the price of Bitcoin (BTC) struggling to find direction and stability, altcoins seem to have to rely on external indicators. These signals have the potential to influence the current movement of crypto tokens, and could even be the trigger for an upward rally.

Here is an analysis of three altcoins; 1INCH, OKB, and CYBER, which are worthy of investors’ attention this week, based on the analysis of the BeInCrypto page.

1inch

1inch (1INCH) caught the attention of investors ahead of a mysterious announcement scheduled for August 19, 2025. In the project’s official upload, mention was made of efforts to unify the DeFi ecosystem, sparking speculation in the market.

Read also: Arbitrum Price (ARB) from Initial Release, Highest Peak (ATH), and Year-to-Year Development

In recent sessions, the altcoin has been moving relatively flat, consolidating with no clear direction. However, the upcoming announcement could be a major catalyst, potentially pushing the price of 1INCH towards $0.273.

If this level is successfully maintained as support, the token has a chance to target $0.311, strengthening bullish sentiment and increasing market confidence.

Conversely, if investors do not respond positively after the announcement, 1INCH risks losing momentum and dropping lower. The price could test the $0.241 level as a support zone, and if broken, the downside potential could reach $0.222.

A drop like this would invalidate a bullish scenario, signaling traders to be cautious.

OKB

OKB (OKB) recorded significant gains over the past week after the token supply was reduced by half, sparking strong bullish sentiment. This sudden reduction in tokens in circulation created scarcity, thus attracting investor interest.

As of August 17, the price of OKB had jumped 28%, reaching $119 at the time of the report. If this bullish momentum holds, the altcoin has the potential to continue its rise towards $143 or even higher, signaling renewed investor confidence.

However, if the momentum starts to fade and traders judge this rally to be overheated, profit-taking could occur. The resulting selling pressure could drop OKB’s price below $105, opening up the possibility of a further drop to $77. This scenario would invalidate the existing bullish outlook.

Read also: Dogecoin Director Reveals RadioDoge Project: What’s Next for DOGE?

Cyber

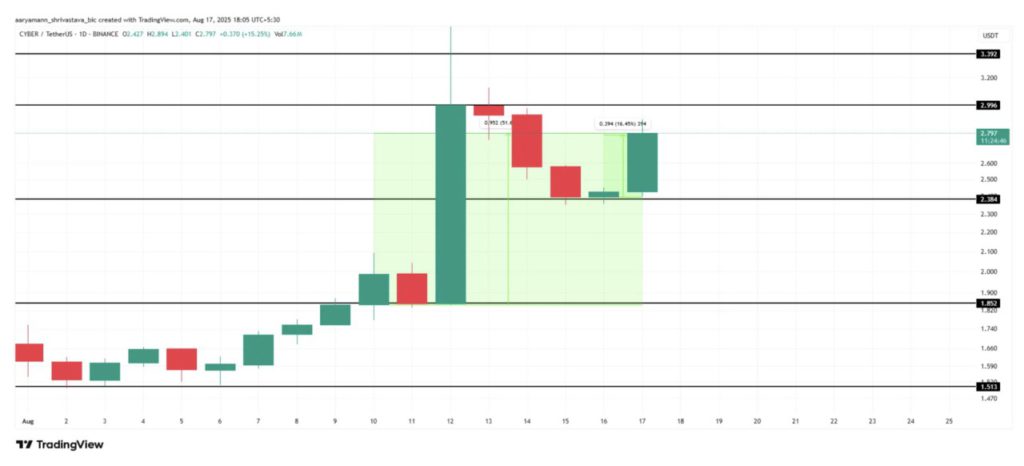

Cyber (CYBER) has been one of the standout performing altcoins this week, boosted by its listing on Upbit Korea on August 12. This development triggered strong buying activity, pushing the token up 51% in the last seven days.

The bullish momentum still continues, with CYBER recording a 16.45% gain in as of August 17, 2025. Trading at $2.79 at the time of writing, this altcoin has the potential to break $2.99.

Sustained buying pressure could extend the rally to $3.39, reinforcing investor optimism and attracting additional capital flows.

However, if the momentum fails to sustain, the recent gains could be reversed. CYBER is at risk of breaking the $2.38 support, and if selling pressure increases, the token could drop further to $1.85.

Such a drop would weaken the bullish outlook, signaling traders to be cautious in the short term.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Altcoins to Watch in the Third Week of August 2025. Accessed on August 22, 2025

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.