Download Pintu App

5 Strategies to Overcome FOMO in the World of Crypto

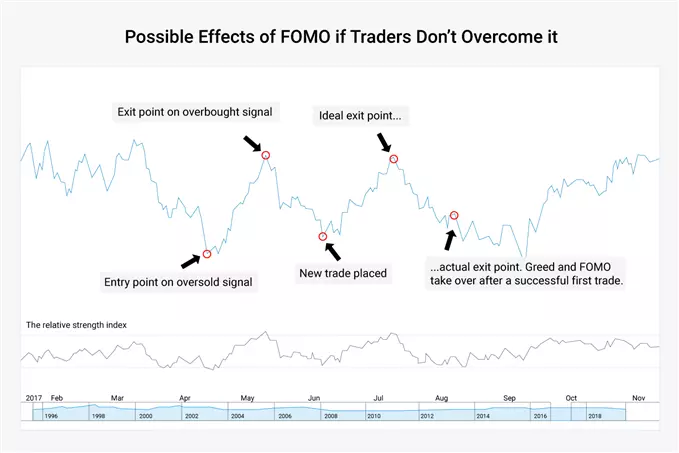

Jakarta, Pintu News – The FOMO (Fear of Missing Out) phenomenon in trading, especially in the crypto market, is still a trap that is often experienced by novice and experienced traders.

The fear of missing out on opportunities leads many people to make emotional decisions without a well-thought-out strategy.

This can lead to huge losses, especially in the highly volatile cryptocurrency market. So, how can you overcome FOMO to make trading more rational and profitable?

Accepting FOMO as Part of Trading

The first step in dealing with FOMO is to accept that the feeling is natural. Many traders feel that others are always more successful, when in reality almost everyone has experienced doubts and regrets in crypto trading. Accepting FOMO will help reduce the emotional baggage that often leaves traders feeling isolated.

If they continue to deny the feeling of FOMO, traders risk getting stuck in an unhealthy cycle. They will continue to seek validation from others, make rash decisions, and end up feeling regretful.

By acknowledging FOMO, steps to improve mindset and strategy can begin. Sharing experiences with the crypto community can also be an effective way to normalize this feeling.

Improve Trading Psychology

FOMO is closely related to trading psychology. Emotions such as fear of missing out or envy of others’ profits can interfere with objectivity in making decisions.

As a result, traders can get stuck in the same pattern: enter the market without a plan, panic when the price moves against them, and then sell at a loss.

A simple example is when a trader feels sorry for missing an opportunity, thinking that they are rare. This feeling encourages them to take more risk in their next transaction.

In fact, healthy crypto trading should be based on analysis, not emotional impulses. By strengthening psychology, traders can keep their focus on long-term goals.

Read also: Bitcoin Whale Swaps $45 Million in Assets to Ethereum, What’s the Reason?

Limit Social Media Activity

Social media can be a double-edged sword for traders. On the one hand, platforms like Twitter or Telegram provide quick access to information. But on the other hand, seeing other people’s posts that always look profitable can lower your confidence and trigger FOMO.

If you feel more stressed every time you open social media, it’s a good idea to reorganize how you use it. Use social media for productive things, such as following trusted analysts or discussing in educational communities. This way, traders can continue to gain insights without getting caught up in harmful feelings of envy.

Use a Trading Journal

One of the most effective ways to combat FOMO is to record every trading activity in a journal. This helps traders evaluate their decisions, recognize habitual patterns, and correct ineffective strategies. With these records, traders can be more disciplined and not just rely on their instincts.

For example, if traders realize that most spontaneous decisions lead to losses, they can immediately suppress the habit. Each note will serve as a reminder that the crypto market is not always friendly to emotional decisions. With consistent reflection, traders can trade more confidently and objectively.

Also read: Cardano NIGHT Airdrop Claims Reach 1.3 Billion, Hoskinson Refutes Negative Allegations!

Implement Risk Management

Risk management is the last bastion to protect yourself from losses due to FOMO. Many traders think that if everyone gets into a particular market, there will be less risk. In fact, without careful calculation, the decision to follow the crowd is dangerous.

Risk management strategies, such as setting a stop loss or using only a small portion of capital for a single transaction, are essential.

This way, any losses incurred will not damage the entire portfolio. Trading the cryptocurrency market requires a balance between the courage to take chances and the ability to control risk.

Conclusion

FOMO is a big enemy of trading, especially in the speculative and volatile world of cryptocurrency. By accepting the feeling, improving psychology, regulating social media use, writing a trading journal, and implementing risk management, traders can reduce its negative impact.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- IG. What is FOMO in Trading. Accessed on August 23, 2025

- Featured image: Generated by AI

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.