Download Pintu App

Bitcoin Loses Ground While 7 Altcoins Gain Attention

Jakarta, Pintu News – As reported by Coinpedia (20/8), the crypto market is starting to show early signs of change. Bitcoin’s dominance appears to be weakening, while the altcoin charts are starting to move.

Historically, such conditions have often paved the way for explosive altcoin rallies, as liquidity moves from BTC to higher-risk tokens. While Bitcoin (BTC) price is still consolidating in a narrow range, small-cap assets are quietly rallying.

This quiet phase could be the foundation for altseason 2025, so accumulation strategies are increasingly important at this stage.

The Market Heads to Altseason

The crypto market as a whole appears to be quietly setting the stage for the next potential alt-season.

Read also: API3 Crypto Drops After 100% Spike, Is a New Trend in the Making?

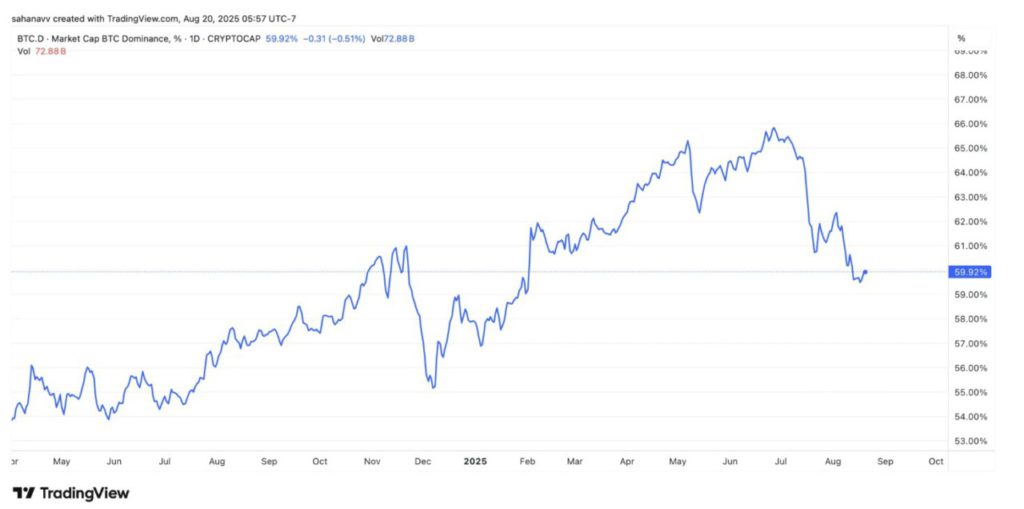

One of the main signals is seen in the dominance of Bitcoin (BTC.D), which is now breaking downwards from its uptrend after several months of steady gains. Historically, declines like this often precede periods when liquidity exits Bitcoin and flows heavily into altcoins.

At the same time, TOTAL3-the crypto market capitalization without counting Bitcoin, Ethereum, and stablecoins-began to show signs of renewed strengthening. After a long consolidation phase, its chart formed a higher low structure that signaled the beginning of accumulation.

This shift signals that traders and investors are slowly starting to increase exposure to mid-cap and small-cap tokens in anticipation of broader market movements.

Meanwhile, Bitcoin’s price movements have remained stable, moving sideways in a narrow range without sharp volatility. This consolidation is healthy, as it reduces market risk and creates ideal conditions for capital rotation towards altcoins.

If BTC continues to be able to hold at the support area while BTC.D resumes its downtrend, then this setup further aligns with the classic pattern that has historically often triggered major altcoin rallies.

Quoting the Coinpedia page, here are 7 altcoins; including ETH, LINK, to XRP which are in the spotlight.

Ethereum (ETH)

Ethereum (ETH) remains the backbone of DeFi and smart contracts. Network upgrades that increase scalability as well as staking growth strengthen the demand for ETH.

As institutional adoption increases, ETH prices are considered safer than other altcoins. Ethereum’s dominance in the Layer-1 ecosystem makes it a prime asset to accumulate, especially ahead of altseason, where typically blue chip assets lead before mid-caps follow.

Ripple (XRP)

XRP (XRP) continues to establish itself as a leader in cross-border payments. Ripple Labs’ progress in global partnerships and legal clarity gives a boost to optimism.

With low transaction costs and growing institutional interest, XRP prices have the potential to benefit greatly from a surge in altcoin demand. A more favorable regulatory environment adds to the positive outlook, making it an attractive hedging option.

Read also: Tidal Trust II Files XRP ETF with SEC Amid Surge in Institutional Demand!

Solana (SOL)

Solana (SOL) price managed to rebound strongly after network concerns, with its thriving ecosystem in DeFi, NFTs, and meme coins. Its high speed and low fees make it attractive to both developers and users.

SOL’s on-chain activity continues to increase, signaling strength. Historically, Solana often rallies heavily during the alt-season, and with the return of institutional attention, SOL is emerging as an attractive high-beta asset.

Chainlink (LINK)

Chainlink (LINK) became the foundation of DeFi through oracle services, connecting real-world data to the blockchain. The adoption of the Cross-Chain Interoperability protocol (CCIP) further strengthens its role as a critical infrastructure of Web3.

With high utility and partnerships with large institutions, LINK’s price often surpasses other altcoins during altseason. The growing demand for secure data feeds puts it as one of the accumulation targets to watch.

Sui (SUI)

Sui (SUI) is starting to establish itself as a next-generation Layer-1 blockchain focused on scalability and user-friendly applications. The object-based architecture that allows parallel transaction execution increases efficiency for developers.

With growing partnerships and the expansion of the DeFi/NFT ecosystem, SUI’s fundamentals remain strong. In the altseason cycle, new L1 projects like Sui usually attract speculative as well as organic growth.

Sei (SEI)

Sei (SEI) is gaining ground as a specialized Layer-1 optimized for trading and DeFi applications. Its sub-second finality and parallelization features make it superior for high-frequency trading needs.

With liquidity and projects migrating towards Sei, this token has the potential to steal the spotlight during altseason. Early adoption and niche focus amplify the exciting asymmetric upside opportunity.

Read also: Mantra Proposes Full Migration of OM Token from ERC-20 to Native Network!

Ondo (ONDO)

Ondo Finance (ONDO) is pioneering the tokenization of real-world assets (RWAs), bridging traditional finance with blockchain. With institutions beginning to explore bonds and yield products in tokenized form, ONDO has the advantage of being a pioneer in a trillion-dollar market.

As the narrative shifts to RWAs, ONDO has the potential to receive huge fund flows. Its utility as well as adoption prospects make it a much-watched crypto candidate before the altseason.

Overall, the weakening of Bitcoin’s dominance alongside BTC’s price consolidation creates ideal conditions for a rotation into altcoins.

Historically, this scenario marks the early phase of altseason. Among the many emerging cryptos, ETH, XRP, SOL, LINK, SUI, SEI, and ONDO-each backed by solid fundamentals, growing adoption, or strong narrative momentum-make them prime candidates to outperform in the upcoming 2025 Altseason.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinpedia. Markets Prepare for Altseason 2025, Top Picks Include Ethereum, XRP, and These Popular Altcoins. Accessed on August 22, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.